Introduction

In the realm of currency trading, understanding pip value is crucial for calculating potential profits and losses. A pip, short for “point in percentage,” represents the smallest increment of price movement in a currency pair. Grasping the concept of pip value is essential for informed decision-making in the volatile world of Forex. This comprehensive guide will delve into the intricacies of pip value calculation, empowering you with the knowledge to maximize your trading experience.

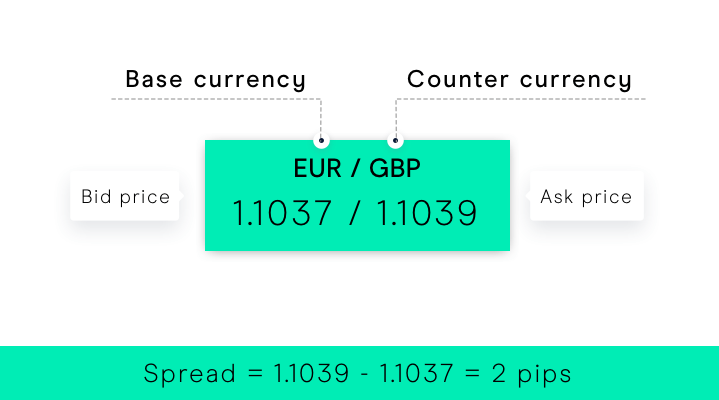

Image: www.cmcmarkets.com

Defining Pip Value

A pip is typically the fourth decimal place in a currency pair’s quotation. For instance, if the EUR/USD exchange rate is 1.1235, a one-pip movement would result in a change to 1.1236. In most currency pairs, one pip equates to 0.0001, or one-tenth of a basis point (0.01%). However, for currency pairs involving the Japanese yen (JPY), one pip represents 0.01, or one-hundredth of a basis point (0.001%).

Calculating Pip Value

To calculate pip value, we use the following formula:

*Pip Value = (1 / Exchange Rate) Contract Size**

Where:

- Exchange Rate: is the current market price of the currency pair.

- Contract Size: is the standard unit of currency traded in a Forex contract, typically 100,000 units.

For example, if the EUR/USD exchange rate is 1.1235 and the contract size is 100,000 EUR, the pip value would be:

*Pip Value = (1 / 1.1235) 100,000 = 8.90**

This means that if the EUR/USD rate fluctuates by one pip (to 1.1236), the value of the trade will change by 8.90 euros.

Importance of Pip Value

Understanding pip value is critical for several reasons:

- Profit/Loss Calculation: It enables traders to quantify potential profits and losses based on market movements.

- Risk Management: By knowing the pip value, traders can adjust their positions to manage risk more effectively.

- Trading Strategies: Certain trading strategies rely on pip value calculations for entry and exit points.

- Trade Execution: Pip value is used to determine the number of units to trade based on the desired profit or loss target.

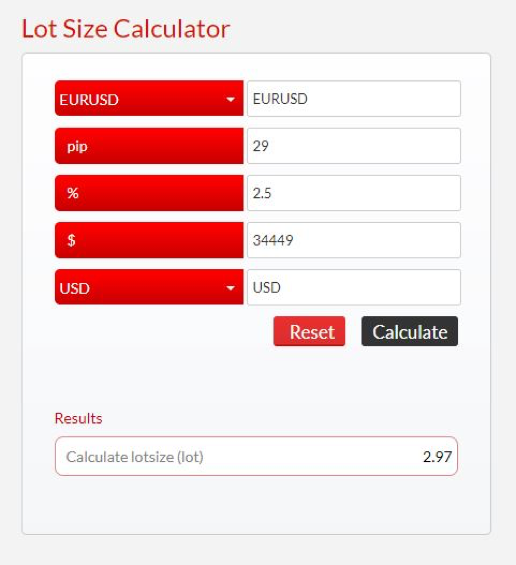

Image: forextraininggroup.com

Expert Insights

- John Bollinger, Technical Analyst: “Pip value is the lifeblood of currency trading. It provides traders with a precise understanding of how price changes impact their positions.”

- Kathy Lien, Managing Director, BK Asset Management: “Calculating pip value accurately is essential for sound money management. It helps traders avoid unnecessary losses and maximize returns.”

Actionable Tips

- Use a Forex calculator to simplify pip value calculations.

- Familiarize yourself with the contract sizes of different currency pairs to avoid errors.

- Consider using a demo account to practice calculating pip values without risking real funds.

How To Calculate Pip Value

Conclusion

Mastering pip value calculation empowers currency traders with a potent tool for navigating the Forex market. By understanding the concepts and applying the formula, traders can make informed decisions, manage risk, and optimize their trading strategies. The ability to accurately calculate pip value unlocks the potential for greater profitability and success in the dynamic world of currency trading.