In the world of trading, few things are more crucial than determining the optimal position size for your trades. Whether you’re a seasoned veteran or a novice investor, calculating your position size accurately can make all the difference between lucrative profits and devastating losses. And when commissions enter the equation, the stakes become even higher.

Image: notariaurbina.cl

That’s where the Position Size Calculator with Commissions comes into play. This invaluable tool takes the guesswork out of position sizing, helping you determine the perfect amount to allocate to each trade while factoring in brokerage fees. But before we dive into its intricacies, let’s unpack the concept of position sizing and why it matters so much.

What is Position Sizing?

Put simply, position sizing is the process of determining the number of shares, contracts, or units of a specific asset to buy or sell in a single trade. It’s all about finding the sweet spot where your risk and reward are optimally balanced.

Getting your position size right is essential for several reasons:

- Risk Management: Proper position sizing ensures you don’t risk more capital than you can afford to lose. It acts as a protective barrier against market volatility and safeguards your trading account.

- Reward Optimization: Conversely, an appropriately sized position can maximize your potential profits. By allocating the right amount of funds, you increase your chances of capturing significant gains.

- Emotional Control: When your position size is too large, emotional decision-making becomes a more likely pitfall. On the other hand, a well-calculated position allows you to trade with confidence, void of fear or greed.

The Impact of Commissions

Trading commissions are fees charged by brokers to execute trades on your behalf. They can vary depending on the brokerage firm, the type of asset traded, and the volume of trades. While commissions may seem small on individual trades, they can add up over time and impact your overall profitability.

That’s why the Position Size Calculator with Commissions is such a valuable tool. By factoring in commission costs, it helps you determine the optimal position size that maximizes your profits while minimizing the impact of fees.

How to Use the Position Size Calculator with Commissions

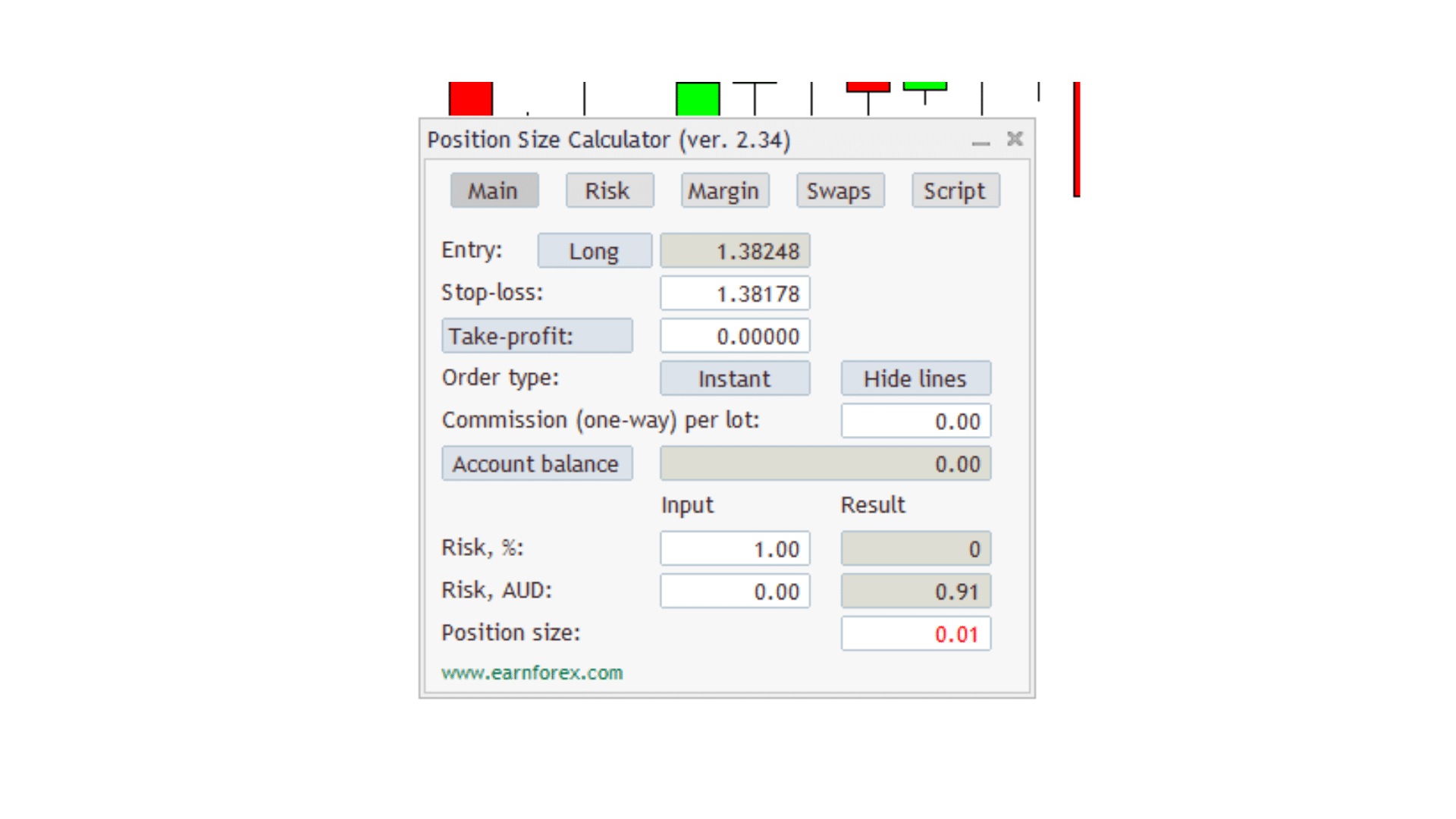

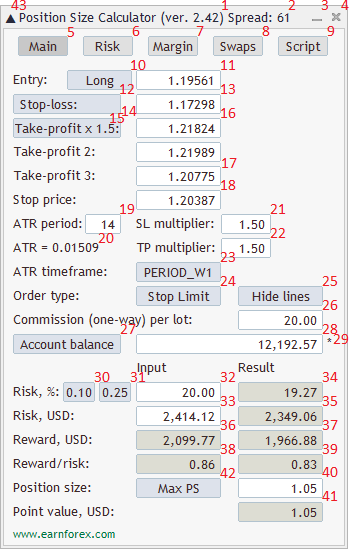

Using the Position Size Calculator with Commissions is remarkably straightforward:

Step 1: Gather Your Data

You’ll need to gather a few key pieces of information:

- Account Balance: The amount of capital you have available for trading.

- Risk Tolerance: Your comfort level with potential losses.

- Profit Target: The amount of profit you’re aiming for on each trade.

- Stop-Loss Level: The price point at which you plan to sell if the trade goes against you.

- Commission Structure: The commission fees charged by your broker.

Step 2: Input the Data

Enter the gathered data into the calculator’s designated fields.

Step 3: Get Results

The calculator will then compute the optimal position size that considers your risk tolerance, profit target, stop-loss level, and commission structure.

Image: www.logoskill.com

Position Size Calculator With Commission

Empowering You with Informed Trading

By leveraging the Position Size Calculator with Commissions, you’re taking a big step towards becoming a more informed and profitable trader. This tool provides you with the necessary insights to:

- Identify the optimal position size for each trade.

- Manage your risk effectively.

- Maximize your potential profits.

- Avoid costly mistakes caused by improper position sizing.

Remember, trading involves inherent risks, but by embracing smart trading practices like using the Position Size Calculator with Commissions, you can mitigate risks and optimize your chances of success.

Take control of your trading destiny and start making more informed decisions today. Embrace the Position Size Calculator with Commissions as your trusted ally in the pursuit of profitable trading.