In the realm of financial markets, traders and investors seek every possible advantage to outsmart the unpredictable nature of price fluctuations. Fibonacci lines, named after the legendary Italian mathematician Leonardo Fibonacci, have emerged as a powerful tool for identifying potential turning points and measuring market trends. This comprehensive guide will delve into the intriguing world of Fibonacci lines, empowering you to harness their analytical prowess for informed trading decisions.

Image: www.itarray.net

Deciphering Fibonacci Lines: A Historical Perspective

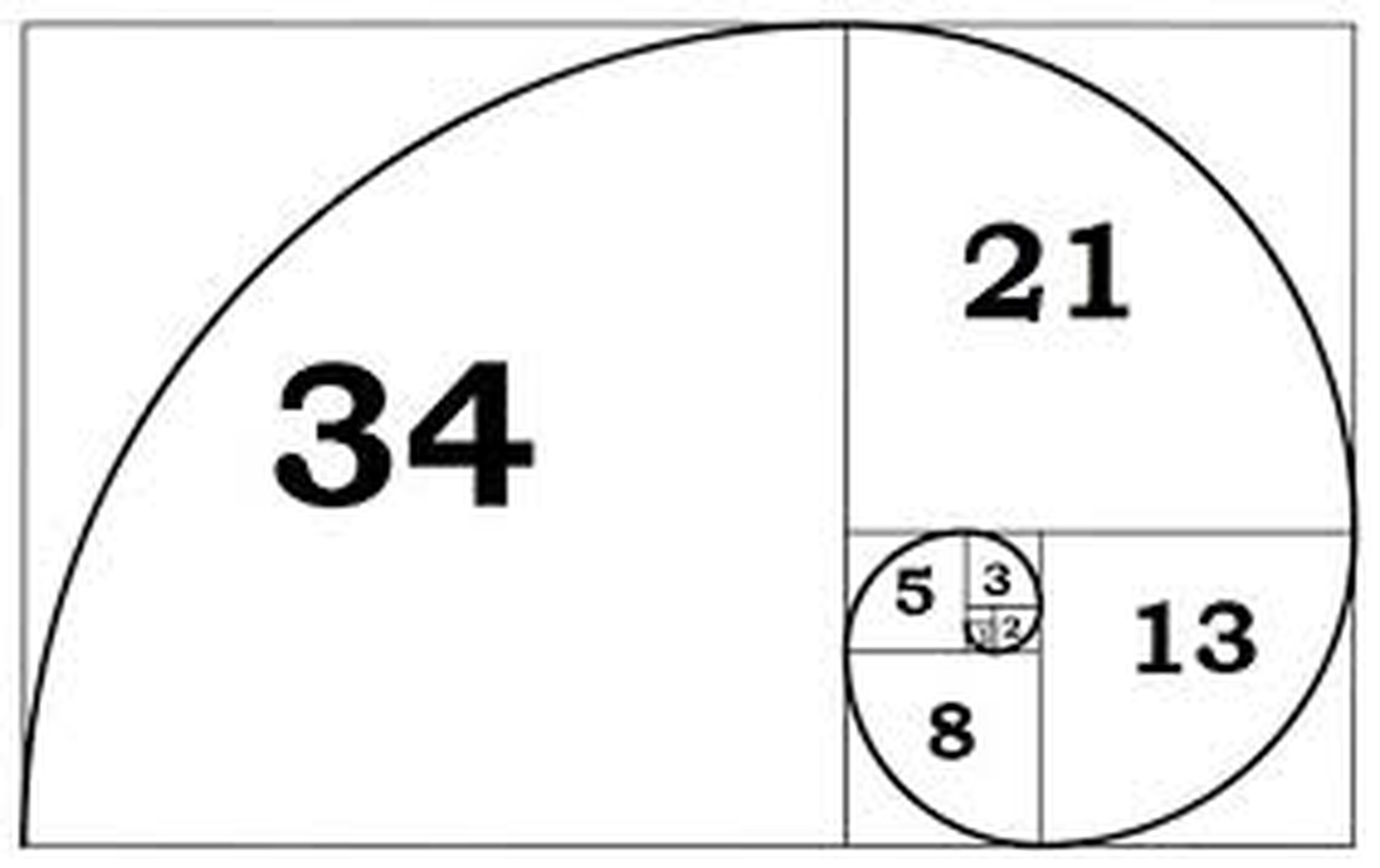

The Fibonacci sequence is an age-old numerical pattern that originates from the 13th century. Each number in the sequence is the sum of the two preceding numbers, following the captivating pattern: 0, 1, 1, 2, 3, 5, 8, 13, 21, and so forth. This seemingly simple sequence, however, conceals a multitude of mathematical wonders and holds a profound significance in various fields, including finance.

Harnessing Fibonacci Lines in Technical Analysis

In the realm of technical analysis, Fibonacci lines are constructed by plotting horizontal lines at specific ratios of the Fibonacci sequence. These lines play a pivotal role in identifying potential support and resistance levels, indicating areas where the price may encounter buying or selling pressure.

Key Fibonacci Ratios: Unlocking Market Insights

- 0%: Start and 100%: End – These represent the baseline and the endpoint of the Fibonacci sequence.

- 23.6%: Retracement – This level signifies a potential retracement of 23.6% in an uptrend or downtrend, representing a pause before continuing the primary trend.

- 38.2%: Retracement – This level marks a deeper potential retracement of 38.2%, often signaling a more significant correction in the price.

- 50.0%: Retracement – This midpoint of the Fibonacci sequence represents a potential 50% retracement, indicating a possible halfway point in a trend.

- 61.8%: Retracement – This level marks a significant retracement of 61.8%, often observed at major turning points in the market.

- 78.6%: Retracement – This level represents a deep retracement of 78.6%, indicating a possible end of the prevailing trend and a potential reversal.

Image: briarcurleyphotography.weebly.com

