Introduction

In the world of forex trading, the concept of a “pip” is of utmost importance. When you buy or sell a currency pair, you’ll encounter the pip often. Knowing what a pip is and how it affects your trades will significantly improve your chances of success in the foreign exchange market. In this article, we’ll delve deep into the world of pips, exploring their history, significance, and practical applications.

Image: www.sanforex101.com

What Is a Pip?

A pip stands for “point in percentage” and represents the smallest unit of price movement in forex. For most major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, a pip is equal to 0.0001 or one-ten thousandth of the quoted currency. However, some currency pairs, like USD/JPY, have a pip value of 0.01 or one hundredth of the quoted currency. It’s essential to check the pip value of the currency pair you’re trading before placing an order.

Historical Significance of Pips

Before the advent of electronic trading, forex transactions were conducted manually, and prices were quoted with fewer decimal places. In the 1970s, with the introduction of floating exchange rates and the proliferation of electronic trading platforms, the need for greater accuracy in currency pricing emerged. This led to the widespread adoption of pips as the standard unit of measurement for price fluctuations.

How Pips Affect Your Trades

When you buy or sell a currency pair, you’re essentially betting on whether the value of one currency will rise or fall against the other. The profit or loss you make on your trade depends on the number of pips the currency pair moves in your favor or against you. For example, if you buy EUR/USD at 1.1000 and the value increases to 1.1010, you have made a profit of 10 pips.

Image: howtotradeonforex.github.io

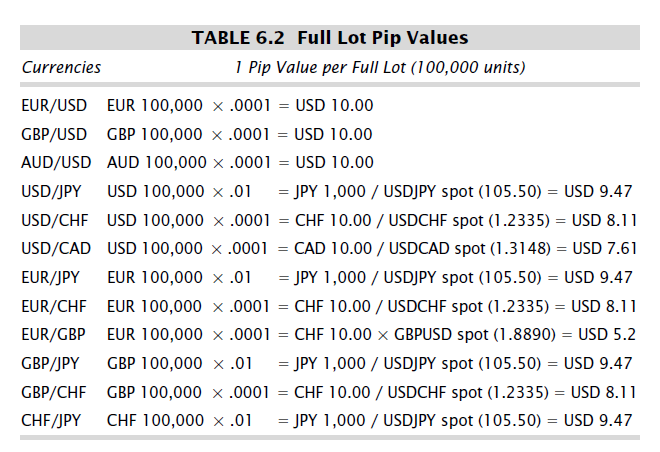

Calculating Pip Value

To determine the pip value of a trade, you’ll need the current price of the currency pair and the contract size. Let’s say you’re trading EUR/USD with a contract size of 100,000. If the current price is 1.1000 and the pip value is 0.0001, then the value of one pip is equal to $1:

Pip Value = Contract Size Pip Value in Points Current Price

= $100,000 0.0001 1.1000

= $1

Trading Pips: Strategies and Tips

While it’s possible to trade pips directly, most traders use leverage to amplify their profits. Leverage allows you to control a larger position with a smaller amount of capital. However, it also magnifies your losses, so it’s crucial to use leverage wisely and manage your risk accordingly.

When trading pips, it’s essential to develop a trading strategy that defines your entry and exit points. Technical analysis, fundamental analysis, and market sentiment can be used to identify profitable trading opportunities. Risk management is also paramount, and traders should employ stop-loss orders to limit potential losses and take-profit orders to secure their profits.

How Much Is 1 Pip In Forex

Conclusion

Pips are the fundamental building blocks of forex trading. Understanding how pips work and how they affect your trades can significantly improve your chances of success. By employing sound trading strategies, carefully managing risk, and continuously educating yourself, you can harness the power of pips to achieve your financial goals in the forex market.