In the bustling world of trading, the market is an ever-changing landscape.

Image: www.tradingsetupsreview.com

Seasoned traders know that the road to success is not a straight line but rather a rhythmic ebb and flow of price movements, including periods of both gains and retracements. Understanding retracements is crucial for effective trading strategies and navigating the market’s dynamic nature.

What is a Retracement?

A retracement refers to a temporary pause or reversal in the prevailing price trend, characterized by a decline in an uptrend or a rise in a downtrend.

It’s a normal market occurrence that provides opportunities for traders to adjust their positions or enter new ones.

Significance of Retracements

Retracements offer valuable trading insights and can have a significant impact on trading strategies.

- Trend Confirmation: Retracements can serve as confirming signals, indicating the continuation of the primary trend after a temporary pullback.

- Profit-Taking Opportunities: They present opportunities for profit-taking, allowing traders to lock in gains before the trend resumes.

- Entry and Exit Points: Retracements can provide ideal entry or exit points, enabling traders to enter at better prices or exit with minimal losses.

Types of Retracements

There are two main types of retracements:

Image: www.tradingwithrayner.com

1. Fibonacci Retracements

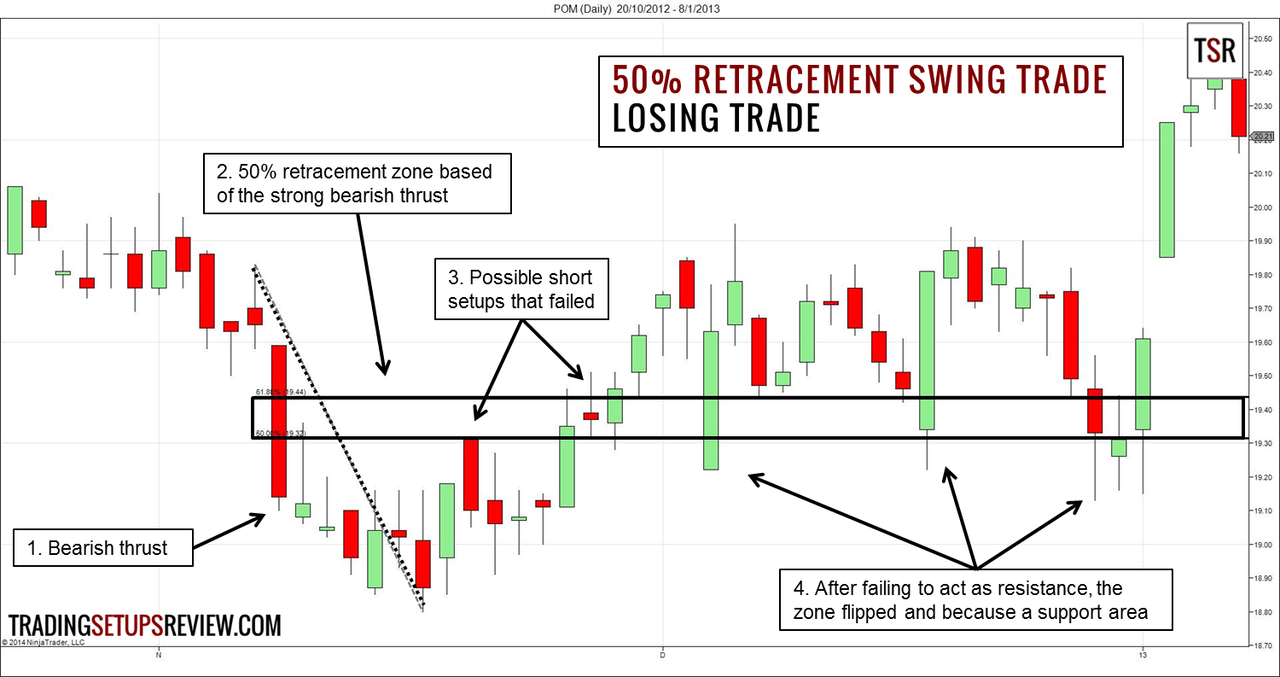

Based on the Fibonacci sequence, Fibonacci retracements use specific ratios to identify potential support and resistance levels.

Common retracement levels include 23.6%, 38.2%, 50%, and 61.8%. These levels are calculated from the swing high (in an uptrend) or swing low (in a downtrend) to the most recent swing low or high.

2. Percentage Retracements

Percentage retracements are simpler than Fibonacci retracements and involve measuring the percentage of the previous price swing that is retraced.

Common percentage retracements include 33%, 50%, and 66%. They provide an alternative approach to identifying potential support and resistance zones.

Understanding the Causes of Retracements

Retracements are influenced by various factors that affect market dynamics:

1. Profit-Taking

After a sustained market rise, traders may choose to take profits by selling some of their positions.

This profit-taking activity can cause a temporary reversal in the trend.

2. Market Consolidation

When a市場 has witnessed a significant move, it may enter a period of consolidation.

During this time, prices fluctuate within a range, allowing traders to assess their positions and prepare for the next move.

3. News and Events

Important economic or political news or events can trigger retracements by shifting investor sentiment and influencing market sentiment and behavior.

Navigating Retracements in Trading

Understanding and navigating retracements is essential for successful trading, and traders can use the following tips and expert advice to their advantage:

1. Identify Retracement Levels

Using technical analysis tools like Fibonacci or percentage retracements, traders can anticipate potential areas of support and resistance where retracements are likely to occur or end.

2. Manage Risk

Retracements can increase trading risks. Implement stop-loss orders and position sizing strategies to protect profits and limit potential losses.

3. Consider Trading Opportunities

Retracements present buying and selling opportunities. Look for confluence of technical indicators and market analysis to make informed decisions about entering or exiting trades during retracements.

FAQ on Retracements

Q: What is the difference between a correction and a retracement?

A: Retracements are temporary setbacks in an ongoing trend, usually ranging from 5% to 15% of the preceding trend.

Corrections are more significant, lasting longer and often involving a reversal of 10% or more.

Q: Do all retracements reach the Fibonacci levels?

A: Not necessarily. Fibonacci levels serve as guidelines, and not all retracements will precisely align with them.

Traders should use them in conjunction with other technical indicators for better analysis.

Q: Can retracements be used in any market?

A: Yes, retracements occur in all financial markets.

They are particularly relevant in trending markets, where they provide opportunities for trend continuation or reversal.

What Is A Retracement In Trading

Conclusion

Retracements form an integral part of trading and mastering them is crucial for enhancing trading strategies.

By understanding the concept, types, and causes of retracements, traders can effectively anticipate market behavior, manage risk, and exploit trading opportunities.

Remember, retracements are not anomalies but rather inherent to market dynamics, and embracing them can significantly strengthen trading performance and profitability.