Introduction: Unlocking the Secrets of Pips and Their Significance in Forex Trading

In the dynamic and complex realm of foreign exchange trading, pips, or points in percentage, stand as the cornerstone units that measure the fluctuations in currency values. Each single pip represents a minute shift in the exchange rate between two currencies, offering traders a precise means of quantifying price movements and calculating potential profits and losses. Understanding how pips work is paramount for any trader navigating the intricacies of the forex market. This comprehensive guide delves into the fundamental principles of pips, their impact on trading strategies, and the latest developments in pip calculations.

Image: www.dreamstime.com

The Genesis of Pips

The concept of pips originated in the early days of manual currency trading, when traders used ticker machines to monitor exchange rate changes. These machines would print out long strips of paper with currency quotations, and each line represented a single price update. The last digit on these lines, typically referred to as the “fraction,” denoted the smallest discernible change in exchange rate. Originally, these fractions were expressed as 1/100th of a percent, hence the term “points in percentage.” Over time, as electronic trading became prevalent, the term “pip” was coined to refer to the fourth decimal place, representing a change of $0.0001 in the value of the US dollar against other major currencies.

The Building Blocks of Pips

Pips, as mentioned earlier, represent the smallest increment of change in currency value. For currency pairs that have the US dollar as the quote currency, such as EUR/USD or GBP/USD, a single pip is equal to $0.0001. In currency pairs where the US dollar is the base currency, such as USD/JPY or USD/CHF, a single pip is equivalent to $0.01. This variance arises from the fact that the quote currency is the currency being bought or sold against the base currency.

Pips: A Cornerstone for Profit and Loss Calculations

In the realm of forex trading, pips serve as the fundamental unit for calculating both potential profits and losses. When a trader buys or sells a currency pair, the difference between the opening and closing prices of the position is expressed in pips. This difference represents the profit or loss incurred on the trade. For instance, if a trader opens a buy position on EUR/USD at 1.1250 and closes it at 1.1258, the profit earned would be 8 pips. The formula for calculating profit or loss is straightforward: (Closing Price – Opening Price) x Contract Size.

