Introduction

Image: library.tradingtechnologies.com

Imagine being amidst a turbulent sea, with choppy waters and unpredictable currents. In such a scenario, a reliable compass becomes an essential tool guiding your vessel towards safer shores. For investors navigating the complexities of financial markets, the Market Facilitation Index (MFI) serves as a similar guiding force, providing invaluable insights into market liquidity and trading conditions.

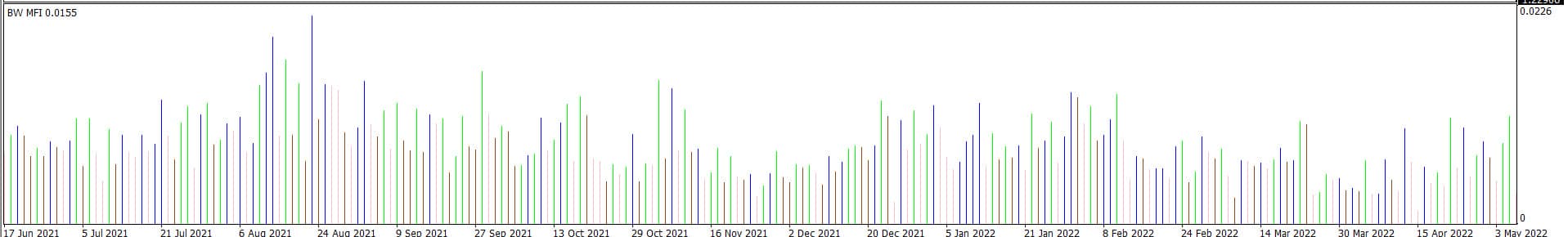

The MFI, developed by renowned market analyst Tom DeMark in the 1970s, is a technical indicator that measures the ease or difficulty with which buyers and sellers can execute trades in a particular market. By identifying periods of high and low liquidity, the MFI helps investors make informed decisions about entering or exiting positions, optimizing their market strategy for optimal returns.

Understanding market facilitation index indicator

The MFI indicator is calculated using a complex formula that considers the volume and price changes of a security over a specific period. It ranges from 0 to 100, with 0 representing extremely low liquidity and 100 indicating maximum liquidity. Generally, higher MFI values suggest increased market participation, while lower values indicate decreased trading activity.

Historical Significance

The MFI indicator has been widely used by traders and investors for decades. It gained prominence in the 1980s when it was featured in DeMark’s book, “The New Science of Technical Analysis.” Since then, the MFI has become a staple in the toolkit of many successful market participants.

Contemporary Applications

Today, the MFI remains a relevant and valuable tool for investors. It is utilized in various trading strategies, including:

- Identifying trading opportunities: Traders use the MFI to identify favorable entry and exit points based on liquidity fluctuations.

- Assessing market sentiment: High MFI values often indicate bullish sentiment, while low values suggest bearish sentiment.

- Measuring volatility: The MFI can help investors gauge market volatility by identifying periods of extreme liquidity fluctuations.

- Risk management: The MFI can assist traders in managing risk by providing insights into market conditions and liquidity availability.

Expert Insights

“The MFI is a valuable tool that can provide traders with a unique perspective on market liquidity,” says market analyst Bill Williams. “By understanding the MFI’s fluctuations, traders can make more informed decisions based on market conditions.”

“The MFI has helped me identify numerous trading opportunities that I might have otherwise missed,” adds professional trader Jane Brian. “It’s an indispensable part of my trading strategy.”

Actionable Tips

Consider these actionable tips to effectively use the MFI indicator in your trading:

- Combine with other indicators: The MFI is best used in conjunction with other technical indicators for a more comprehensive analysis.

- Consider different timeframes: The MFI can be applied to different timeframes, ranging from intraday to weekly charts.

- Set alerts: You can set up alerts based on MFI levels to identify trading opportunities or potential market shifts.

- Understand its limitations: The MFI is not a perfect indicator and should be used as one piece of information within your overall trading strategy.

Conclusion

The MFI indicator is a powerful tool that can help investors navigate the complexities of financial markets by providing insights into market liquidity, sentiment, and volatility. By understanding the MFI’s significance and utilizing it effectively, you can gain a competitive edge and improve your trading decisions. Remember, like any tool, the MFI is most effective when combined with other indicators, a thorough understanding of market dynamics, and a disciplined trading strategy.

Image: learnpriceaction.com

Market Facilitation Index Indicator