A Journey into the World of Enhanced Trading with mt5 Synthetic Indices Accounts

In today’s fast-paced and dynamic financial markets, traders seek innovative tools and platforms to optimize their trading strategies. Amidst this search, the emergence of mt5 synthetic indices accounts has revolutionized the realm of online trading by providing traders with a powerful arsenal of benefits. This comprehensive guide delves into the depths of mt5 synthetic indices accounts, their significance, and how they can empower traders in their quest for success.

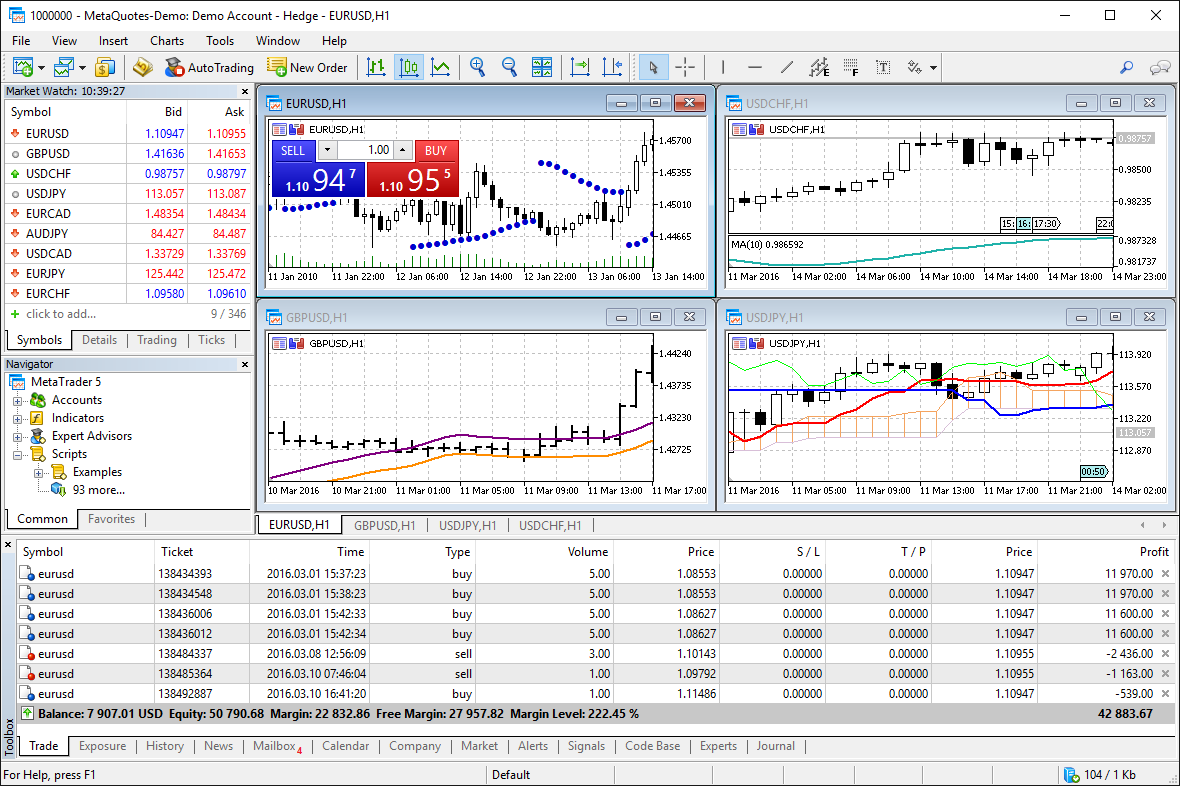

Image: faqogumypoze.web.fc2.com

Navigating the Labyrinth of mt5 Synthetic Indices Accounts

At their core, mt5 synthetic indices accounts are trading accounts that allow traders to speculate on the price movements of synthetic indices without the inherent risks associated with trading real-world assets. These synthetic indices are constructed by combining the price data of multiple underlying assets, providing traders with a broader exposure to the market while mitigating the risks associated with individual asset volatility.

Delving into the Advantages of Synthetic Indices Accounts

The utilization of mt5 synthetic indices accounts offers traders a myriad of advantages, propelling them towards enhanced trading outcomes. These benefits include:

-

Diversification: Synthetic indices inherently provide traders with instant diversification as they incorporate a multitude of underlying assets. This broader exposure reduces the impact of individual asset performance on the overall portfolio, thereby minimizing risk.

-

Accessibility: mt5 synthetic indices accounts are accessible to traders of all experience levels and capital sizes. Unlike real-world asset trading, synthetic indices offer lower minimum capital requirements, allowing traders to participate in the markets with modest investments.

-

Flexibility: Synthetic indices accounts provide traders with unmatched flexibility. Traders can access a wide range of indices, including major global indices, sector-specific indices, and volatility indices. This flexibility empowers traders to tailor their strategies to specific market conditions or risk appetites.

