In the dynamic world of forex trading, determining the appropriate position size is crucial for managing risk and maximizing profits. MetaTrader 5 (MT5), a renowned trading platform, has introduced an essential tool to aid traders in this endeavor: the MT5 Position Size Calculator.

Image: www.forexrobotacademy.com

This innovative calculator empowers traders to calculate optimal position sizes based on their desired risk tolerance and account balance. It eliminates the guesswork and provides a structured approach to position sizing, ensuring traders can confidently enter and manage trades.

Understanding Position Sizing

Why is Position Sizing Important?

Proper position sizing is paramount for several reasons. It helps control risk exposure by limiting potential losses to a manageable level. Additionally, it optimizes capital utilization, ensuring traders can allocate funds across multiple trades without overleveraging their accounts.

Factors to Consider

When determining position size, several factors need consideration:

- Risk tolerance: Each trader has a unique level of acceptable risk.

- Account balance: The available capital dictates the maximum position size.

- Risk-reward ratio: The expected profit-to-loss ratio should align with risk tolerance.

- Market volatility: The more volatile the market, the smaller the position size should be.

Image: mt4gadgets.com

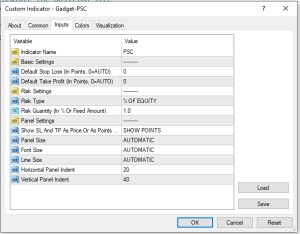

How to Use the MT5 Position Size Calculator

The MT5 Position Size Calculator is an intuitive tool that simplifies position size calculations. Here’s a step-by-step guide:

- Enter your account balance, risk tolerance, desired risk per trade, and stop-loss distance.

- Select your currency pair and leverage.

- Click the “Calculate” button.

Tips and Expert Advice

Tips from Seasoned Traders

- Start with small positions and gradually increase size as you gain experience.

- Use a risk-to-reward ratio of at least 1:2.

- Never risk more than 1-2% of your account balance on a single trade.

- Consider using a trailing stop-loss to protect profits.

Expert Advice

Listen to the insights of experienced traders:

- “Position sizing is the foundation of successful trading.” – George Soros

- “Risk is not an amount of money, but a function of account size.” – William Eckhardt

- “The key to trading is not how much you make but how much you don’t lose.” – Richard Dennis

FAQ on Position Sizing

Q: What is the optimal risk-to-reward ratio?

A: A risk-to-reward ratio of 1:2 or higher is generally considered a good starting point.

Q: How do I calculate my risk tolerance?

A: Determine the maximum amount of loss you are willing to take on a single trade or over a period.

Q: What happens if I overleverage my account?

A: Overleveraging can lead to significant losses and potential margin calls.

Mt5 Position Size Calculator

Conclusion

Understanding position sizing and using the MT5 Position Size Calculator empower traders to make informed decisions and manage risk effectively. By adhering to the principles discussed and leveraging the tips and advice provided, you can enhance your trading strategy and increase your chances of success in the markets.

We invite you to delve deeper into the topic of position sizing by exploring other resources and engaging in discussions with experienced traders.