The financial markets are a dynamic and ever-changing landscape, where making informed investment decisions requires a deep understanding of market behavior. Candlestick patterns, a time-tested technical analysis tool, offer valuable insights into market sentiment, price movements, and potential trading opportunities. In this comprehensive guide, we will delve into the intricacies of candlestick patterns, empowering you to decipher market action with confidence.

Image: peacecommission.kdsg.gov.ng

Candlestick Patterns: A Historical Overview

Candlestick patterns originated in Japan centuries ago, as rice traders sought to understand market fluctuations. These patterns, characterized by their distinct shapes and colors, provide valuable visual cues that can help traders identify potential trading opportunities. Each candlestick represents a specific period of time, typically one day, and provides information about the opening, closing, high, and low prices of the underlying asset.

Understanding the Basics of Candlestick Patterns

Candlesticks consist of two main components: the body and the wicks. The body, which can be either filled or hollow, represents the difference between the opening and closing prices. A filled body indicates that the closing price was higher than the opening price, while a hollow body indicates the opposite. The wicks, which extend above and below the body, represent the highest and lowest prices reached during the period.

Types of Candlestick Patterns

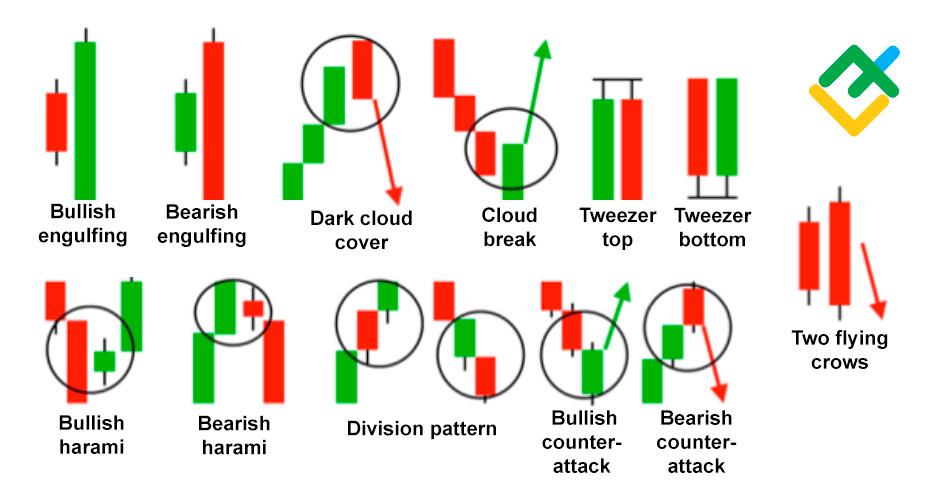

There are numerous candlestick patterns, each with its unique characteristics and implications. Some of the most common and significant patterns include:

Image: balidarelo.weebly.com

Bullish Patterns:

- Bullish Engulfing: A long, filled green candle that completely engulfs the previous red candle, indicating a strong reversal of a downtrend.

- Hammer: A candlestick with a small body and a long lower wick, indicating potential bullish momentum.

- Bullish Harami: A small, filled green candle within a larger red candle, suggesting a possible reversal of a downtrend.

Bearish Patterns:

- Bearish Engulfing: A long, filled red candle that completely engulfs the previous green candle, indicating a strong reversal of an uptrend.

- Hanging Man: A candlestick with a small body and a long upper wick, indicating potential bearish momentum.

- Bearish Harami: A small, filled red candle within a larger green candle, suggesting a possible reversal of an uptrend.

Neutral Patterns:

- Doji: A candlestick with a very small or nonexistent body, indicating indecision or a potential reversal.

- Spinning Top: A candlestick with a small body and long wicks, indicating a period of consolidation or indecision.

Interpreting Candlestick Patterns

While candlestick patterns can provide valuable insights, it’s important to note that they should not be used in isolation. Consider the following:

- Context is key: Evaluate candlestick patterns in the context of the overall market trend and other technical indicators.

- Confirmation: Look for confirmation signals, such as multiple candlesticks forming the same pattern or other technical indicators that support your interpretation.

- Limitations: Candlestick patterns are not always reliable and can be influenced by market volatility or external factors.

Expert Insights and Actionable Tips

Renowned technical analyst, Steve Nison, emphasizes that candlestick patterns are only one tool among many and should be used as part of a comprehensive trading strategy. He advises using multiple patterns together and looking for confirmations to increase the reliability of interpretation.

For aspiring traders, it is crucial to practice identifying and interpreting candlestick patterns using historical market data. This hands-on experience will enhance your understanding and enable you to apply these patterns effectively in your own trading endeavors.

How To Read Candlestick Patterns

Conclusion: Empowering Market Knowledge

Mastering the art of reading candlestick patterns empowers traders with a valuable tool for deciphering market action. By understanding the different patterns, their implications, and the importance of context, traders can gain a competitive edge in the financial markets. Remember, the key to successful trading lies in utilizing multiple technical indicators, practicing pattern identification, and honing your analytical skills. Embark on this journey with confidence and unlock the secrets of market behavior using candlestick patterns.