Introduction

In the ever-evolving world of digital finance, Skrill stands out as a prominent player. Its seamless money transfer capabilities and vast global network have made it an indispensable tool for individuals and businesses alike. In this comprehensive guide, we delve into the intricacies of a Skrill account, exploring its features, benefits, and practical applications.

Image: fxpedia.info

Skrill, formerly known as Moneybookers, is an e-wallet service that has gained widespread adoption since its inception in 2001. With over 40 million active accounts in more than 200 countries, it bridges the gap between traditional banking and the digital world, offering a convenient and secure platform for online payments, international money transfers, and financial management.

Understanding a Skrill Account

A Skrill account serves as a digital wallet where users can store, send, and receive money. It offers a user-friendly interface and a range of features designed to facilitate seamless financial transactions. Creating a Skrill account is a straightforward process that requires basic personal and financial information. Once verified, users gain access to a suite of services that empower them to manage their finances efficiently.

Key Features and Benefits of a Skrill Account

1. Global Reach:

One of the primary advantages of a Skrill account is its extensive global reach. It operates in over 200 countries and supports multiple currencies, making it an ideal solution for international money transfers and cross-border payments. Whether you need to send money to family abroad or make business payments to overseas partners, Skrill offers a convenient and cost-effective channel.

Image: iqtradingpro.com

2. Fast and Secure Transactions:

Skrill prides itself on its fast and secure transaction processing. Transfers between Skrill accounts are typically instant, allowing users to send and receive funds in real-time. Additionally, Skrill employs robust security measures, including SSL encryption and anti-fraud systems, to protect user data and financial information.

3. Competitive Fees:

Compared to traditional bank transfers, Skrill offers competitive fees for both domestic and international transactions. Its transparent fee structure allows users to plan their financial operations effectively, avoiding hidden charges or excessive costs.

4. Merchant Acceptance:

Skrill’s global reach and reputation make it widely accepted by merchants worldwide. You can use your Skrill account to make online purchases, pay for services, or fund your gaming accounts with ease. Many leading e-commerce platforms, travel agencies, and service providers support Skrill payments, enhancing your online shopping experience.

5. Skrill Prepaid Mastercard:

For added convenience, Skrill offers a prepaid Mastercard that can be linked to your Skrill account. This physical card allows you to make purchases in stores or withdraw cash at ATMs worldwide, providing you with greater flexibility and accessibility to your funds.

Applications of a Skrill Account

The versatility of a Skrill account extends to a wide range of applications, both personal and business-related:

1. Personal Use:

- Sending money to family and friends

- Making online purchases

- Paying bills

- Funding online gaming accounts

- Receiving payments for freelance work

2. Business Use:

- Accepting payments for online goods and services

- Making payments to suppliers or contractors

- Facilitating international business transactions

- Managing payroll disbursements

- Streamlining expense reporting

Creating and Managing a Skrill Account

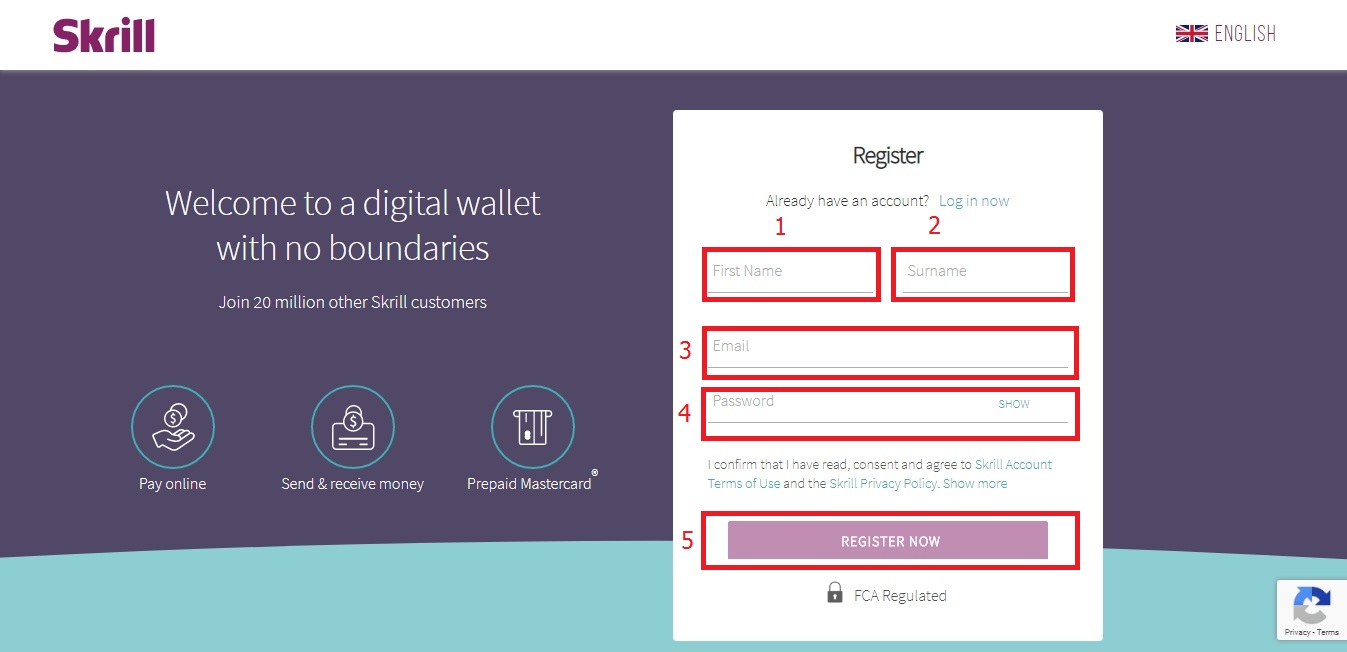

Creating a Skrill account is a straightforward process that can be completed in a few simple steps:

1. Visit the Skrill website or download the mobile app

2. Click on “Register” and provide your basic personal information

3. Set up your password and security questions

4. Verify your email address

5. Link your bank account or credit/debit card

Once your account is created, you can start using it to send, receive, and manage your funds. The user-friendly interface makes it easy to track your transactions, view your account balance, and manage your settings.

Fees and Limits of a Skrill Account

Skrill charges a range of fees for different services, including account maintenance, money transfers, currency conversions, and withdrawals. These fees vary depending on the transaction type, the amount being transferred, and the destination country. It’s important to ознакомиться with the fee structure before making transactions to avoid unexpected costs.

Skrill also imposes limits on the amount of money you can send or receive, based on your account verification level. These limits can vary for different countries and account types. You can increase your transaction limits by providing additional verification documents.

What Is Skrill Account

Conclusion

A Skrill account offers a comprehensive solution for managing your finances in the digital age. Its global reach, fast transaction processing, competitive fees, merchant acceptance, and user-friendly features make it an indispensable tool for both personal and business use. Whether you need to send money across borders, make online purchases, or streamline your financial management, a Skrill account provides a convenient and secure platform to meet your needs.

To learn more about Skrill and open an account, visit their website or download the mobile app today.