Imagine a world where money is not just a piece of paper or a bunch of digits on a screen but is instead backed by something tangible, something with real value. In this world, currencies would be intrinsically linked to commodities such as gold, silver, or oil, providing a level of stability and security that fiat currencies cannot match. Welcome to the fascinating realm of commodities-backed currencies, where intrinsic value meets financial innovation.

Image: www.cmegroup.com

Commodities-backed currencies are rooted in the ancient tradition of using precious metals as a medium of exchange. For centuries, gold and silver have been recognized as stores of value and have been used to back up currencies, ensuring their stability and purchasing power. In modern times, as fiat currencies became the norm, the idea of commodities-backed currencies has resurfaced as a way to address concerns about inflation, currency manipulation, and economic uncertainty.

The concept of a commodities-backed currency is simple: the value of the currency is directly tied to the value of the underlying commodity. This means that if the price of gold rises, the value of a gold-backed currency will also rise, providing stability and protection against inflation. Similarly, if the price of oil falls, the value of an oil-backed currency will decrease, reflecting the changing market conditions.

One of the most well-known examples of a commodities-backed currency is the gold standard. Under a gold standard, the value of a currency is pegged to a fixed amount of gold. This means that the government承诺 to redeem its currency for gold at a fixed rate. The gold standard was widely used in the 19th and early 20th centuries but was eventually abandoned due to factors such as economic instability and the need for greater monetary flexibility.

Despite the decline of the gold standard, the idea of commodities-backed currencies has never fully disappeared. In recent years, as concerns about inflation and economic uncertainty have grown, interest in commodities-backed currencies has surged. Several countries, including Venezuela and Iran, have introduced commodities-backed currencies as a way to stabilize their economies and protect against the devaluation of their fiat currencies.

The use of commodities-backed currencies comes with a number of advantages. First and foremost, they provide a level of stability that fiat currencies cannot match. Because the value of a commodities-backed currency is tied to the value of a physical commodity, it is less susceptible to inflation and currency manipulation. This can be particularly important for countries with unstable or developing economies.

Another advantage of commodities-backed currencies is that they can help to reduce economic uncertainty. By providing a tangible backing for the currency, commodities-backed currencies can give businesses and investors confidence in the value of the currency, which can lead to increased investment and economic growth.

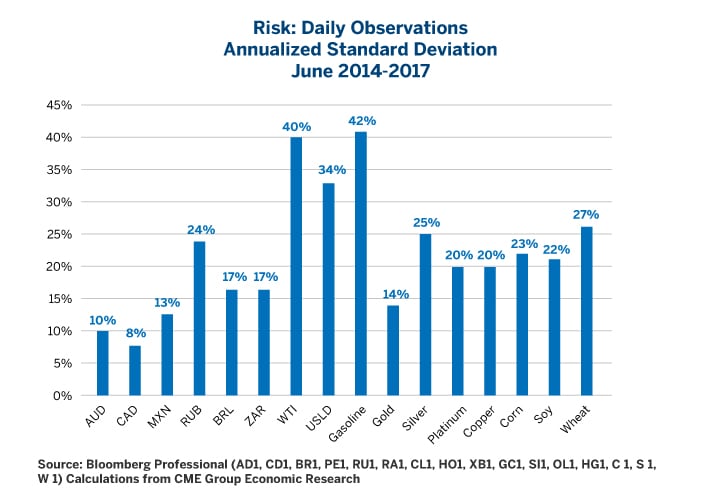

Of course, commodities-backed currencies are not without their drawbacks. One major concern is that they can be subject to the volatility of the underlying commodity. If the price of the commodity fluctuates significantly, the value of the currency can also fluctuate, which can be disruptive to businesses and investors.

Additionally, commodities-backed currencies can be difficult to manage. In order to maintain the peg between the currency and the commodity, the government must have a sufficient supply of the commodity. This can be a challenge for countries that do not have a significant domestic production of the commodity or that must rely on imports.

Despite these drawbacks, commodities-backed currencies remain an attractive option for countries looking to stabilize their economies and protect against inflation. By tying the value of their currency to a tangible commodity, countries can provide their citizens with a level of financial security that is difficult to achieve with fiat currencies alone.

As the world continues to grapple with economic uncertainty and the challenges of global trade, the allure of commodities-backed currencies is likely to grow. Whether they become a widespread alternative to fiat currencies remains to be seen, but their potential for stability and security is undeniable.

Image: nas100scalping.com

Currencies Backed By Commodities