Introduction

In the intricate world of finance, investors strive to make informed decisions that optimize their portfolios. One crucial tool they employ is the Market Value Weighted Index (MVWI). This index holds immense significance as it enables investors to track and evaluate the performance of a broad market or specific sector. Understanding how to calculate the MVWI empowers investors to leverage its potential and make discerning investment choices.

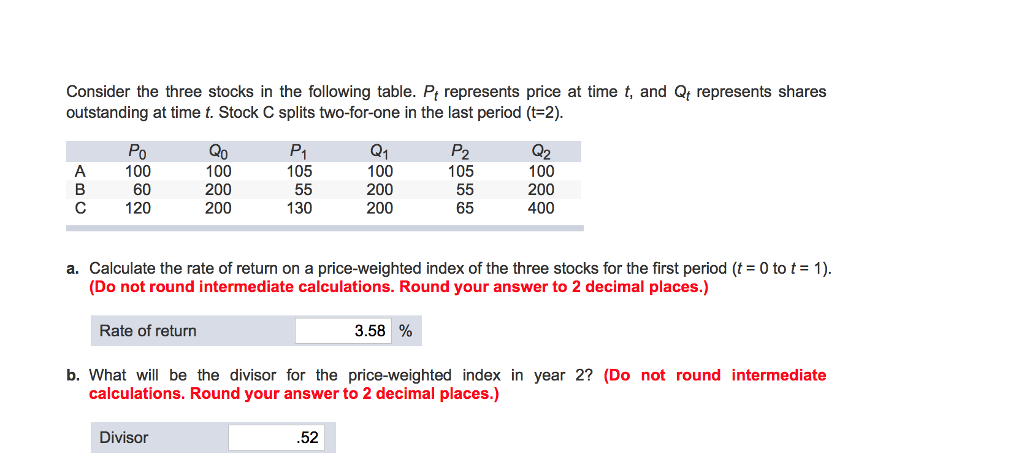

Image: www.chegg.com

The MVWI is a weighted average of the prices of a group of stocks, where the weights are determined by the market value of the underlying companies. Simply put, it reflects the overall market performance by considering the impact of companies with larger market capitalizations. This unique weighting methodology allows the MVWI to accurately capture the value of the entire market or specific industry segments.

Calculating the Market Value Weighted Index

Calculating the MVWI involves a straightforward process that empowers investors to grasp the underlying principles.

Step 1: Obtain Stock Prices and Market Capitalizations

The initial step involves gathering the current stock prices and market capitalizations of all the stocks included in the index. The market capitalization is calculated by multiplying the current stock price by the total number of outstanding shares.

Step 2: Calculate Weights

Using the market capitalizations, you can determine the weight of each stock in the index. The weight is simply the market capitalization of the stock divided by the total market capitalization of all the stocks in the index. This step assigns higher weights to companies with larger market values.

Image: haipernews.com

Step 3: Weighted Average Calculation

To compute the MVWI, you multiply each stock’s weight by its stock price and then sum these values across all the stocks in the index. The result is the weighted average that represents the overall market performance.

Expert Insights and Actionable Tips

Noted investment expert, Dr. Mark Fisher, emphasizes the significance of scrutinizing constituent weights when evaluating an MVWI. “Weighting schemes can influence the index’s sensitivity to individual stock price movements,” he advises. “Investors should assess whether the weights align with their investment objectives.”

Incorporating the MVWI into your investment strategy can yield substantial advantages. Ron Barnes, a distinguished financial advisor, recommends leveraging the index as a benchmark for portfolio performance. “Comparing your portfolio’s return to that of the MVWI provides valuable insights into your investment strategy’s effectiveness,” he suggests.

Real-World Example

Consider a hypothetical MVWI composed of three stocks:

- Stock A: Stock price: $50, Market capitalization: $100 million

- Stock B: Stock price: $100, Market capitalization: $200 million

- Stock C: Stock price: $150, Market capitalization: $300 million

To calculate the MVWI:

- Calculate Weights:

- Weight of Stock A = 100 / 600 = 0.1667

- Weight of Stock B = 200 / 600 = 0.3333

- Weight of Stock C = 300 / 600 = 0.5

- Weighted Average Calculation:

- MVWI = (0.1667 50) + (0.3333 100) + (0.5 * 150) = $116.67

In this example, the MVWI value is $116.67, representing the weighted average of the stock prices based on their market capitalizations.

How To Calculate Market Value Weighted Index

Conclusion

Understanding how to calculate the Market Value Weighted Index empowers investors with a valuable tool for evaluating market performance and making informed investment decisions. By meticulously following the steps outlined in this article, investors can calculate the MVWI and gain insights into the overall health and direction of the market or specific industry segments.