In the fast-paced world of financial markets, where volatility reigns supreme, traders and investors constantly seek tools to help them navigate the ever-shifting tides. Among these, one technique stands out as a beacon of clarity and predictability: Fibonacci retracements. By harnessing the power of this mathematical sequence, market participants can gain valuable insights into potential price reversals and retracement levels, enhancing their trading strategies and increasing their chances of success.

Image: www.forexboat.com

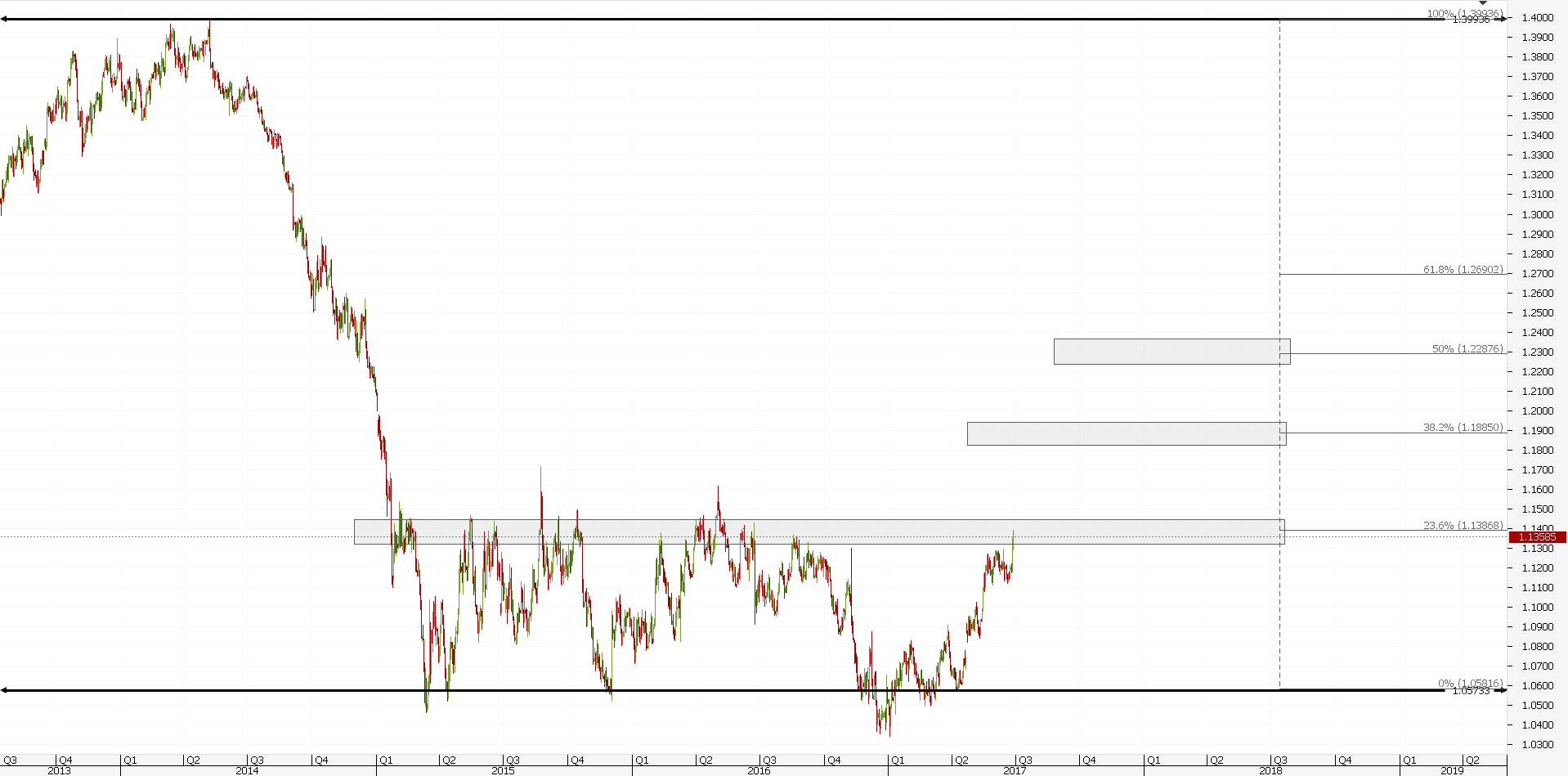

Fibonacci retracements, named after the renowned Italian mathematician Leonardo Fibonacci, are a set of horizontal lines drawn on a price chart, indicating potential areas where a stock, commodity, or currency may encounter support or resistance after a significant price movement. These lines are derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones (0, 1, 1, 2, 3, 5, 8, 13, and so on).

The key Fibonacci retracement levels are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. These levels represent the ratios of the Fibonacci sequence, and they are believed to indicate potential price targets or reversal points. For instance, if a stock price rises sharply, a retracement to the 38.2% level suggests a possible area where the upward momentum may pause or reverse. Conversely, if a stock price falls abruptly, a retracement to the 61.8% level could indicate a potential area of support.

Using Fibonacci retracements requires careful analysis and an understanding of market context. Traders should consider the overall trend of the market or asset, as well as any recent news or events that may influence price movements. Additionally, Fibonacci retracements are not foolproof, and they should be used in conjunction with other technical analysis tools and indicators for a comprehensive view of market dynamics.

Expert Insights and Actionable Tips

Renowned trading expert and Fibonacci specialist Ralph Elliott once said, “The Fibonacci ratio of 61.8% forms a bottom in falling prices and a top in rising prices. It forecasts!” This observation highlights the significance of recognizing these key levels in price action.

To effectively use Fibonacci retracements, traders should:

-

Identify significant price swings: Determine clear uptrends or downtrends before applying Fibonacci retracements.

-

Draw retracement lines: Plot horizontal lines at the Fibonacci levels (23.6%, 38.2%, 50%, 61.8%, and 78.6%) between the swing high and swing low.

-

Monitor price behavior at retracement levels: Observe how price reacts when it touches or approaches Fibonacci lines. Bounces off these levels often indicate potential reversals or continuations of the prevailing trend.

-

Consider multiple retracements: Using multiple retracement levels can provide a more comprehensive view of potential price targets and support or resistance zones.

-

Interpret with caution: Fibonacci retracements are not infallible, and they should be used alongside other technical indicators and market analysis.

Conclusion

Mastering Fibonacci retracements is an invaluable skill for traders and investors alike. By harnessing the power of this mathematical sequence, market participants can gain valuable insights into price movements, identify potential retracement levels, and enhance their decision-making process. Remember, the most successful traders are those who combine technical analysis with sound judgment and an understanding of market fundamentals. By delving into the world of Fibonacci retracements, you unlock a powerful tool that can help you navigate the financial markets with greater confidence and precision.

Image: www.olymptradewiki.com

How To Use Fibonacci Retracements