-

Hedge Against Risk: For experienced traders, synthetic indices accounts present an invaluable tool for hedging against potential losses. By taking opposite positions on real-world assets and synthetic indices, traders can mitigate the impact of adverse market movements on their portfolios.

Harnessing the Power of Expert Insights

Mastering the intricacies of mt5 synthetic indices accounts requires traders to seek guidance from renowned industry experts. Seasoned traders and financial analysts unanimously emphasize the following strategies:

-

Diversify Your Portfolio: As previously mentioned, diversification is paramount to successful trading. Traders should allocate their funds across multiple synthetic indices, ensuring exposure to different market sectors and asset classes.

-

Set Realistic Expectations: Synthetic indices, while providing numerous advantages, are not immune to market fluctuations. Traders should set realistic expectations and avoid overleveraging their accounts in the pursuit of unrealistic returns.

-

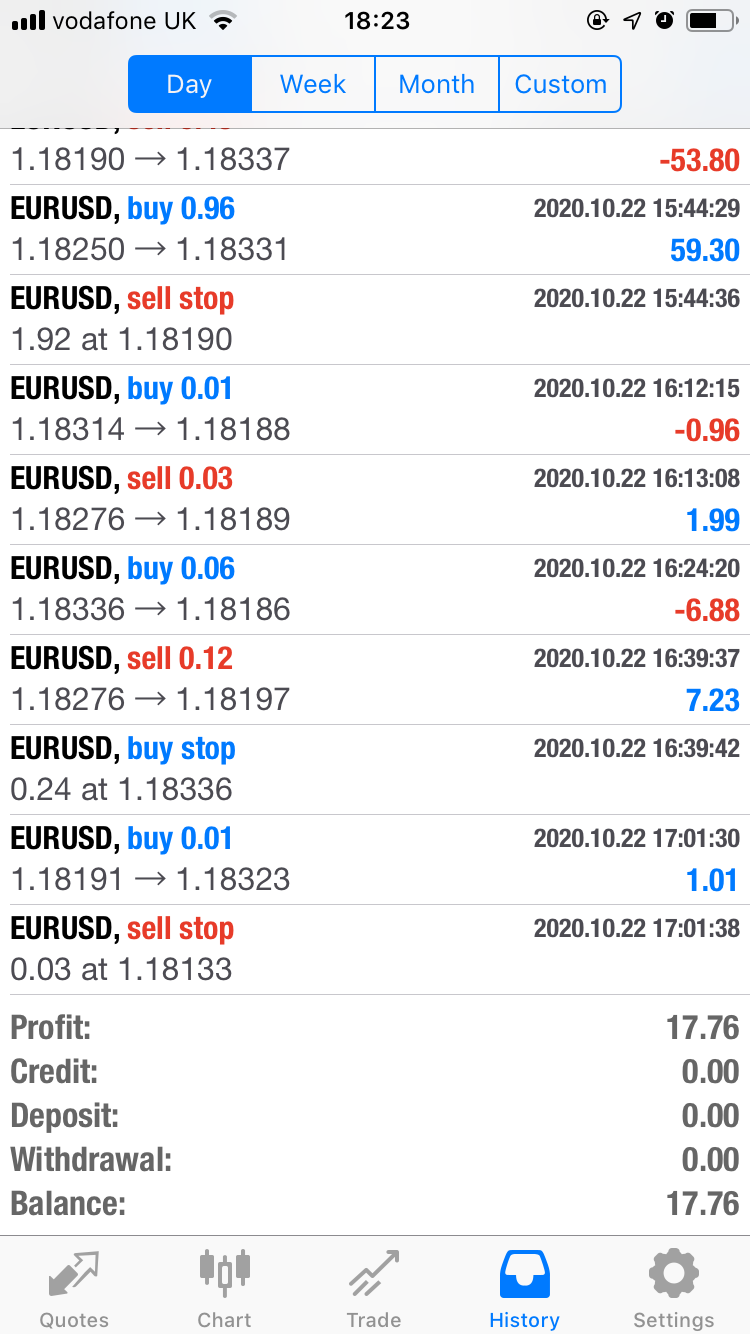

Employ Risk Management Techniques: Risk management is an indispensable aspect of trading. Traders should implement stop-loss orders, position sizing strategies, and other risk management techniques to protect their capital from excessive losses.

Image: www.mql5.com

Mt5 Synthetic Indices Account

Conclusion: Embracing the Future of Trading

The advent of mt5 synthetic indices accounts has transformed the online trading landscape, empowering traders with innovative tools and unparalleled flexibility. By harnessing the benefits of diversification, accessibility, and risk management, traders can unlock new avenues of success in the dynamic financial markets. Embracing mt5 synthetic indices accounts is a testament to the ever-evolving nature of trading and a commitment to achieving enhanced outcomes through strategic innovation.