Introduction

As a forex trader, mastering the art of calculating potential profits is crucial for success. Pip profit calculators are indispensable tools that empower traders with real-time insights into their potential earnings, enabling them to make informed decisions in the dynamic forex market. In this article, we will delve into the world of pip profit calculators, exploring their significance, functionality, and how they can elevate your trading strategies.

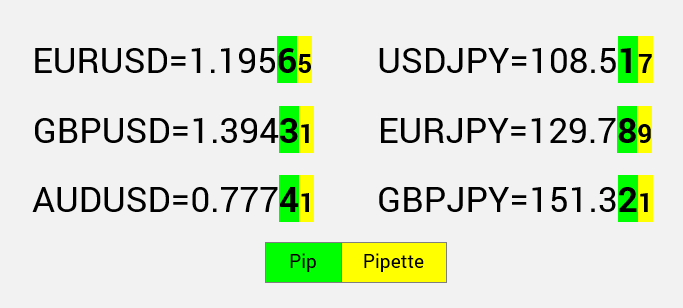

Image: forex-pak.com

Unlocking the Power of Pips

Pips are the fundamental unit of measurement in the forex market, representing the smallest increment of price change for a currency pair. Understanding pip values is essential for calculating potential profits and managing risk effectively. Forex pip profit calculators leverage this concept to provide traders with precise estimates of their earnings based on market movements.

Calculating Forex Profits with Precision

Understanding Pip Value

The pip value varies depending on the currency pair being traded. For example, for currency pairs involving the US dollar (USD), each pip is worth $0.0001. Conversely, for currency pairs without USD, the pip value is determined by the conversion rate between the two currencies.

Formula for Profit Calculation

To calculate your potential profit or loss, you can use the following formula:

Profit/Loss = (Pip Value x Pips Gained/Lost) x Number of Units Traded

For instance, if you trade 10,000 units of EUR/USD and close a position with a profit of 50 pips, your profit calculation would be:

Profit = (0.0001 x 50) x 10,000 = $50

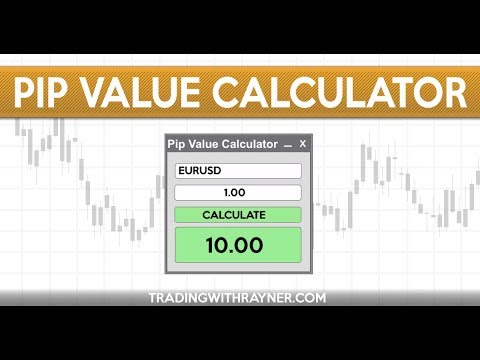

Image: analiticaderetail.com

Navigating the Forex Pip Profit Calculator Landscape

Various forex pip profit calculators exist, offering an array of features and functionalities. By leveraging these tools, traders can tailor calculations to their specific trading strategies and preferences.

Types of Calculators

Basic Calculators: These provide fundamental profit/loss calculations.

Advanced Calculators: Offer additional features, such as real-time currency rate updates and customized trading scenarios.

Spread/Commission Calculators: Calculate the impact of spreads and commissions on profitability.

Tips for Selecting a Calculator

- Consider your trading style and objectives.

- Prioritize calculators with intuitive interfaces and real-time updates.

- Explore calculators that provide both basic and advanced features.

Expert Advice on Pip Profit Calculation

Mastery of Position Sizing

Proper lot sizing is crucial for managing risk and maximizing potential profits. Traders should calculate their ideal position size based on their risk tolerance, account balance, and market volatility.

Hedging and Risk Management

Employ hedging strategies and risk management tools, such as stop-loss orders, to mitigate losses and protect profits.

Frequently Asked Questions

Q: How accurate are forex pip profit calculators?

A: Pip profit calculators provide approximate profit estimates based on current market conditions. Actual results may vary due to factors such as liquidity, slippage, and trading costs.

Q: What are the limitations of pip profit calculators?

A: Pip profit calculators do not consider trading psychology, market sentiment, or geopolitical events that may influence trading outcomes.

Forex Pip Profit Calculator

Conclusion

Forex pip profit calculators are indispensable tools that empower traders to make informed decisions and optimize their trading strategies. By understanding the intricacies of pip value, selecting the appropriate calculator, and following expert advice, traders can harness the power of these tools to maximize their profitability and navigate the dynamic forex market with confidence. May this article inspire you to delve deeper into the world of pip profit calculation.

Call to Action:

Would you like to learn more about forex trading and the effective use of pip profit calculators? Join our vibrant online community, where you can connect with experienced traders, exchange knowledge, and gain valuable insights to enhance your trading journey.