Image: www.newtraderu.com

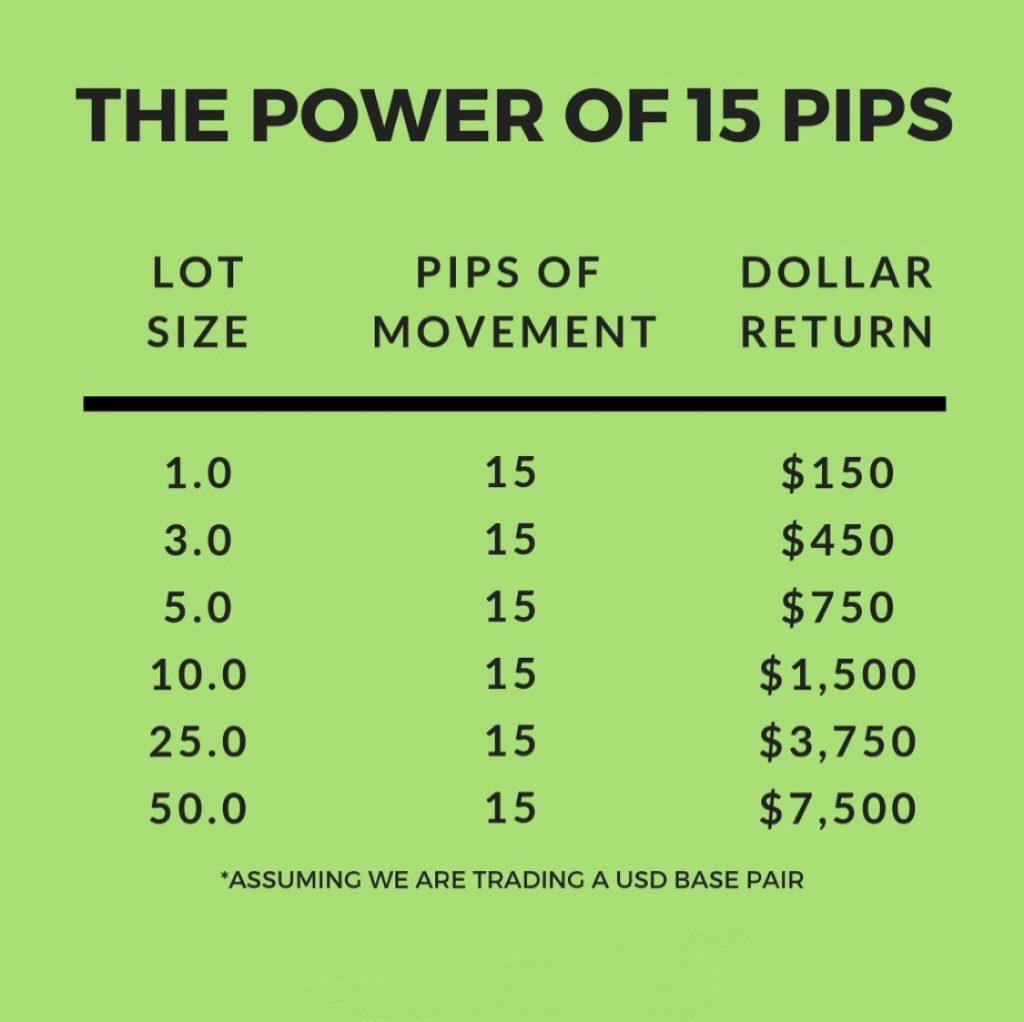

Pip Value and Trade Position

The value of a single pip is directly proportional to the size of the trading position. The pip value is calculated by multiplying the contract size by the pip value per unit. For a standard forex contract, which typically involves trading 100,000 units of the base currency, each pip is worth $10. Larger contract sizes, such as those used in institutional trading, would result in correspondingly higher pip values.

Types of Pips

There are two primary types of pips used in forex trading: typical pips and fractional pips. Fractional pips, also known as nano pips, represent even smaller increments of currency value. Nano pips are expressed as the fifth decimal place, indicating a change of $0.00001 in the value of the US dollar against other major currencies. Fractional pips provide increased precision for traders seeking tighter spreads and more accurate profit calculations.

The Impact of Pip Volatility on Trading Outcomes

Pip volatility measures the magnitude of price fluctuations in a currency pair over a specific time period. High pip volatility indicates that the currency pair is experiencing significant price swings, while low pip volatility suggests relatively stable prices. Traders often consider pip volatility when making trading decisions. Periods of high volatility can present opportunities for profit but also carry increased risk, whereas periods of low volatility may be more suitable for range trading strategies.

Pip Spreads: Understanding Broker Markups

Pip spreads, also referred to as bid-ask spreads, are the difference between the buy price and the sell price of a currency pair. Brokers typically charge a markup on the spreads they offer to clients, which can vary depending on the broker, currency pair, and market conditions. The pip spread represents the cost of executing a forex trade and is an important factor to consider when choosing a broker and optimizing trading strategies.

The Role of Pip Calculations in Risk Management

Pip calculations play a pivotal role in risk management for forex traders. By understanding the pip value and pip volatility of a currency pair, traders can make informed decisions about position sizing and risk exposure. Proper risk management techniques, such as setting stop-loss and take-profit orders, rely on accurate pip calculations to mitigate potential losses and secure profits.

Technological Advancements in Pip Calculations

Technological advancements have significantly streamlined pip calculations and improved the overall trading experience for forex traders. Automated trading platforms and mobile apps seamlessly calculate pips, pip values, and profit or loss in real-time, enabling traders to make quick and informed decisions. Advanced trading tools, such as charting software and technical indicators, incorporate pip calculations into their analysis to provide traders with valuable insights into price movements.

How Do Pips Work

Conclusion: Empowering Forex Traders with Pip Knowledge

Pips are an indispensable element of the forex market, providing traders with a precise and standardized means of measuring price fluctuations, calculating profits and losses, and managing risk. By understanding how pips work, traders can navigate the complexities of the forex market with confidence and make informed decisions that can lead to successful trading outcomes. As technology continues to evolve, pip calculations will become increasingly sophisticated and accurate, further empowering forex traders in their pursuit of market opportunities.