As an avid home improvement enthusiast, I frequently find myself browsing through Home Depot’s aisles, marveling at the vast selection of products. But it wasn’t until recently that I stumbled upon the company’s financial performance and became particularly interested in its price-to-earnings (P/E) ratio.

Image: www.insidermonkey.com

The P/E ratio is a financial metric that indicates how much investors are willing to pay for a share of a company’s earnings. It is calculated by dividing the current market price of the stock by its annual earnings per share. In the case of Home Depot, its P/E ratio has been consistently above the industry average, suggesting that investors believe in the company’s strong growth prospects.

Unveiling the Key Factors

Several key factors contribute to Home Depot’s relatively high P/E ratio. Firstly, the company has established itself as a dominant player in the home improvement industry, commanding a significant market share. Its reputation for providing a comprehensive product selection, competitive prices, and exceptional customer service has fostered a loyal customer base.

Moreover, Home Depot has demonstrated consistent growth over the years, even amidst economic downturns. The company has effectively expanded its footprint, both through the acquisition of smaller competitors and by opening new stores. This growth has been fueled by the rising popularity of DIY projects and the increasing demand for home improvement products.

A History of Stability and Growth

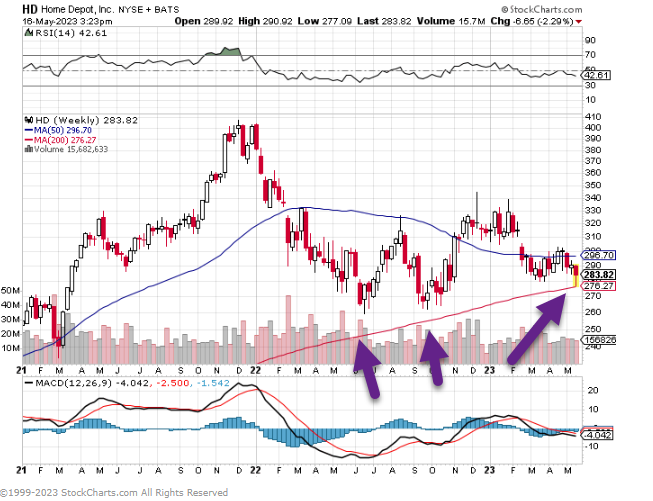

Home Depot’s P/E ratio has generally exhibited a pattern of stability and growth over the past decade. In 2012, the P/E ratio stood at approximately 17, and it has since moved within a range of 15 to 25. This relative stability reflects the company’s ability to navigate economic fluctuations and maintain a strong financial position.

The Role of P/E Ratio in Investment Decisions

The P/E ratio can be a valuable tool for investors looking to make informed decisions. A low P/E ratio can indicate that the stock is undervalued, while a high P/E ratio may suggest that it is overvalued. However, investors should consider other factors, such as the company’s growth prospects, financial health, and industry trends, before making investment decisions based solely on the P/E ratio.

For investors interested in investing in Home Depot, it is important to note that the company’s P/E ratio has historically been higher than the industry average. This premium is primarily attributed to Home Depot’s consistent growth, its strong brand recognition, and its ability to generate substantial profits.

Image: matttopley.com

Expert Advice for Savvy Investors

Based on my research and experience, I have compiled a few tips for investors seeking to leverage the P/E ratio for informed investment decisions:

- Consider the Long-Term Performance: Rather than focusing on short-term fluctuations, examine the P/E ratio over a longer period to assess the company’s overall stability and growth trajectory.

- Compare to Industry Benchmarks: Compare the P/E ratio of Home Depot to similar companies within the home improvement industry. This will provide context and help you determine if Home Depot’s P/E ratio is in line with its peers.

- Consider the Future Prospects: Evaluate Home Depot’s growth potential, industry trends, and economic outlook. If the company is expected to continue growing and maintaining its competitive advantage, a premium P/E ratio may be justified.

Frequently Asked Questions

To address common questions, here is a brief FAQ on Home Depot’s P/E ratio:

-

Q: What is a Price-to-Earnings (P/E) ratio?

A: A P/E ratio measures the value of a company’s stock relative to its earnings per share, providing insights into investor sentiment and growth potential.

-

Q: Is Home Depot’s P/E ratio considered high?

A: Compared to the industry benchmark, Home Depot’s P/E ratio is generally higher, suggesting that investors believe in its future growth opportunities.

-

Q: How can I use the P/E ratio in my investment decisions?

A: By analyzing the P/E ratio in conjunction with other factors like company performance and industry trends, you can make informed judgments about the potential value of a stock.

Home Depot Pe Ratio

Conclusion

Home Depot’s P/E ratio serves as an indicator of investor confidence and future growth expectations. While it is an important consideration for investment decisions, it should be used in conjunction with other financial metrics and qualitative factors. By understanding the complexities of the P/E ratio and its implications for Home Depot, investors can make more informed choices in their investment portfolios.

If you found this article insightful and informative, I would encourage you to continue exploring the topic. Delve deeper into the financial aspects of Home Depot, analyze its industry dynamics, and stay updated with the latest news and developments. By staying informed, you can make sound investment decisions and potentially reap the rewards.