Introduction

Are you curious about the thrilling world of options trading but hesitant to venture into the realm of live markets? A demo options trading account offers an invaluable opportunity to cut your teeth, hone your skills, and gain invaluable experience without risking a single penny. In this comprehensive guide, we’ll delve into the intricacies of demo options trading accounts, providing you with the insights you need to make informed decisions and embrace the possibilities that lie ahead.

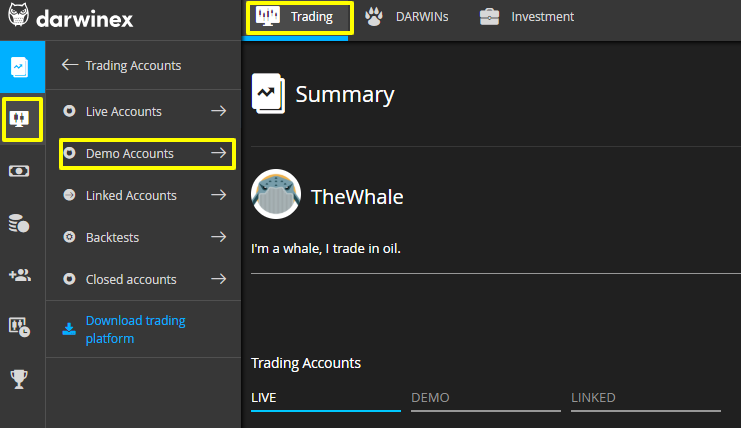

Image: help.darwinex.com

What is a Demo Options Trading Account?

A demo options trading account is a simulated trading environment that mimics the real market in every aspect, from price fluctuations to order execution. It allows you to trade options contracts without committing real capital, providing a risk-free canvas to test your strategies, measure your performance, and develop a deep understanding of market dynamics.

Benefits of Using a Demo Options Trading Account

Embracing the convenience of a demo options trading account unlocks an array of benefits for both seasoned traders and beginners alike:

-

Risk-free learning: Experiment with different options strategies, hone your analytical skills, and navigate market volatility without the fear of losing actual funds.

-

Strategy Optimization: Fine-tune your trading strategies, identify winning patterns, and make adjustments without the pressure of real-time decision-making.

-

Market familiarization: Immerse yourself in realistic market conditions, track price movements, and learn how different factors influence options pricing.

How to Choose the Right Demo Options Trading Account

Selecting the right demo options trading account is paramount to ensure a seamless and rewarding experience. Consider these factors when making your choice:

-

Platform usability: Opt for a platform that aligns with your trading style and provides an intuitive interface, efficient order execution, and comprehensive charting tools.

-

Asset availability: Ensure the platform offers a wide range of options contracts, including stocks, indices, and commodities, to cater to your specific interests.

-

Market data quality: Real-time and accurate market data is crucial for effective learning. Choose a provider that offers reliable data feeds with minimal delays.

Image: www.forexcrunch.com

Demo Options Trading Account

Getting Started with a Demo Options Trading Account

Embarking on your demo options trading journey involves a few simple steps:

-

Open a demo account: Visit the website of your chosen provider and create a demo account. Most providers offer free demo accounts with virtual funds.

-

Fund your account: Although it’s a demo account, you’ll be given a virtual balance to practice trading with. This balance lets you experience the emotional ups and downs of trading.

-

Familiarize yourself with the platform: Take some time to explore the platform’s features, practice placing orders, and become acquainted with the available tools.