Unlocking the Power of CFD Trading in the Heart of the Financial World

Image: www.cmcmarkets.com

In the bustling metropolis of finance and innovation, the United States has emerged as a pivotal hub for CFD (Contract for Difference) trading. Designed to empower traders of all levels, CFDs provide a versatile and potentially lucrative pathway to navigate the intricate world of financial markets. This comprehensive guide will delve into the nuances of CFD trading in the US, empowering you with the knowledge and strategies to harness its potential.

Defining CFD Trading: A Journey into Market Dynamics

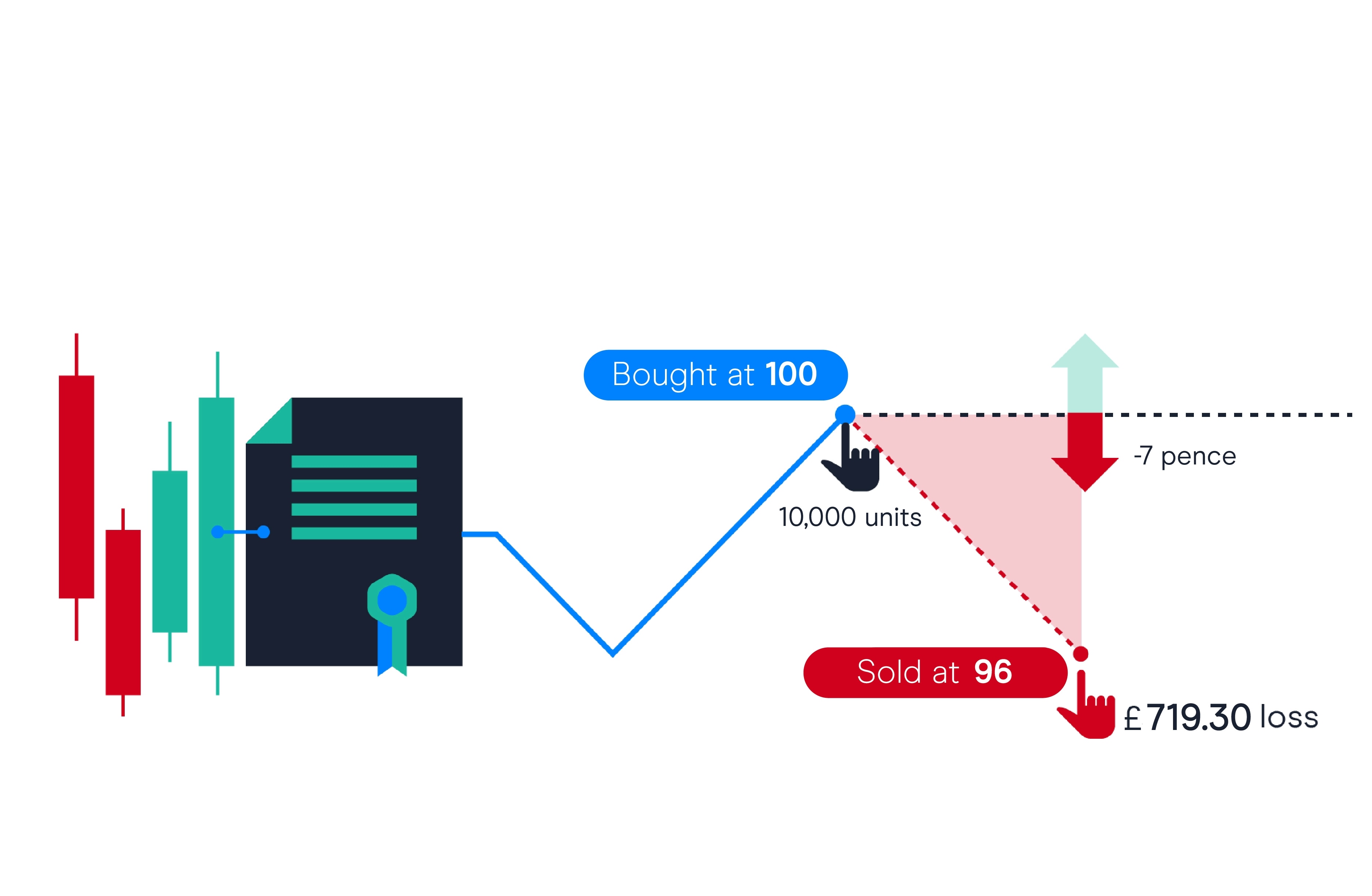

A CFD is an agreement between two parties to exchange the difference in the value of an underlying asset, such as a stock, currency, or commodity, over a defined period. Unlike traditional stock trading, where traders own the underlying asset, CFDs allow traders to speculate on price movements without actually taking ownership of the asset itself. This unique mechanism offers traders several advantages, including increased flexibility, reduced capital requirements, and the ability to profit from both rising and falling markets.

Unveiling the US CFD Landscape: Navigating Regulations and Market Trends

The regulatory landscape governing CFD trading in the US is overseen by the Commodity Futures Trading Commission (CFTC), ensuring transparency and investor protection. US-based CFD brokers must adhere to stringent regulatory guidelines, providing traders with a secure and well-regulated trading environment. The US CFD market has witnessed significant growth in recent years, with major financial institutions and online trading platforms offering a diverse range of CFD instruments.

Diving into CFD Strategies: Unlocking the Potential for Success

To excel in CFD trading, traders must embrace a range of strategies tailored to their unique risk tolerance and investment objectives. Scalping involves profiting from small price movements over short time frames, while intraday trading focuses on capturing profits within a single trading day. Swing trading targets price fluctuations over a period of several days or weeks, and long-term CFD trading seeks to capitalize on broader market trends over months or even years.

Embracing Risk Management Techniques: Safeguarding Your Trading Journey

Risk management is paramount in the realm of CFD trading. Stop-loss orders limit potential losses by automatically closing a position when the market price reaches a predefined trigger point. Limit orders help secure profits by closing a position when a desired profit target is met. Additionally, position sizing and diversification play a crucial role in managing risk and enhancing trading performance.

Mastering the Art of Technical and Fundamental Analysis

Successful CFD traders leverage both technical and fundamental analysis to make informed trading decisions. Technical analysis involves studying historical price movements and chart patterns to identify potential trading opportunities, while fundamental analysis focuses on macroeconomic factors, company earnings, and industry trends that influence asset prices. Combining these analytical approaches provides a comprehensive understanding of market dynamics and enhances trading strategies.

Harnessing the Power of Psychology in Trading

Trading psychology is an often-overlooked but vital aspect of CFD trading. Emotional control, discipline, and rational decision-making are essential to navigate the unpredictable nature of financial markets. Understanding the psychological biases that can influence trading behavior and implementing strategies to mitigate emotional reactions empowers traders to make sound decisions and achieve long-term profitability.

Conclusion: Embracing the Lucrative World of CFD Trading in the US

CFD trading in the US offers a myriad of opportunities for traders seeking to capitalize on market movements. By understanding the regulatory landscape, employing proven trading strategies, and embracing risk management techniques, traders can harness the potential of CFDs to achieve financial success. Remember, trading involves both rewards and risks, and it’s essential to approach the markets with a well-informed and disciplined mindset. By embracing the financial landscape, traders can unlock the full potential of CFD trading in the heart of the world’s financial center.

Image: www.financenews.global

Cfd Trading In The Us