Introduction

Trading can be a lucrative profession, but it requires a clear understanding of the market, investment strategies, and risk management. For初心者, it can be overwhelming to navigate the complex world of finance. This article aims to demystify the process and provide beginner traders with a comprehensive guide to successful trading. By following these strategies, beginners can increase their chances of profiting in the markets.

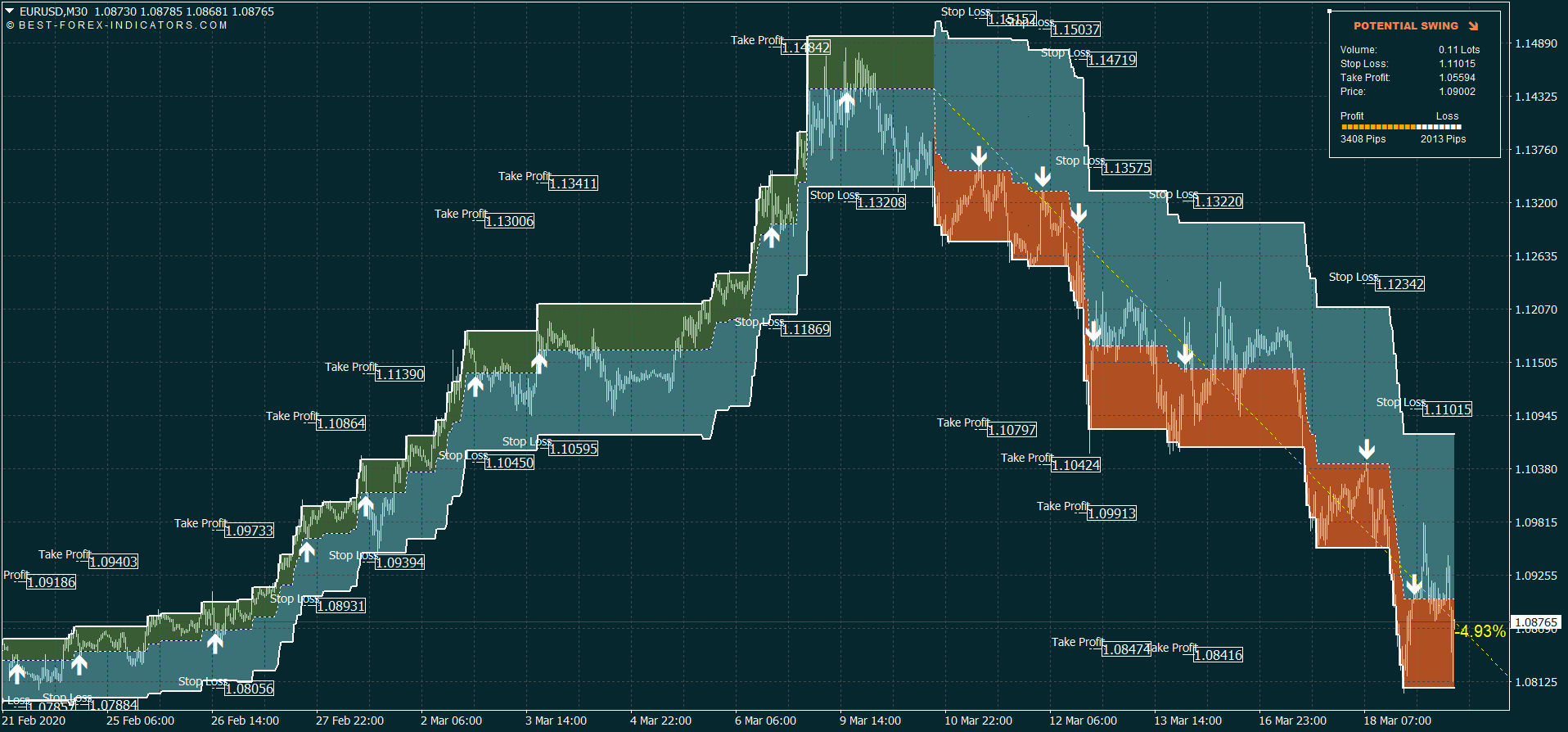

Image: best-forex-indicators.com

Before delving into specific strategies, it is crucial to understand the fundamentals of trading. Technical analysis, fundamental analysis, risk management, and discipline are key components of successful trading. Technical analysis involves studying price charts and patterns to identify trends and predict future market movements. Fundamental analysis focuses on a company’s financial health, management, and industry to determine its intrinsic value.

Trading Strategies for Beginners

Once you have a grasp of the basics, it’s time to explore trading strategies suitable for beginners. Remember, there is no one-size-fits-all approach, and the best strategy depends on your individual risk tolerance and trading style.

1. Trend Trading

Trend trading involves identifying and trading in the direction of the prevailing market trend. This strategy is popular among beginners as it is relatively straightforward to identify trends and trade accordingly. To implementトレンド, traders can use moving averages, support and resistance levels, and other technical indicators to identify trend direction.

2. Scalping

Scalping is a short-term trading strategy where traders aim to profit from small price movements within a single trading session. Scalpers use high leverage and tight stop-loss orders to minimize risk and take advantage of small profit opportunities. This strategy requires quick decision-making and a deep understanding of price movements.

Image: es.benzinga.com

3. Position Trading

Position trading is a long-term trading strategy where traders hold positions for weeks, months, or even years. This strategy is suitable for traders who are patient and willing to wait for substantial market movements. Position traders rely on fundamental analysis to select undervalued stocks and hold them until their intrinsic value is realized.

4. Swing Trading

Swing trading is a hybrid strategy that combines elements of trend trading and position trading. Swing traders hold positions for a few days to a few weeks, capturing short-term market swings. This strategy requires a combination of technical analysis to identify swing points and fundamental analysis to select stocks with strong underlying fundamentals.

Risk Management and Discipline

Risk management and discipline are essential aspects of successful trading. Beginners should always use stop-loss orders to limit their potential losses and set realistic profit targets. It is also crucial to avoid overtrading and chasing losses. Discipline and emotional control are key to long-term trading success.

Best Strategy For Beginner Traders

Conclusion

Trading can be a rewarding endeavor, but it requires a deep understanding of the market, proper trading strategies, and unwavering discipline. By following the strategies outlined in this guide, beginner traders can increase their chances of profitability and navigate the complex world of finance with confidence. Remember to conduct thorough research, practice patience, and never risk more money than you can afford to lose.