The ABSA dollar rate is a crucial indicator of the economic relationship between South Africa and the United States. As the world’s reserve currency, the US dollar holds immense significance in international trade, investment, and financial markets. Understanding the factors that influence the ABSA dollar rate is essential for businesses, investors, and individuals who engage in cross-border transactions.

Image: businesstech.co.za

In this comprehensive guide, we will delve into the intricacies of the ABSA dollar rate, exploring its history, key drivers, and implications for the South African economy. We will also provide insights into how to stay informed about the latest ABSA dollar rate and make informed decisions.

History of the ABSA Dollar Rate

The ABSA dollar rate has its roots in the post-apartheid era of South Africa. In 1994, the country’s central bank, the South African Reserve Bank (SARB), introduced a floating exchange rate regime, replacing the previous system of a fixed parity with the US dollar. This move allowed the rand to fluctuate freely against other currencies, based on market forces of supply and demand.

Since then, the ABSA dollar rate has experienced significant ups and downs, reflecting the economic and political conditions in both South Africa and the United States. Major events such as the global financial crisis and the implementation of quantitative easing in the US have had a profound impact on the rand’s value against the dollar.

Factors Influencing the ABSA Dollar Rate

Numerous factors play a role in determining the ABSA dollar rate. These include macro-economic indicators, global market conditions, and political developments:

- Economic Growth: The strength of South Africa’s economy and its growth prospects influence the ABSA dollar rate. A growing economy attracts foreign investment, increasing demand for the rand and driving up its value.

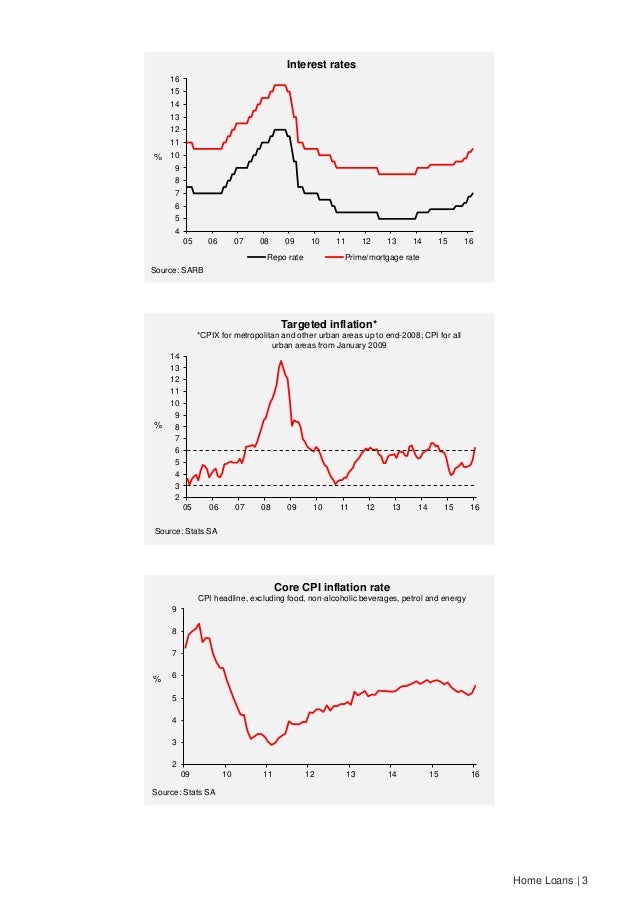

- Inflation: Inflation is a major factor affecting the ABSA dollar rate. High inflation erodes the purchasing power of the rand, making it less attractive to foreign investors and potentially leading to a depreciation against the dollar.

- Interest Rates: The SARB sets interest rates to manage inflation and influence economic growth. Higher interest rates make South African investments more attractive to foreign investors, increasing demand for the rand and potentially appreciating its value.

- Global Market Conditions: The ABSA dollar rate is also influenced by global economic conditions. A strengthening US economy, for example, tends to increase demand for the US dollar, while economic weakness in Europe can make the rand more attractive.

- Political Developments: Domestic and international political events can also impact the ABSA dollar rate. Political instability, corruption, or policy changes can erode investor confidence and lead to a depreciation of the rand.

Implications for the South African Economy

The ABSA dollar rate has a substantial impact on various sectors of the South African economy:

- International Trade: Importers of goods and services from the US will face higher costs if the rand depreciates, while exporters will benefit from a stronger rand.

- Debt Repayment: For borrowers who have external debt denominated in US dollars, a weaker rand means higher repayment costs. Conversely, a stronger rand reduces their burden.

- Investment: A favorable ABSA dollar rate can attract foreign investors to South Africa, boosting the capital inflows and supporting economic growth. However, a depreciating rand can discourage foreign investment and limit access to funding.

- Tourism: A weaker rand can make South Africa a more affordable destination for foreign tourists, while a stronger rand makes it more expensive for South Africans to travel abroad.

Image: www.slideshare.net

Monitoring the ABSA Dollar Rate

Stay up-to-date with the latest ABSA dollar rate by referring to reliable sources such as:

Keeping track of the ABSA dollar rate is particularly important for businesses and individuals engaging in international trade, making foreign investments, or planning overseas travel.

Absa Dollar Rate Today

Conclusion

The ABSA dollar rate is a complex phenomenon that can significantly impact the South African economy and its citizens. Affected by a diverse range of factors, the rate influences international trade, debt repayment, investment, and tourism. By understanding the factors influencing the ABSA dollar rate and staying informed about its latest developments, individuals, businesses, and decision-makers can make informed choices in managing their finances and engaging in cross-border activities.