We navigated life’s choppy seas, our vessel buffeted by the relentless headwinds of changing economic climates. Amidst these tempestuous economic waters, one beacon of hope emerged: the allure of the stock market. The promise of multiplied returns danced before our eyes, but it was soon replaced by a profound realization – the share price is a mercurial mistress, its whims dictated by a labyrinth of factors, a tapestry woven with threads of both the visible and the unseen.

Image: www.termscompared.com

Let us venture beyond the surface, delving into the depths of that enigmatic entity known as the share price, seeking to unravel the symphony of forces that orchestrate its ever-shifting value.

The Heart of the Matter: Supply and Demand

To understand the ebb and flow of share prices, it is imperative to grasp the fundamental principle of economics: the interplay of supply and demand. The dance of supply and demand is a continuous and delicate negotiation conducted between those seeking to acquire shares (demand) and those seeking to part with them (supply). The price of a share is determined at the point where the quantity demanded meets the quantity supplied. It’s like a large game of tug-of-war: when demand is high (many people want to buy), the price rises; when supply is high (many people want to sell), the price falls.

The Share Price Pendulum: The Role of Value

In the realm of investing, value is a compass, guiding investors toward opportunities for growth and shielding them from treacherous pitfalls. A company’s intrinsic value, a measure of its underlying worth, exerts a gravitational pull on its share price, keeping it tethered to a logical and rational trajectory. However, in the short term, the price of a share can detach itself from its intrinsic value, embarking on whimsical adventures into overvaluation and undervaluation. These price deviations from intrinsic value create opportunities for shrewd investors to buy at a discount and sell at a premium.

The relationship between share price and intrinsic value is a complex dance, often influenced by a tangled web of external factors, ranging from economic growth to global political events. Nonetheless, by scrutinizing company fundamentals, analyzing past performance, and making informed projections, investors can make educated decisions, seeking to harness the power of intrinsic value to guide their path.

