In the realm of global currency trading, understanding the concept of a pip is fundamental. A pip, short for “point in percentage,” measures the minimal change in the value of a currency pair. Forex traders rely on pips to gauge market movements and calculate potential profits or losses.

Image: www.forexgdp.com

Defining Pips: The Essence of Currency Fluctuations

A pip is typically equivalent to the fourth decimal place of a currency quote. For instance, in the popular EUR/USD currency pair, a pip is 0.0001, indicating a one pip movement if the euro-dollar rate shifts from 1.1234 to 1.1235. This subtle change may seem insignificant, yet over time, it can accumulate to substantial gains or losses for traders.

The Significance of Pips in Forex Trading

Pips are the building blocks of profit and loss in forex trading. By accurately calculating pip values, traders can assess trade potential and manage risk. Smallpip movements can lead to sizeable returns when compounded over numerous trades. Understanding pips also simplifies the analysis of currency price fluctuations and enables traders to make informed trading decisions.

Practical Applications of Pips: Measuring Market Movements

Pips serve as a common denominator across currency pairs, enabling traders to compare the volatility and value of different markets. Forex platforms often displaycurrency prices in pips to facilitate quick and accurate calculations. By analyzing pip movements, traders can identify trends, predict price action, and developtrading strategies to maximize profitability.

Image: www.switchmarkets.com

Calculating Pip Value: A Personalized Approach to Forex Trading

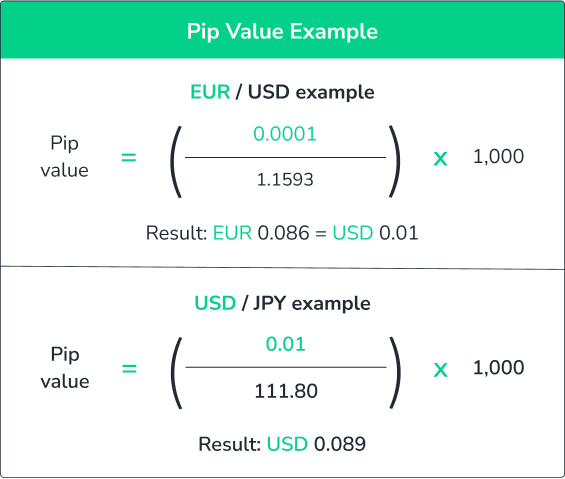

Calculating pip value varies depending on the currency pair and trading account. The formula for calculating pip value is:

Pip Value = (1 / Exchange Rate) x Currency Lot Size

For example, if the EUR/USD exchange rate is 1.1234 and you have a trading account denominated in euros with a lot size of 100,000, the pip value would be:

Pip Value = (1 / 1.1234) x 100,000 = 89.05 euros

Mastering Pips: A Path to Informed Forex Trading

Comprehending the concept of pips is indispensable for success in forex trading. It empowers traders with the ability to evaluate market movements, calculate potential profits and losses, and develop effective trading strategies. Traders who master the art of pip valuation gain a significant advantage in the fast-paced world of forex trading.

Expert Insights: Harnessing Pips for Trading Success

“Pips are the lifeblood of forex trading,” asserts renowned trader James Stanley. “Understanding pips enables traders to measure market fluctuations, assess trade potential, and manage risk effectively.”

“Pip value varies depending on the currency pair and trading account,” cautions forex strategist Kathy Lien. “Accurate pip value calculation is crucial to avoid costly trading mistakes.”

Actionable Tips for Forex Traders: Maximizing Pip Potential

- Monitor pip movements closely to identify trading opportunities.

- Calculate pip values accurately to assess trade risks and rewards.

- Consider trading currency pairs with higher pip values for increased profit potential.

- Use leverage with caution, as it can amplify both profits and losses.

- Practice risk management techniques, including stop-loss and take-profit orders, to protect profits and limit losses.

How Much Is A Pip

Conclusion: Unveiling the Power of Pips in Currency Trading

Pips lie at the heart of forex trading, serving as the fundamental unit of currency value measurement. By understanding how much a pip is, traders can accurately evaluate market movements, calculate potential profits and losses, and make informed trading decisions. Mastering the concept of pips paves the way for successful navigation in the dynamic world of forex trading.