Unlocking the secrets of technical analysis with chart patterns just got easier with this comprehensive PDF guide. Join me on a journey into the world of market forecasting, where these patterns emerge as valuable tools for predicting price movements.

Image: us.europedias.com

Before we dive into the specifics, it’s essential to understand the fundamental concept of technical analysis. Simply put, it’s the art of predicting future price behavior by analyzing historical price data. Chart patterns, in particular, serve as visual representations of this data, offering insights into potential market trends.

Chart Patterns: A Visual Guide to Predicting the Market

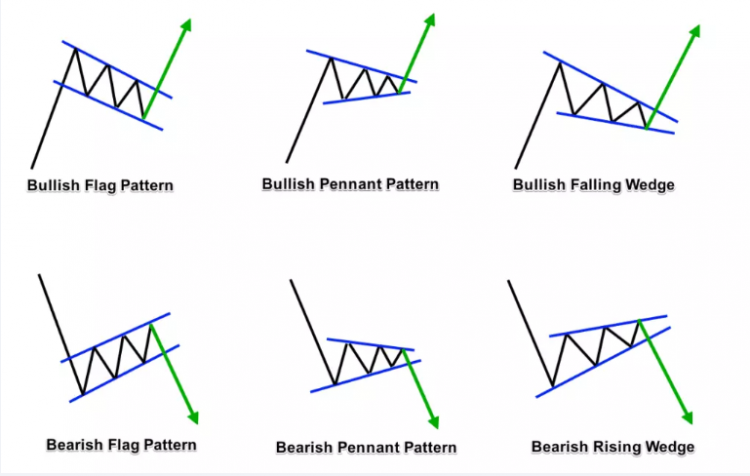

Chart patterns come in various forms, each with its unique characteristics and implications. From continuation patterns that signal a continuation of the current trend to reversal patterns that indicate a potential change in direction, these patterns provide valuable clues about market sentiment and price behavior.

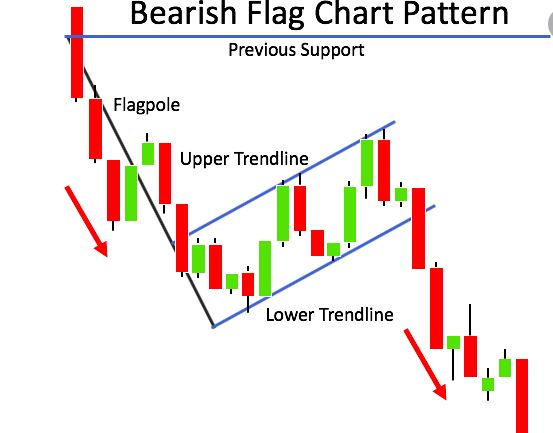

Common continuation patterns include pennants, flags, and triangles, while reversal patterns include head-and-shoulders, double tops and bottoms, and triple tops and bottoms. By identifying and understanding these patterns, traders can gain an edge in navigating market fluctuations and making informed trading decisions.

Historical Evolution and Meaning of Chart Patterns

The use of chart patterns in technical analysis has a rich history dating back to the 18th century. Renowned traders like Charles Dow and William Peter Hamilton recognized the predictive power of these patterns and incorporated them into their trading strategies. Over the years, chart patterns have evolved to encompass a wide range of variations and interpretations, but their core principles remain the same.

The meaning of chart patterns lies in their ability to reflect the psychology of market participants. These patterns often represent moments of indecision, accumulation, or distribution, providing insights into the collective sentiment and behavior of traders. By studying chart patterns, traders can identify potential turning points, support and resistance levels, and forecast market reversals.

Latest Trends and Developments in Technical Analysis

The field of technical analysis, including chart patterns, is constantly evolving. New techniques and indicators are emerging to enhance pattern recognition and improve trading strategies. Artificial intelligence (AI) and machine learning (ML) algorithms are now being employed to analyze massive amounts of historical data and identify patterns with greater accuracy.

Additionally, social media platforms and online forums provide traders with real-time insights and discussions about chart patterns. By engaging with these platforms, traders can stay up-to-date with the latest market trends and benefit from collective knowledge and experience.

Image: forexindicatormt4.com

Tips and Expert Advice for Navigating Chart Patterns

- Focus on High Probability Patterns: Not all chart patterns are equally reliable. Concentrate on patterns with a higher success rate and proven historical significance.

- Consider Context: Analyze chart patterns within the broader market context, including the overall trend, volume, and news events. Contextualization enhances pattern interpretation and improves trading decisions.

- Combine Indicators: Enhance chart pattern analysis by incorporating technical indicators like moving averages, relative strength index (RSI), and stochastic oscillator. Combining patterns and indicators boosts trading accuracy.

- Manage Risk Wisely: Technical analysis is not a foolproof method. Implement sound risk management strategies such as stop-loss orders to mitigate potential losses.

- Practice and Observe: Mastering chart patterns requires practice and patience. Study historical charts, observe real-time markets, and refine your trading strategies over time.

Frequently Asked Questions (FAQs)

- Q: Which chart patterns are most reliable?

A: There is no definitive answer, but patterns like head-and-shoulders, double/triple tops/bottoms, triangles, and flags tend to have a higher success rate. - Q: How often do chart patterns occur?

A: Chart patterns occur frequently in financial markets. Different time frames and trading instruments can yield varying frequency of patterns. - Q: Are chart patterns effective in all market conditions?

A: While chart patterns can provide valuable insights, their effectiveness may vary based on market volatility and overall market sentiment.

Technical Analysis Chart Patterns Pdf

Conclusion

Technical analysis chart patterns serve as a powerful tool for traders seeking to navigate financial markets. By understanding their history, characteristics, and implications, traders can develop profitable trading strategies and make informed decisions. While chart patterns offer valuable guidance, it’s important to remember that market analysis is not an exact science. Risk management and continuous learning are essential for successful trading.

So, my fellow readers, are you ready to embark on this journey into the realm of technical analysis chart patterns? Let’s unlock the secrets of the markets together and harness the power of historical data for profitable trading.