Introduction

Image: zandtraders.com

In the captivating realm of forex trading, understanding the value of pips is paramount for navigating the ebb and flow of currency dynamics. A pip, short for point in percentage, represents the smallest increment by which exchange rates fluctuate in the foreign exchange market. Comprehending the significance of pips empowers traders with the precision necessary to make informed decisions and maximize their trading potential.

Defining Pips: The Building Blocks of Currency Fluctuations

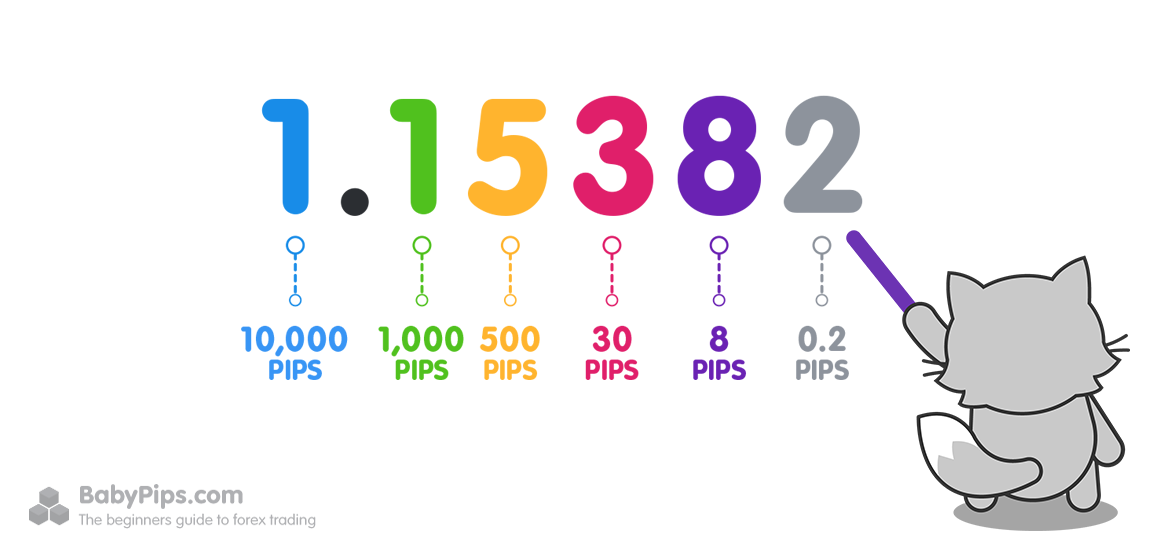

At its core, a pip represents the fourth decimal place for currency pairs involving the US dollar. For example, if the EUR/USD exchange rate changes from 1.1234 to 1.1235, that shift represents a one-pip movement. However, it is important to note that the value of a pip varies based on the currency pair being traded. For non-US dollar pairs, the pip is the second decimal place.

Calculating Pip Value: Converting Pips into Monetary Units

The monetary value of a pip is directly tied to the contract size of the trade. The standard contract size in the forex market is 100,000 units of the base currency. This means that a one-pip movement in a currency pair where the base currency is worth one US dollar results in a profit or loss of $10.

To illustrate, let’s consider a hypothetical scenario where the EUR/USD exchange rate is 1.1234. If a trader buys 100,000 euros (equivalent to $112,340) and the exchange rate subsequently rises to 1.1235, they will realize a profit of $10 (1 pip * $10 per pip).

The Role of Pips in Forex Trading

Pips serve as the lifeblood of forex trading, enabling traders to quantify price changes and assess potential profits and losses with accuracy. In scalping strategies, which involve entering and exiting trades within minutes or seconds, pips take center stage as traders seek to capitalize on even the most minor market movements.

Moreover, pips are crucial for calculating risk and managing positions effectively. Traders utilize pip values to determine the potential financial impact of market fluctuations and adjust their trading strategies accordingly.

Historical Evolution of Pips: From Fractional Pips to ECNs

Historically, the minimum price increment in forex was 10 pips, known as a fractional pip. However, advancements in technology have paved the way for electronic communication networks (ECNs) that allow for pip increments as small as 0.1, known as decimal pips. This increased precision has enhanced trading efficiency and reduced trading costs.

Conclusion

Comprehension of the concept of pips is an indispensable prerequisite for success in forex trading. Pips represent the lifeblood of exchange rate fluctuations, enabling traders to make precise calculations of profits, losses, and risk. Whether you’re a seasoned veteran or a budding novice in the forex market, mastering the value of pips is the key to unlocking the intricacies of this dynamic and ever-evolving landscape.

Image: www.teaminfin8e.org

How Much Is One Pip In Forex