Introduction

In the ever-evolving world of finance, forex trading has emerged as a powerful tool for generating income and mitigating risk. At its core, forex trading involves the exchange of currencies in the global foreign exchange market, known as the Forex or FX market. To navigate this complex and fast-paced arena, traders rely heavily on technical analysis, which involves studying historical price data and identifying patterns to predict future market behavior. In this comprehensive guide, we’ll delve into the realm of forex trading charts, providing a live roadmap to enhance your trading strategies and empower you to make informed decisions.

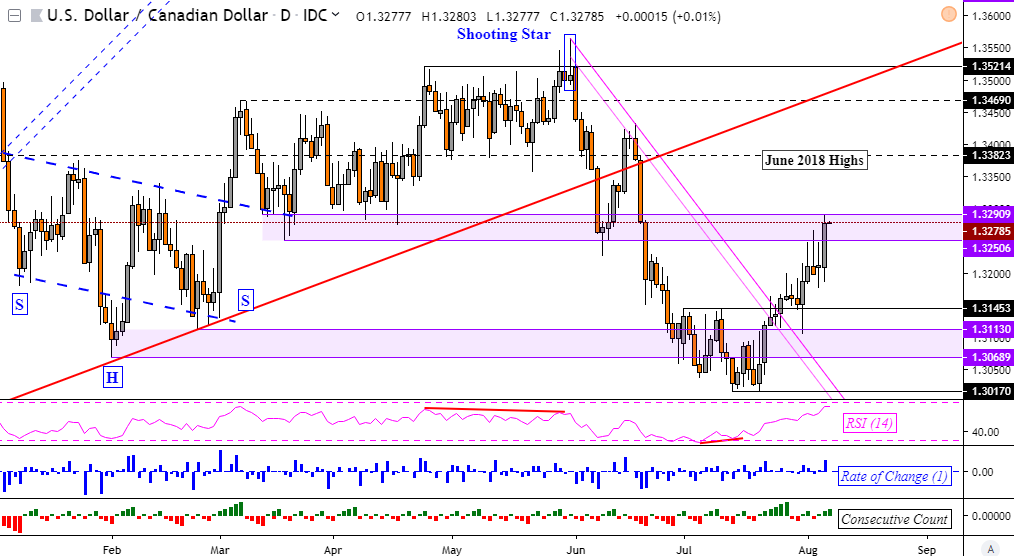

Image: bilgiguvende.com

Understanding Forex Trading Charts

A forex trading chart is a graphical representation of the price movements of a specific currency pair over a specified period. It displays two primary lines: the bid price (the price at which you can buy the base currency) and the ask price (the price at which you can sell the base currency). The difference between the bid and ask price is known as the spread, which represents the broker’s commission for facilitating the trade. Forex charts provide invaluable insights into market trends, support and resistance levels, and potential trading opportunities.

Types of Forex Trading Charts

Traders utilize various types of forex trading charts to suit their specific strategies and preferences. Here are the most common:

-

Line charts: Display the closing prices of a currency pair over time, providing a simple yet effective overview of price movements.

-

Bar charts: Represent the opening, closing, high, and low prices of a currency pair for each time period, offering a more detailed view of price action.

-

Candlestick charts: Visually appealing charts that use colored rectangles (candlesticks) to represent price movements, providing insights into market sentiment and volatility.

-

Point and figure charts: Focus on price changes rather than time, creating a simplified representation of market trends.

Charting Tools and Indicators

To enhance their analysis, forex traders employ a range of charting tools and indicators. These tools help identify potential trading opportunities, assess market conditions, and confirm trading signals. Some of the most commonly used include:

-

Moving averages: Calculate the average price of a currency pair over a specific period, smoothing out price fluctuations and indicating trend direction.

-

Fibonacci retracement levels: Identify potential support and resistance levels based on mathematical ratios.

-

Relative Strength Index (RSI): Measures the strength of a trend by comparing the magnitude of recent gains to recent losses.

-

Stochastics: Analyze momentum and identify overbought or oversold conditions.

Image: easyforextradingmethod.blogspot.com

Live Charting Platforms

In today’s fast-paced trading environment, traders rely on live charting platforms that provide real-time data and advanced technical analysis tools. These platforms enable traders to:

-

Monitor market movements: Track price changes in multiple currency pairs simultaneously.

-

Analyze historical data: Access historical price data to identify recurring patterns and market cycles.

-

Set alerts and notifications: Receive real-time notifications when specific market conditions are met.

-

Execute trades: Place and manage trades directly from the charting platform.

Trading Strategies Using Forex Charts

Forex charts provide the foundation for developing effective trading strategies. Here are a few common strategies:

-

Trend following: Identifying and trading in the direction of the prevailing trend.

-

Range trading: Trading within a defined price range, capitalizing on support and resistance levels.

-

Breakout trading: Trading when a currency pair breaks out of a trading range or trend.

-

Scalping: Making numerous small trades in a short period, aiming to profit from small price movements.

Forex Trading Charts Live

Conclusion

Mastering the art of forex trading charts is essential for success in the global currency markets. By understanding the different chart types, employing technical analysis tools, and utilizing live charting platforms, traders can gain a competitive edge and make informed trading decisions. Whether you’re a seasoned trader or just starting out, the insights provided in this guide will equip you with the tools and knowledge to navigate the complexities of forex trading with confidence. Embrace the live charts, stay informed, and embark on a rewarding trading journey.