In the bustling world of finance, the stock market takes center stage, a beguiling arena where fortunes are made and lost. Driven by a symphony of factors, the market’s relentless dance confounds and captivates investors alike. So, what are the invisible threads pulling the strings of this financial behemoth?

Image: familyfinancemom.com

A Tapestry of Influences

The stock market, like a tapestry, is woven from diverse strands of influence. These threads, intertwining and separating, create the intricate patterns that govern its enigmatic movements. At the heart of this intricate web lies the interplay between supply and demand. When the desire to own stocks (demand) outstrips the availability of those stocks (supply), prices rise. Conversely, when supply exceeds demand, prices fall.

The Sentinels of Value: Earnings and Dividends

One of the most influential factors in determining stock prices is a company’s financial performance, reflected in its earnings and dividends. Strong earnings, a testament to a company’s profitability, spark optimism among investors, fueling demand and driving prices higher. Dividends, a distribution of profits to shareholders, serve as tangible evidence of a company’s success, further bolstering investor confidence and stock value.

The Oracle’s Influence: Interest Rates

Central banks around the world wield immense power over the stock market. Their decisions regarding interest rates can set the stage for either economic expansion or contraction. Lower interest rates make borrowing more attractive, leading to increased investment in businesses and ultimately driving stock prices up. However, higher interest rates can dampen economic growth and reduce corporate profitability, potentially driving stock prices down.

Image: awealthofcommonsense.com

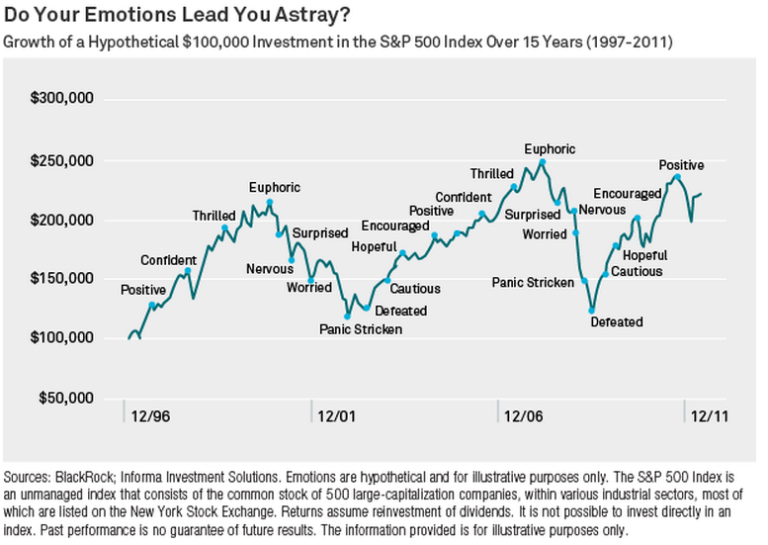

The Sway of Sentiment: Fear and Greed

Invisible yet potent forces within the human psyche, fear and greed play a pivotal role in shaping the stock market. Fear, a primal instinct to avoid loss, can lead to a sell-off as investors rush to shed their holdings, driving prices down. Conversely, greed, the insatiable hunger for profit, can fuel a buying frenzy, pushing prices higher. These emotional tides can sway the market, creating temporary distortions from its fundamental value.

The Alchemist’s Predictions: Technical Analysis

In an effort to discern the future, some market participants turn to technical analysis, the study of historical price movements to identify patterns that may offer clues about future trends. While not always reliable, technical analysis relies on the assumption that past patterns will repeat, allowing traders to identify potential support and resistance levels that may influence future price movements.

The Global Symphony: Economic Indicators

The stock market does not exist in isolation; it is intertwined with the global economy. Economic indicators, such as GDP growth, unemployment rates, and inflation levels, provide valuable insights into the overall health of the economy. Positive economic conditions, characterized by strong growth and low unemployment, can fuel optimism and boost stock prices. In contrast, economic downturns can cast a shadow over the market, leading to widespread declines.

Navigating the Market’s Labyrinth

Understanding the forces that drive the stock market is the first step towards reaping its rewards. Investors must recognize the complex interplay of these factors and avoid knee-jerk reactions based on fear or greed. Patience, guided by sound analysis and a long-term perspective, can help investors stay the course amidst market volatility and capitalize on its long-term potential.

What Drives The Stock Market

Conclusion

The stock market, a perpetual motion machine of human ambition and economic forces, offers both opportunities and pitfalls. By peeling back its layers and understanding the unseen threads that guide its ebbs and flows, investors can navigate its labyrinthine paths with greater confidence and reap the rewards of calculated decision-making. Whether seeking financial growth or simply navigating its complexities, the knowledge of what drives the stock market empowers individuals to harness its potential and shape their financial destinies.