Unveiling the Significance of Pips in Gold Markets

In the fast-paced world of gold trading, understanding the concept of pips is crucial for success. A pip, or point in percentage, represents the smallest price increment in foreign exchange and precious metals markets. For gold, a pip typically refers to a change of $0.01 in the quoted price per troy ounce. Pips serve as the basis for calculating profit and loss in gold trades.

Image: www.cashbackforex.com

Pip Calculation: A Detailed Walkthrough

Calculating pips is a straightforward process. The formula for calculating the number of pips between two gold prices is:

Number of pips = (New price – Old price) / Tick size

The tick size, commonly known as the minimum price increment, varies depending on the broker or trading platform. For precious metals like gold, the tick size is usually $0.01 per troy ounce.

Example of Pips in Gold Trading

For instance, suppose you purchase gold at a price of $1,800 per troy ounce and later sell it at $1,802 per troy ounce. The change in price is $2, and the number of pips gained is:

Number of pips = (1,802 – 1,800) / 0.01 = 20 pips

Leveraging Pips for Profitability

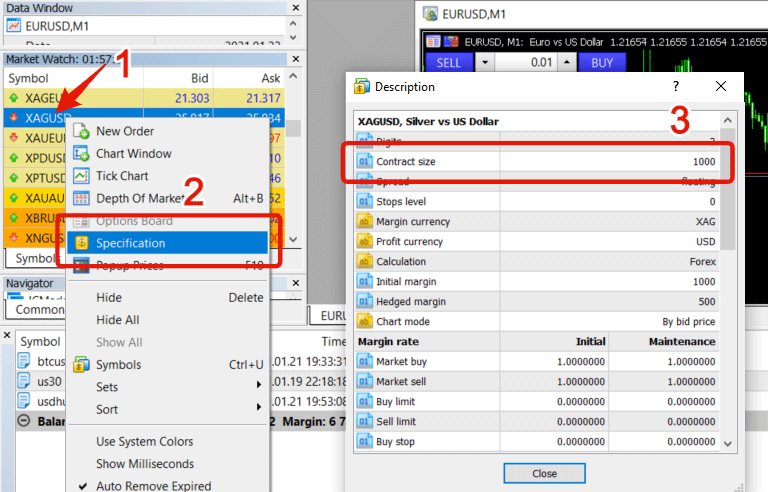

Pips are vital in determining the profitability of gold trades. Traders multiply the number of pips gained or lost by the contract size, known as the lot size, to calculate the profit or loss in dollars. A typical lot size in gold is 100 troy ounces.

For example, if you trade a standard lot of gold and gain 20 pips, your profit would be:

Profit = 20 pips x $0.01 per pip x 100 troy ounces = $200

Image: www.youtube.com

Advanced Techniques for Pip Analysis

Seasoned gold traders employ advanced techniques to maximize pip profitability. They analyze historical price data, market trends, and geopolitical events that influence gold prices. By identifying patterns and forecasting price movements, traders can position themselves to capture more pips and enhance their overall returns.

Tips for Enhancing Pip Performance

- Understand the factors influencing gold prices and keep abreast of market news.

- Select a reputable broker with competitive spreads and reliable price feeds.

- Manage your risk effectively by implementing stop-loss orders.

- Use technical analysis tools to identify potential trading opportunities.

- Practice patience and avoid overtrading to preserve capital and improve profitability.

FAQs on Pips in Gold Trading

Q: What is the tick size for gold?

A: Typically, the tick size for gold is $0.01 per troy ounce.

Q: How many pips are there in one dollar?

A: It depends on the lot size. For a standard lot of 100 troy ounces, 1 dollar equals 100 pips.

Q: Can pips be used to calculate profit in gold trading?

A: Yes, pips are the basis for calculating profit or loss in gold trades. Traders multiply the number of pips gained or lost by the lot size to determine the profit/loss amount.

Pip Calculator For Gold

Conclusion

Understanding pips is essential for success in gold trading. By grasping the concepts of pip calculation and applying advanced techniques, traders can increase their profitability and navigate the dynamic gold markets with greater confidence. Are you ready to delve deeper into the world of gold trading and master the art of pip management?