Picture this: you’re new to the world of trading and feel overwhelmed by the complexities of technical analysis. Instead of starting from scratch, you could tap into the expertise of experienced traders through copy trading. It’s like having a pro mentor guide you every step of the way.

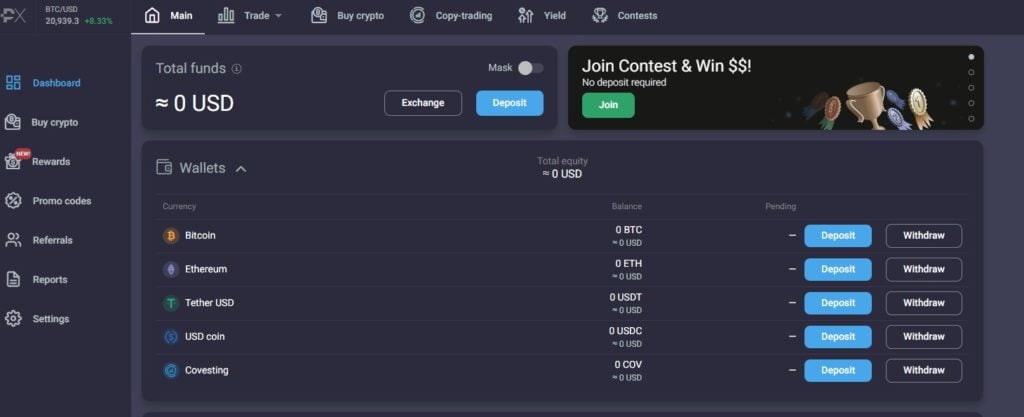

Image: primexbt.com

Copy trading opens up opportunities for traders of all levels. For beginners, it provides a low-entry barrier, allowing them to learn and profit from the strategies of successful traders. Seasoned traders, on the other hand, can diversify their portfolio by copying multiple strategies.

Understanding Copy Trading

Copy trading is a form of automated trading where you mirror the positions of another trader, known as a signal provider. When the signal provider opens or closes a trade, your account will automatically execute the same trade.

This eliminates the need for you to analyze the markets and make trading decisions yourself. However, it’s crucial to remember that copy trading involves following another trader’s decisions, so it’s essential to choose a provider with a proven track record and a strategy that aligns with your risk tolerance.

Choosing a Copy Trading Platform

The platform you choose for copy trading is key. Look for one that offers a wide range of signal providers, advanced trading tools, and robust security features.

Consider the following factors when selecting a platform:

- Track record and reputation

- Variety of signal providers

- Trading tools and capabilities

- Security measures

- Commission and fees

Tips and Expert Advice for Successful Copy Trading

Following these tips and expert advice can enhance your copy trading experience:

- Research and due diligence: Before copying any trader, thoroughly research their trading history, strategy, and risk management practices.

- Diversify your portfolio: Spread your investments among multiple signal providers to mitigate risk.

- Understand your risk tolerance: Copy trading can be risky, so only allocate capital that you’re willing to lose.

- Monitor your trades regularly: Even with automated trading, it’s essential to monitor your positions and adjust your strategy or signal provider as needed.

- Don’t chase quick profits: Be patient and allow time for your strategy to unfold.

Image: phemex.com

FAQs on Copy Trading

Q: Is copy trading profitable?

A: The profitability of copy trading depends on the signal provider’s skills and your own risk management. It’s not a guaranteed profit-making strategy.

Q: What is the best copy trading platform?

A: The best platform depends on your individual needs. Consider Faktoren such as signal provider selection, trading tools, and fees.

How To Start Copy Trading

Conclusion

Copy trading can be a powerful tool for traders of all levels, providing access to the expertise of experienced traders. By following the steps outlined in this comprehensive guide, you can increase your chances of success and navigate the world of copy trading effectively.

Are you ready to embark on your copy trading journey and unlock the potential of following the moves of successful traders?