In the realm of currency trading, the concept of pips serves as a fundamental building block for understanding market fluctuations and calculating potential profits or losses. For traders, grasp how much a pip is crucial for making informed decisions and managing risk effectively. In this comprehensive guide, we will delve into the intricacies of pips, their calculation, and their significance in forex trading.

Image: fabalabse.com

What is a Pip?

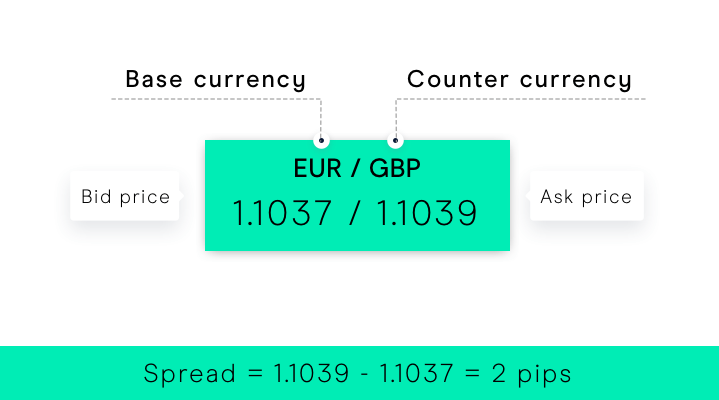

A pip (point in percentage) represents the smallest increment of change in the exchange rate between two currencies. It is typically the fourth decimal place for currency pairs that include the Japanese yen (JPY) and the second decimal place for all other currency pairings. For example, if the EUR/USD exchange rate moves from 1.1500 to 1.1501, this represents a change of one pip.

Calculating Pips

The calculation of pips is directly influenced by the currency pair being traded and the size of the position held. Generally, one pip is equal to 0.0001 for currency pairs involving JPY and 0.00001 for all other pairings.

To determine the pip value for a particular currency pair and position size, the following formula can be applied:

Pip Value = Contract Size / Exchange Rate

For instance, if you hold a position of 10,000 units of EUR/USD with an exchange rate of 1.1500, the pip value can be calculated as follows:

Pip Value = 10,000 / 1.1500 = 8,696

This indicates that for this particular position, each pip movement is equivalent to a gain or loss of 8,696 units of the account’s base currency.

Significance of Pips in Forex Trading

Pips play a crucial role in Forex trading as they serve as the fundamental unit for measuring price movements and calculating profitability. In essence, pips represent a standardized and quantifiable way to assess the magnitude of exchange rate fluctuations.

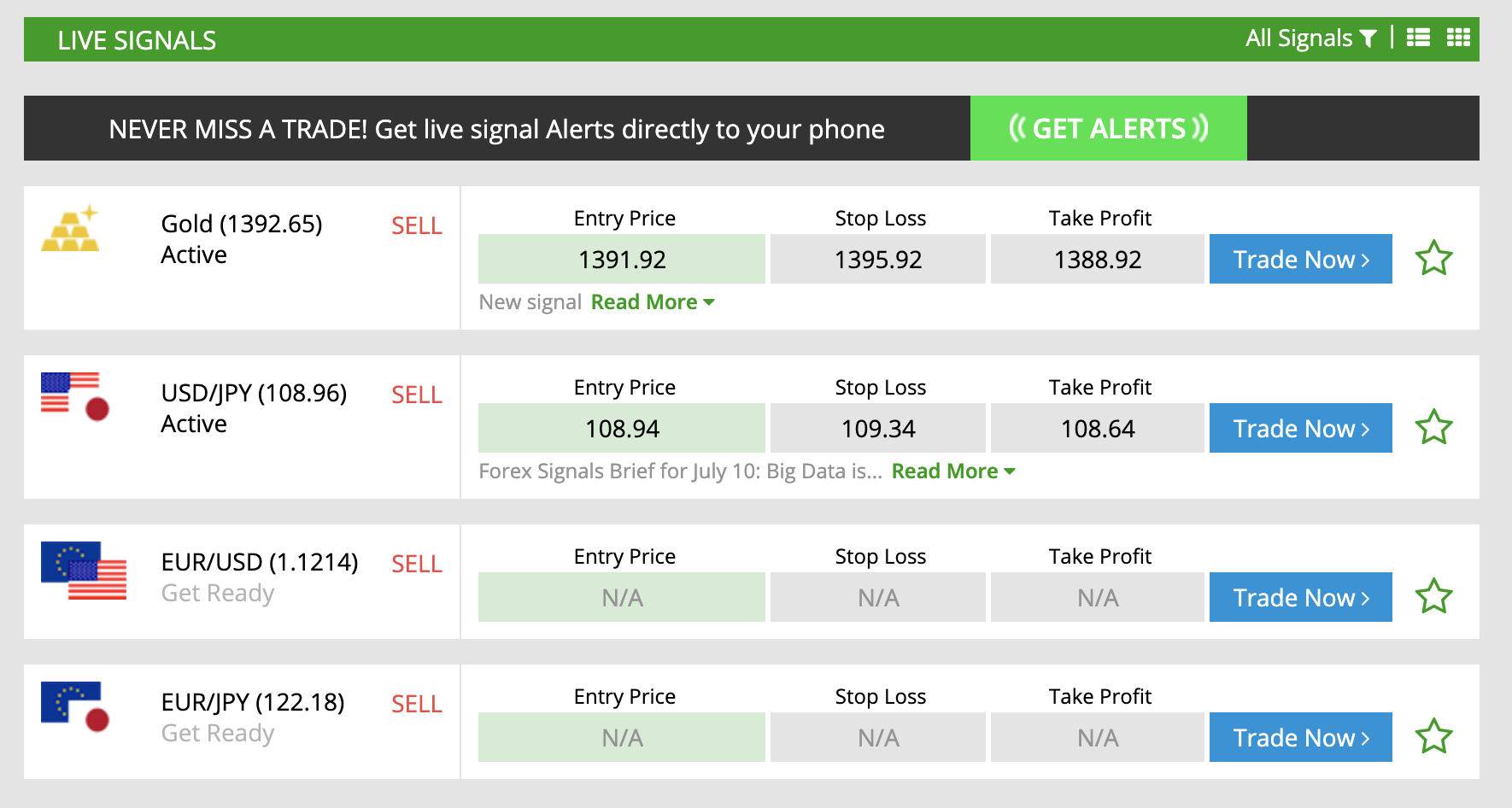

Traders utilize pips to monitor market conditions, set stop-loss and take-profit orders, and determine the potential profitability of trading opportunities. Understanding the pip value for a given position is essential for managing risk and optimizing trading strategies.

Image: www.cmcmarkets.com

How Much Is 1 Pip

Conclusion

The comprehension of pips and their calculation is a fundamental aspect of Forex trading. By grasping how much a pip is, traders can navigate market fluctuations more effectively, make informed decisions about position sizing, and accurately evaluate the risk and reward potential of their trading activities. A thorough understanding of pips empowers traders to capitalize on market movements, optimize their trading strategies, and ultimately achieve their financial goals.