Candle stick charts have become the go-to charting technique for technical traders worldwide. Their unique visual representation of price action provides valuable insights into market dynamics, enabling traders to identify key trends, patterns, and potential trading opportunities. In this comprehensive guide, we’ll delve into the enigmatic world of candle stick chart patterns, unlocking their secrets and empowering you to elevate your trading prowess.

Image: games.udlvirtual.edu.pe

Unveiling the Anatomy of a Candle Stick

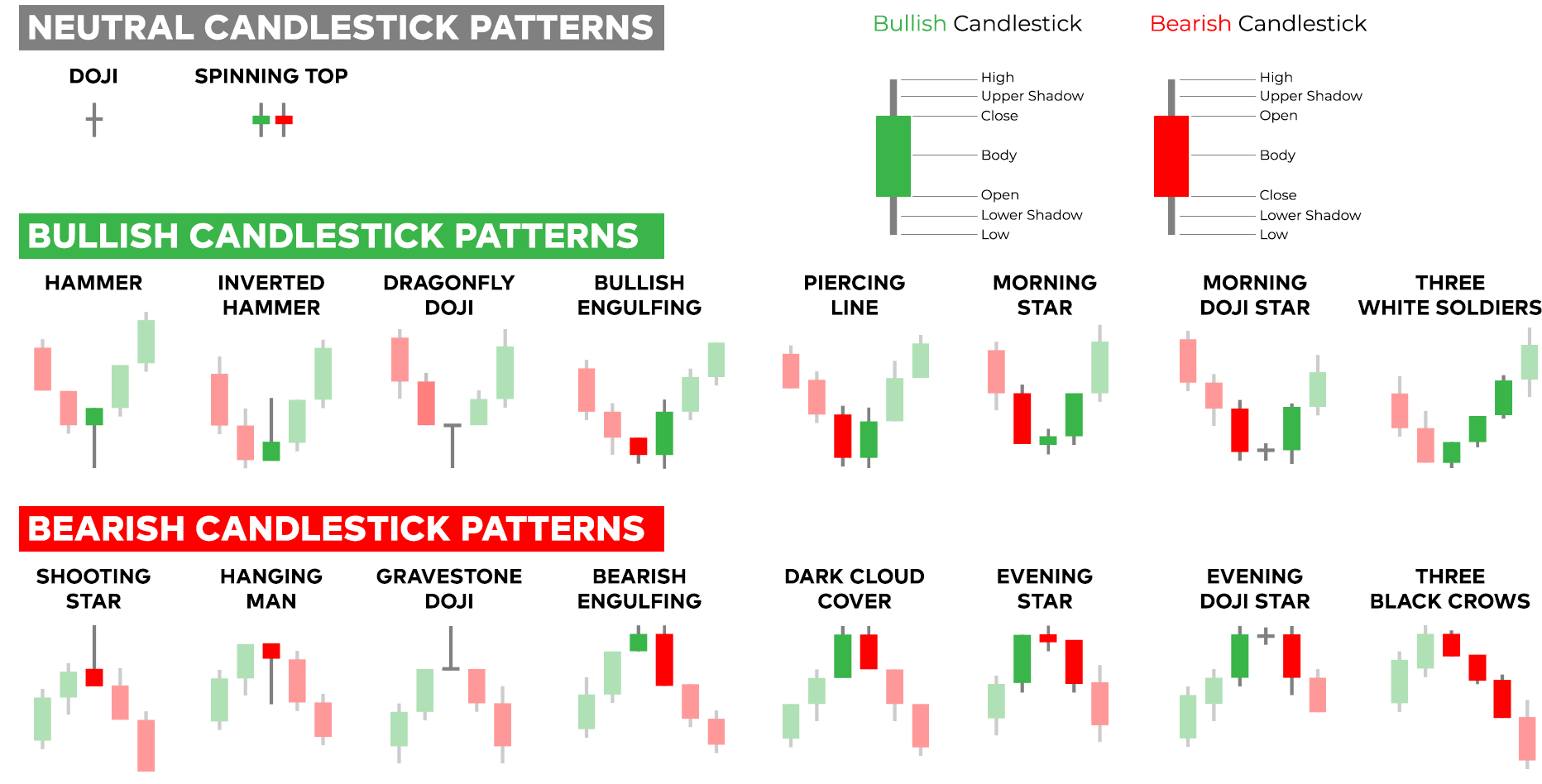

At its core, a candle stick is a graphical representation of a security’s price movement over a specific time period, typically ranging from a minute to a month. The candle stick’s body, which is filled or colored, signifies the opening and closing prices within that time frame. The wick or shadow, which extends above and below the body, represents the highest and lowest prices reached during that period. The color of a candle stick typically denotes price movement, with green or white candles indicating an upward trend (closing price higher than opening price) and red or black candles indicating a downward trend (closing price lower than opening price).

A Visual Lexicon of Candle Stick Patterns

The beauty of candle stick charts lies in their diverse array of patterns, each conveying a unique message about market sentiment and potential price behavior. From singular candles like the hammer and hanging man to complex multi-candle formations like the engulfing and piercing patterns, these patterns provide valuable insights into the underlying price dynamics. By recognizing these patterns and understanding their implications, traders can gain a significant edge in anticipating market movements and making informed trading decisions.

Single Candle Stick Patterns:

-

Hammer: A small candle stick with a long lower shadow and a short upper shadow. It suggests that the bears had control during the session but were eventually overcome by the bulls, indicating potential reversal.

-

Hanging Man: Similar to a hammer but with a long upper shadow. It suggests indecision between bulls and bears, highlighting a potential reversal if confirmed by subsequent price action.

-

Shooting Star: An inverted hammer with a long upper shadow and a short lower shadow. It signifies a false breakout to the upside, suggesting a potential reversal to the downside.

-

Spinning Top: A small candle stick with a short body and long shadows, indicating a period of consolidation and indecision in the market.

-

Dragonfly Doji: A cross-shaped candle stick with no body and long wicks, signifying a strong reversal in momentum.

Multi-Candle Stick Patterns:

-

Engulfing Pattern: A candle stick pattern where the second candle completely engulfs the first candle’s body, indicating a strong reversal in momentum.

-

Piercing Pattern: A two-candle pattern where the second candle’s body penetrates the first candle’s body but does not engulf it, suggesting a potential reversal to the upside.

-

Dark Cloud Cover: A three-candle pattern where a large black candle stick engulfs the previous candle stick’s body, indicating a strong reversal to the downside.

-

Three Black Crows: A three-candle pattern with three long black candle sticks, suggesting a strong downtrend and a potential continuation of the bearish trend.

-

Three White Soldiers: A three-candle pattern with three long white candle sticks, suggesting a strong uptrend and a potential continuation of the bullish trend.

Conclusion: The Power of Candle Stick Charts

The mastery of candle stick chart patterns is a cornerstone of technical analysis, providing traders with a powerful tool to decipher market behavior and uncover potential trading opportunities. By recognizing and interpreting these patterns, traders can gain invaluable insights into market dynamics, identify key trends, and make well-informed trading decisions.

As the financial markets continue to evolve, the ability to effectively utilize candle stick chart patterns remains an indispensable skill for savvy traders. By embracing this intricate but rewarding charting technique, traders can unlock the secrets of market behavior and navigate the complexities of trading with greater confidence and success.

Image: www.andrewstradingchannel.com

Candle Stick Chart Patterns