Introduction:

In the dynamic realm of financial markets, technical analysis has emerged as a powerful tool for traders and investors alike. Among the plethora of analytical techniques available, the Fibonacci retracement tool stands out as a cornerstone for market trend analysis.

Image: burnspainting1.com

Inspired by the natural phenomenon known as the Fibonacci sequence, the Fibonacci retracement tool helps traders identify critical support and resistance levels that price action tends to respect during market movements. Understanding the Fibonacci retracement levels can provide invaluable insights into market trends, potential reversal points, and optimal trading opportunities.

Understanding Fibonacci Retracement Levels:

The Fibonacci sequence is a series of numbers in which each number is the sum of the two preceding ones. This sequence manifests itself in various patterns and proportions found throughout nature, from the spirals of seashells to the branching of tree limbs.

When applied to financial markets, specific ratios derived from the Fibonacci sequence serve as significant retracement levels. These levels are plotted on a price chart to identify potential areas where the price might pause or reverse its direction during a trend.

Key Fibonacci Retracement Levels:

- 23.6% Retracement: Represents a 23.6% retracement of the prior price move.

- 38.2% Retracement: Indicates a 38.2% retracement of the prior price move.

- 50% Retracement: Shows a 50% retracement of the prior price move.

- 61.8% Retracement: Represents a 61.8% retracement of the prior price move.

- 78.6% Retracement: Indicates a 78.6% retracement of the prior price move.

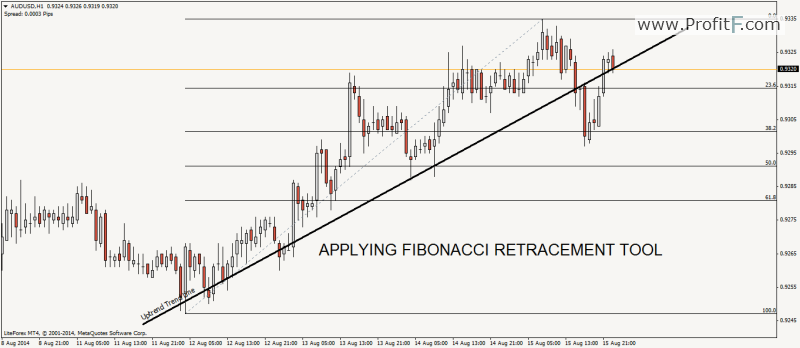

Applying Fibonacci Retracement in Trading

To utilize the Fibonacci retracement tool effectively, traders first need to identify a significant market trend, such as an uptrend or downtrend. The retracement levels are then plotted on the price chart based on the high and low points of the trend.

During an uptrend, support levels are created at the Fibonacci retracement levels, indicating areas where the price may pause or reverse before the upward movement continues. Conversely, during a downtrend, resistance levels are formed at the Fibonacci retracement levels, suggesting potential reversal points for the downward price action.

Image: kulyfyyepi.web.fc2.com

Tips for Using Fibonacci Retracement:

- Use multiple time frames: Apply the Fibonacci retracement tool to different time frames to identify potential reversal points that align across multiple charts.

- Combine with other indicators: Enhance the accuracy of your analysis by combining the Fibonacci retracement tool with other technical indicators, such as moving averages or candlestick patterns.

- Manage your expectations: Recognize that Fibonacci retracement levels provide potential support or resistance zones, not guarantees. The market may not always react precisely at these levels.

Expert Advice on Using Fibonacci Retracement

Renowned trader Alexander Elder advises using Fibonacci retracement levels in conjunction with other technical tools to confirm trading decisions.

Technical analyst and author John Murphy suggests traders be patient and wait for the price to confirm support or resistance at Fibonacci levels before entering or exiting trades.

FAQs

Q: Is the Fibonacci retracement tool reliable?

A: The Fibonacci retracement tool is a widely used indicator with historical significance. However, it does not provide guaranteed predictions, and traders should use it in conjunction with other analysis methods.

Q: What other Fibonacci tools can I use?

A: In addition to the Fibonacci retracement tool, traders can utilize other Fibonacci tools such as the Fibonacci extension and the Fibonacci fan, which help identify potential price targets and trend continuation patterns.

How To Use Fibonacci Retracement Tool

https://youtube.com/watch?v=3Bh_5iUkZuk

Conclusion:

The Fibonacci retracement tool is a valuable asset for traders looking to gain a deeper understanding of market trends and identify potential support and resistance levels. By incorporating Fibonacci retracement into your trading strategy, you can enhance your decision-making and improve your chances of successful trading.

While the Fibonacci retracement tool is a powerful tool, it is crucial to remember that no technical indicator is 100% accurate. Always consider it as a complementary tool within a comprehensive trading strategy.

Are you ready to delve further into the world of technical analysis and harness the power of Fibonacci retracement? Check out our advanced trading courses and start optimizing your trading performance today.