Unraveling the Hidden Secrets of Market Fear

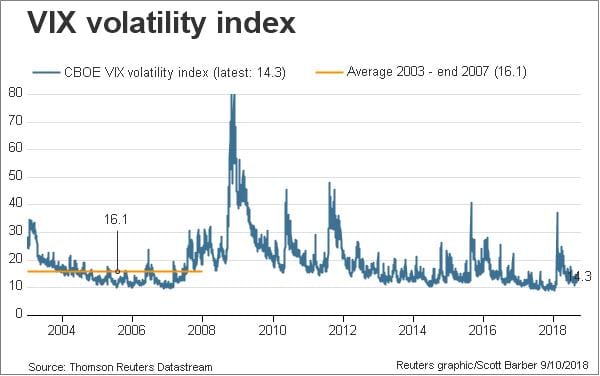

Fear, a powerful force that courses through the veins of investors, can send markets tumbling like a towering inferno. The VIX Index, like a financial seismograph, measures the intensity of this fear, capturing the market’s collective unease and anticipation of future volatility. With the VIX Index live chart, we gain a real-time glimpse into this elusive sentiment, allowing us to navigate the tumultuous seas of financial uncertainty.

Image: fity.club

Understanding the VIX Index: A Measure of Investor Fear

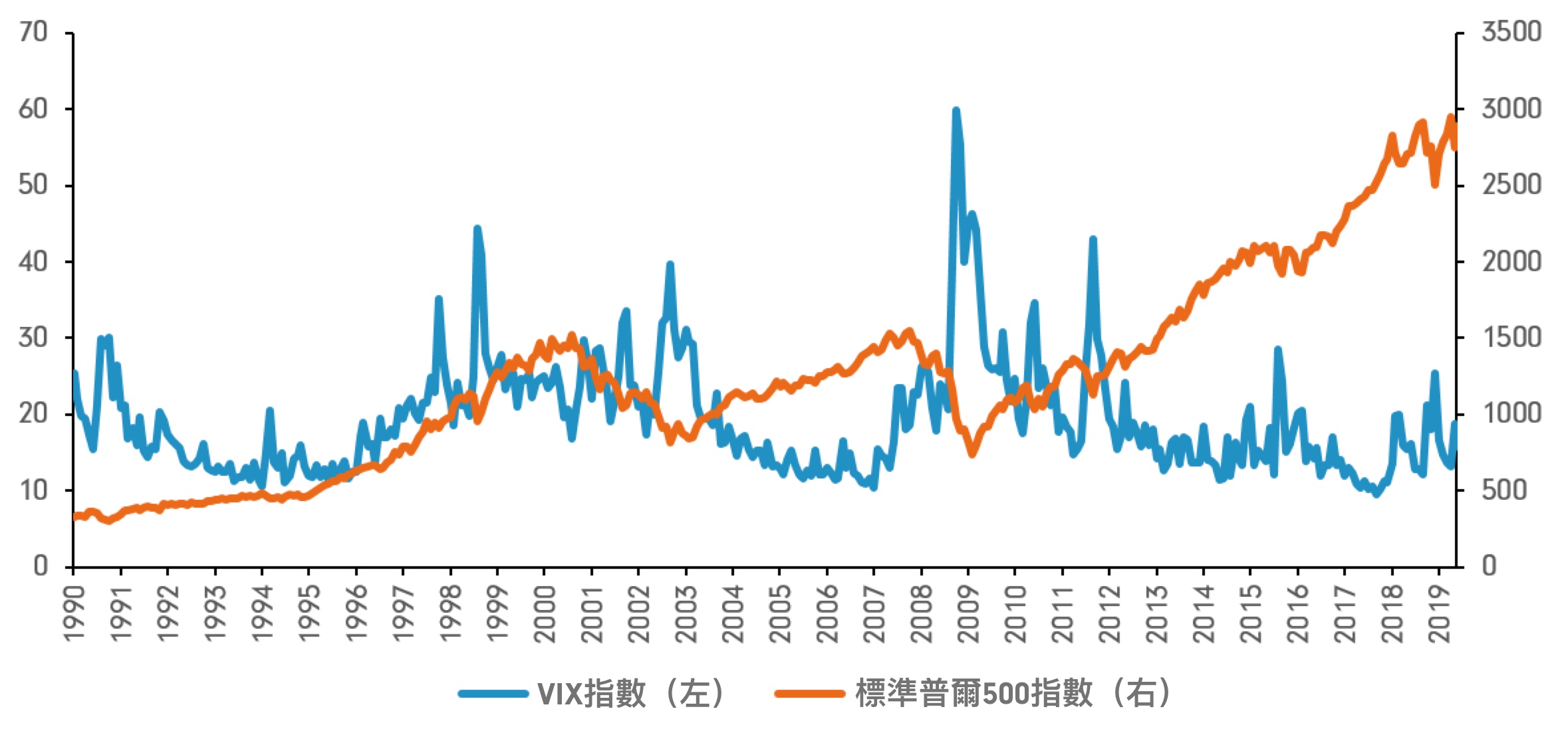

The VIX Index, also known as the Volatility Index, is a forward-looking indicator derived from S&P 500 index options. It gauges the market’s expectations of volatility over the next 30-day period, providing a forward-looking assessment of investor sentiment. When traders purchase options to hedge against potential market downturns, the increased demand for these contracts drives up the VIX Index, reflecting heightened fear.

The Significance of the VIX Index: A Market Mood Barometer

The VIX Index serves as a barometer of investor sentiment, acting as a measure of their collective fear and greed. High VIX readings, typically above 20, indicate a heightened sense of uncertainty and a surge in demand for protective options. Conversely, VIX readings below 20 suggest a more sanguine outlook, as investors anticipate a calmer market ahead.

Practical Applications of the VIX Index: Guiding Investment Strategies

savvy investors utilize the VIX Index in myriad ways to enhance their investment strategies. By incorporating the VIX into their analysis, traders can:

-

Identify Market Trends: The VIX Index can signal changes in market direction, as rising VIX values often precede periods of market decline.

-

Assess Market Risk: High VIX readings indicate increased risk aversion among investors, which can prompt traders to adjust their risk exposure accordingly.

-

Hedge Investment Portfolios: The VIX Index can be used to hedge against market downturns, with traders purchasing VIX options to protect their portfolios from potential losses.

Image: www.fidelity.com.hk

Historical Perspective: The VIX Index in the Market Cycle

The VIX Index has a rich history, mirroring the ebb and flow of market volatility. Notably, during periods of excessive market optimism, such as the dot-com bubble, the VIX Index plumbed to record lows, reflecting an unsustainably low fear premium. Conversely, during the 2008 financial crisis, the VIX Index skyrocketed to historic highs, as fear and panic gripped the markets.

Vix Index Live Chart

The VIX Index: Guiding Post in the Realm of Uncertainty

The VIX Index live chart serves as an invaluable guide through the uncertain and often volatile landscapes of the financial markets. By deciphering the market’s collective fear and anticipation, investors can navigate with greater confidence and make informed decisions to mitigate risk and maximize gains.