In the realm of technical analysis, candlestick patterns stand as beacons of market insight, guiding traders through the labyrinthine trails of price movements. These visual representations of market behavior hold immense significance, unlocking valuable information about market trends, reversals, and potential trading opportunities.

Image: www.lupon.gov.ph

Embark on this profound journey to unravel the intricacies of candlestick patterns, their origins, and profound interpretations. Discover the wisdom embedded within these enigmatic formations as we embark on an illuminating exploration.

The Birth of Candlesticks

Candlestick patterns owe their genesis to the ingenious mind of Japanese rice trader Homma Munehisa, who developed them in the 18th century. These patterns emerged from his meticulous observations of the relationship between rice prices and market sentiments. By studying the daily price movements represented as candles, Homma devised a system that enabled him to decipher market trends with remarkable accuracy.

Over the centuries, candlestick patterns have evolved to become an integral part of technical analysis, transcending geographical and cultural boundaries. Today, traders worldwide utilize these patterns to gain invaluable insights into market dynamics and make informed trading decisions.

Unlocking the Meaning of Candlesticks

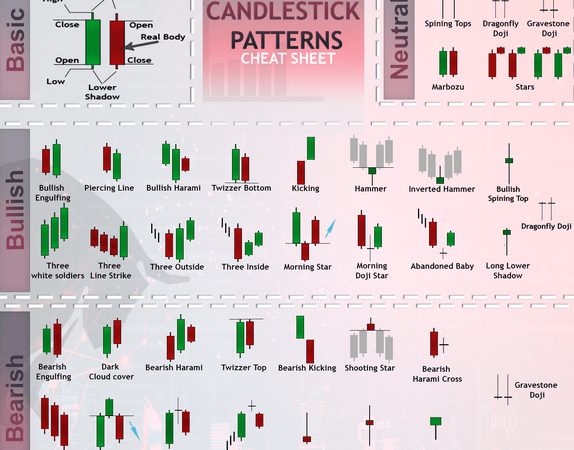

Candlesticks provide a visual representation of a security’s price movements over a specific time interval, typically a day or a week. Each candlestick comprises four fundamental elements:

- Open: The price at which the security opened during the period.

- Close: The price at which the security closed during the period.

- High: The highest price reached during the period.

- Low: The lowest price reached during the period.

The relationship between the open and close prices determines the color of the candlestick. A green (or white) candlestick indicates that the close price was higher than the open price, signifying a price increase. Conversely, a red (or black) candlestick denotes a price decline, with the close price falling below the open price.

In addition to their color, candlestick patterns also possess distinct shapes and formations, each conveying a specific market sentiment or potential price movement. These patterns can be broadly categorized into bullish, bearish, reversal, and continuation patterns. Understanding the implications of these patterns is paramount for effective trading.

Latest Trends in Candlestick Analysis

Contemporary technological advancements have revolutionized candlestick analysis, introducing cutting-edge tools and techniques that enhance the accuracy and efficiency of pattern recognition. Automated trading platforms leverage advanced algorithms to scan price charts for predetermined patterns, providing traders with timely alerts. Candlestick recognition software utilizes AI to analyze large volumes of historical data and identify recurring patterns, assisting traders in making informed decisions.

The advent of social trading platforms has fostered a vibrant community of traders, where insights and strategies involving candlestick patterns are shared and scrutinized. Forums and social media groups serve as active hubs for knowledge exchange, fostering collaboration and continuous learning among traders.

Image: www.pixazsexy.com

Expert Tips and Advice

For effective candlestick analysis, adherence to these expert tips is invaluable:

- Context is Paramount: Isolate candlestick patterns within the context of the prevailing market trend. Patterns formed amidst an uptrend hold different implications than those occurring during a downtrend.

- Confirmations Reign Supreme: Rare candlestick patterns may be prone to false signals. Seek confirmation from other technical indicators or patterns to bolster your analysis.

- Trendline Considerations: Patterns that align with established trendlines gain significance. Trendlines provide additional support or resistance levels, enhancing the reliability of candlestick patterns.

- Volume Validation: Assess the volume accompanying candlestick patterns. High-volume patterns tend to exhibit a more reliable trend change than low-volume patterns.

- Patience Prevails: Understand that candlestick patterns do not guarantee instant results. Practice patience and objectivity in your analysis, waiting for the market to validate your interpretation.

FAQs on Candlestick Patterns

Q: How many candlestick patterns exist?

A: There is no definitive count as new patterns continue to emerge. However, over 100 commonly recognized patterns form the core of candlestick analysis.

Q: Are candlestick patterns foolproof?

A: While highly valuable, candlestick patterns are not infallible. They should be used in conjunction with other technical indicators for a comprehensive market understanding.

Q: Is candlestick analysis suitable for all timeframes?

A: Candlestick patterns can be applied to any timeframe, from short-term intraday trading to long-term investment strategies.

Most Important Candlestick Patterns

Call to Action

Embark on a voyage of discovery with candlestick patterns, unlocking the secrets of market behavior. Embrace the transformative power of these visual gems to elevate your trading prowess. Embrace curiosity, engage with discussion forums, and seek knowledge. Remember, the pursuit of market mastery is an ongoing endeavor. Discover the hidden insights embedded within candlestick patterns and harness their potential to navigate the ever-evolving market landscape.

Are you ready to unlock the secrets of candlestick patterns?