At the heart of global commerce lies the intricate web of currency exchange rates, allowing nations to transact and connect economically. Among the prominent players in this dynamic arena stands ABSA, a renowned South African financial institution that plays a vital role in facilitating currency conversions between the South African rand (ZAR) and the United States dollar (USD). In this comprehensive guide, we delve into the complexities of the ABSA USD exchange rate, deciphering its nuances and empowering you with insights to navigate this financial landscape with confidence.

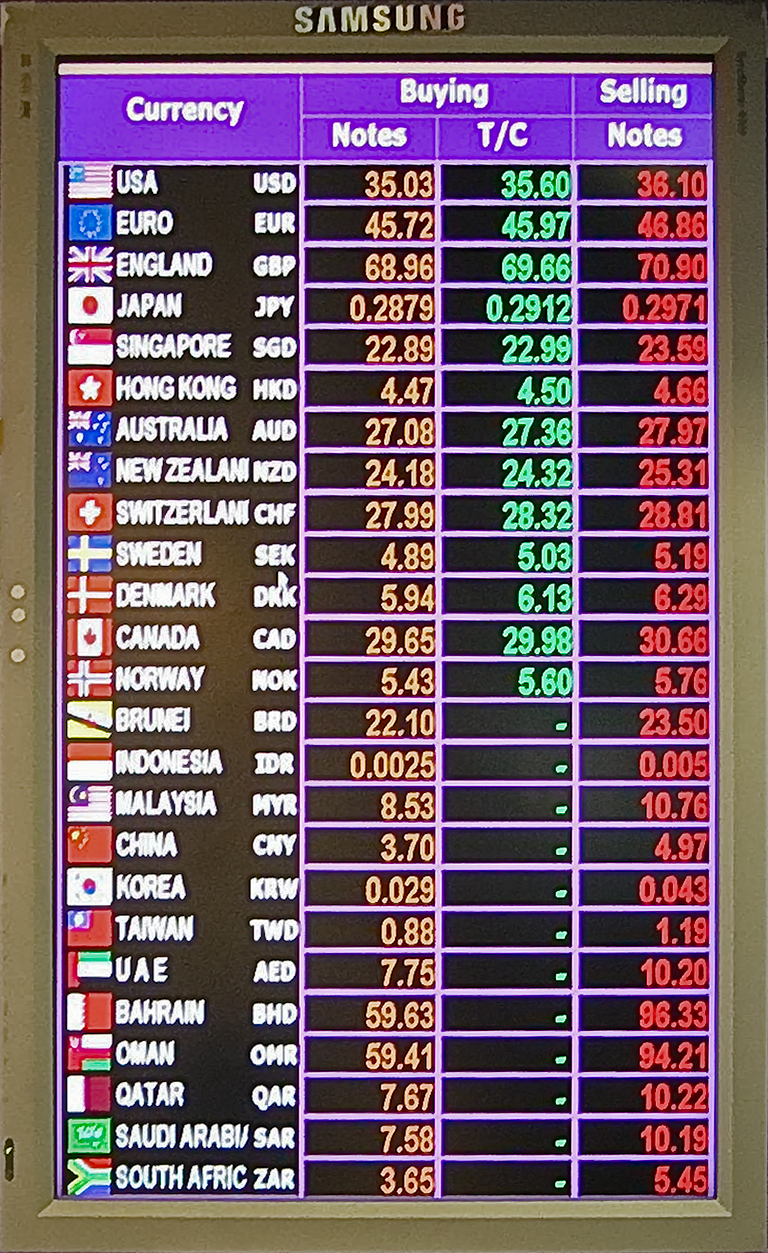

Image: dic.academic.ru

Exploring the ABSA USD Exchange Rate: A Tale of Two Currencies

The ABSA USD exchange rate is simply the value of the USD relative to the ZAR. This rate fluctuates continuously, influenced by a multitude of economic, political, and market factors. Comprehending these factors is crucial to discerning the dynamics that shape this crucial currency pair.

Factors Shaping the ABSA USD Exchange Rate: A Tapestry of Influences

Multiple interconnected forces orchestrate the dance of the ABSA USD exchange rate, including:

-

Economic indicators: Shifts in economic growth, inflation rates, and unemployment levels can sway the exchange rate.

-

Political events: Political stability, elections, and international relations can impact investor sentiment and consequently affect currency values.

-

Global economic outlook: Broad trends in the global economy, such as changes in interest rates and commodity prices, can ripple through currency markets.

-

Supply and demand: The relative demand for USD and ZAR in international trade, investment, and tourism also contributes to exchange rate fluctuations.

Decoding ABSA’s Role: A Gateway to Currency Conversion

ABSA, as a leading financial institution in South Africa, plays a pivotal role in facilitating USD conversions for businesses and individuals alike. When dealing with ABSA, it is essential to understand the following:

-

Transaction fees: ABSA typically charges a transaction fee for currency conversions, varying based on the amount and currency pair involved.

-

Exchange rate margins: The exchange rate offered by ABSA may include a small margin, representing the bank’s profit on the transaction.

-

Online and offline services: ABSA offers both online and offline channels for currency conversions, providing convenience and flexibility to its customers.

Image: www.uab.com.mm

Maximize Your Currency Conversions: Strategies for Savvy Traders

To optimize your currency conversions, consider these practical tips:

-

Monitor market trends: Stay abreast of economic news and events that may impact the ABSA USD exchange rate, allowing you to make informed decisions.

-

Compare exchange rates: Explore different financial institutions and online platforms to compare exchange rates and identify the most favorable option for your needs.

-

Utilize limit orders: Place limit orders with ABSA to secure a desired exchange rate, ensuring you execute your trade at a specific price point.

-

Consider hedging strategies: For businesses and individuals exposed to currency fluctuations, hedging instruments, such as forward contracts, can mitigate potential losses.

Absa Usd Exchange Rate

https://youtube.com/watch?v=As1t8sIhukA

Embracing a Changing Landscape: The Future of ABSA USD Exchange Rate

The ABSA USD exchange rate, like all currency exchange rates, is inherently dynamic, constantly adapting to the ever-evolving global economy. As technology advances and financial markets continue to evolve, we can expect new trends and innovations to shape this landscape.

Embrace the fluidity of the ABSA USD exchange rate, staying informed and employing savvy strategies to navigate the complexities of currency conversion. By understanding its intricacies, you unlock a world of financial opportunities, empowering yourself to make informed decisions and harness the transformative potential of global commerce.