Applications of Fibonacci Lines: Navigating Market Trends

Fibonacci lines offer versatile applications in technical analysis, serving as a compass for traders navigating the complexities of price movements.

- Identify Support and Resistance Levels: Fibonacci lines pinpoint potential areas where the price may find support or encounter resistance, helping traders anticipate market reversals or continuations.

- Gauge Trend Strength and Momentum: By studying how the price interacts with Fibonacci lines, traders can assess the strength and momentum of the underlying trend, determining whether to stay the course or adjust their positions.

- Forecast Potential Price Targets: Fibonacci lines can be employed to project potential price targets based on the extent of previous trend moves, aiding traders in setting realistic profit targets.

- Validate Trading Strategies: By incorporating Fibonacci analysis into their trading arsenals, traders can bolster the validation of their existing strategies, increasing the likelihood of profitable outcomes.

Additional Fibonacci Tools: Expanding Analytical Capabilities

Beyond Fibonacci lines, traders leverage a range of additional Fibonacci tools to enhance their technical analysis.

- Fibonacci Arcs: These are curved lines that connect Fibonacci retracement levels, offering insights into the trajectory and momentum of the price action.

- Fibonacci Fans: Consisting of multiple Fibonacci lines emanating from a single point, Fibonacci fans help identify potential trend channels and price projections.

- Fibonacci Time Zones: Based on Fibonacci ratios, these tools divide time intervals into Fibonacci proportions, aiding in predicting potential timing for market reversals or continuations.

How To Draw Fibonacci Lines

Conclusion: Fibonacci Lines – A Cornerstone of Technical Analysis

Navigating the volatile financial markets requires a comprehensive understanding of various analytical tools. Fibonacci lines stand out as indispensable instruments for traders and investors, empowering them to decipher market trends, identify potential price inflection points, and make well-informed trading decisions. By integrating Fibonacci analysis into their analytical toolbox, individuals can gain a competitive edge in the pursuit of consistent and profitable trading outcomes.