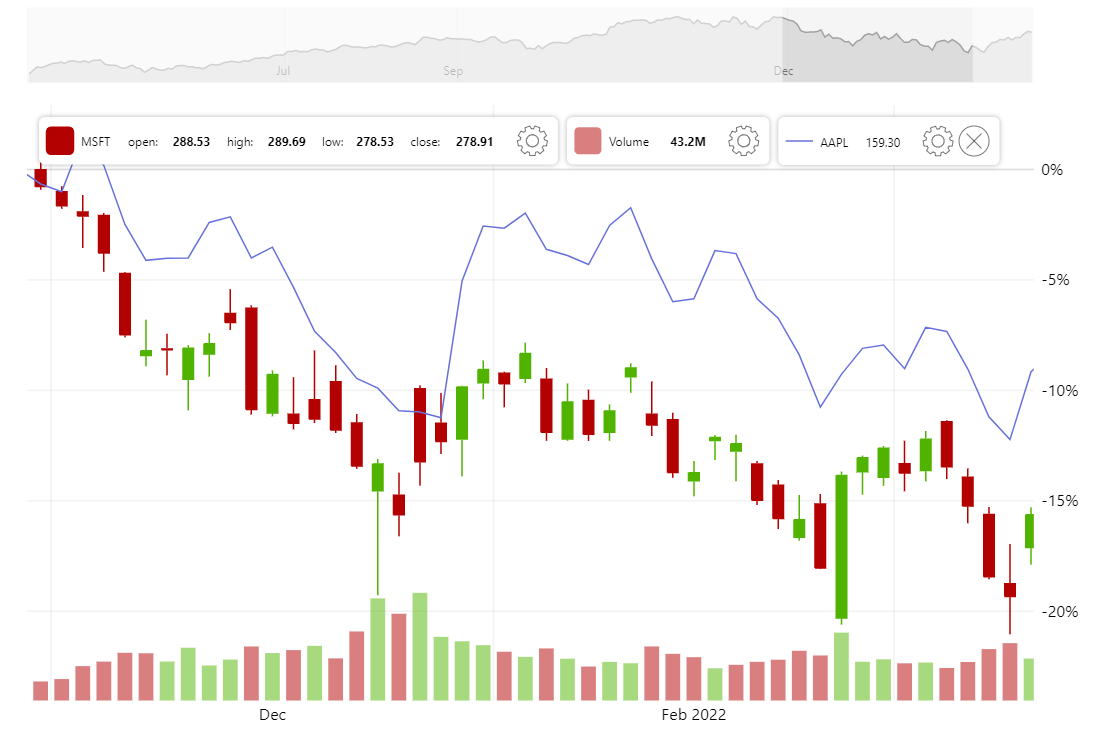

The Pulse of the Market: News and Sentiment

The financial pulse of the world reverberates through every fiber of the stock market. Major news events, economic shifts, company announcements, and even the elusive forces of market sentiment can send the share prices of companies hurtling in unpredictable directions. Like a tempestuous ocean, the market can be swayed by winds of both optimism and pessimism.

Positive news, such as exceeding revenue targets or the launch of promising new products, can trigger an influx of demand, propelling share prices upward. Conversely, negative events, like disappointing earnings reports or unfavorable regulatory changes, can spark a sell-off, driving prices downward. However, it is important to remember that not all market movements are logical or fair. Sentiment, influenced by factors such as fear and greed, can inflate or deflate share prices, creating opportunities for both cautious and adventurous investors.

Image: ar.inspiredpencil.com

Expert Guidance: Navigating the Market’s Maze

I have learned much on my meandering expedition through the stock market, encountering invaluable lessons along the way. These insights, gained through both triumphs and setbacks, are now yours to ponder and employ in your own financial pursuits.

A Cyclical Quest: Managing Risk and Reward

The stock market is an endless loop of risk and reward. Historically, over the long haul, the market has been a formidable force of growth and wealth creation. However, even for the most seasoned investors, there is no such thing as a free lunch. The possibility of losing capital is an inescapable reality.

To mitigate risk, diversification is a powerful tool. By spreading your eggs across a basket of diverse investments, you can reduce your exposure to any single company’s misfortunes. Patience is another weapon in your financial arsenal. The stock market often rewards those who remain steadfast through inevitable market fluctuations.

Seeking Knowledge: Research and Understanding

The stock market is a labyrinth, and successful navigation requires a map and a compass. To a large extent, this map is forged with the ink of knowledge, and the compass is guided by a deep understanding of the companies you invest in. Before embarking on your investment journey, take the time to study the markets, learn how to analyze companies, and gain insights into the movements of the broader economy.

Ignorance is a perilous guide in the realm of investing. By investing without first understanding the intricacies of the market, you are essentially leaving your financial fate to the whims of chance. The key to success lies in diligent research, seeking knowledge, and always striving to further your financial acumen.

FAQs: Illuminating the Path

Allow me to conclude our exploration by illuminating some of the most common questions that aspiring investors often pose:

What are the signs of a healthy stock?

-Consistent revenue growth -Stable or improving profit margins -Low debt -Strong cash flow -Positive analyst ratings

What red flags should I look for when evaluating a stock?

-Declining revenues -Falling profit margins -High debt -Negative cash flow -Poor management team -Lack of a competitive advantage

How can I stay up-to-date on market trends?

-Read financial news -Follow reputable finance blogs -Attend investor conferences -Network with other investors

What are some common mistakes novice investors make?

-Investing without a plan -Trading too often -Chasing hot stocks -Ignoring risk management -Not diversifying their portfolios

What Affects The Share Price

Enlightenment: An Invitation to Engage

Within this article, we have sought to disentangle the intricate web that dictates the share price, unveiling the forces of supply and demand, value, and market sentiment. Armed with this newfound knowledge, you stand at the gates of the stock market, an explorer poised to venture into the unknown.

So, my fellow adventurers, are you ready to embrace the kaleidoscopic world of shares, to ride the waves of market movements, and to potentially grow your wealth beyond your wildest dreams? The choice lies before you, and the path is yours to forge.

The stock market, in all its complexity and allure, awaits your arrival.