Navigating the dynamic world of forex trading demands a keen understanding of the intricate interplay between currency values and market movements. Among the fundamental elements that every trader must master is the concept of a pip, or point in percentage, and its associated value. A pip value calculator is an invaluable tool that empowers traders with the ability to translate currency fluctuations into meaningful monetary terms. By utilizing this indispensable resource, traders can make informed decisions, optimize their strategies, and maximize their profit potential.

Image: www.fxforever.com

What is a Pip Value Calculator?

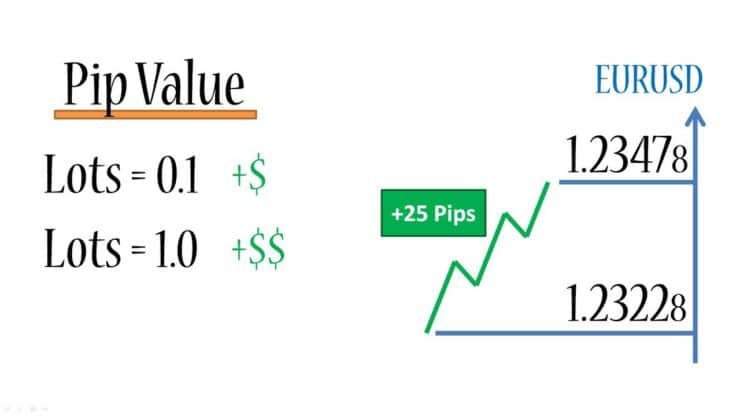

A pip value calculator is an online or software-based tool designed to determine the value of a pip in a specific currency pair based on the current exchange rate. It allows traders to input the size of their trade in units, the currency pair they are trading, and the current exchange rate. The calculator then computes and displays the value of a single pip in the trader’s account currency. This precise calculation is crucial for traders as it provides a clear understanding of the potential profit or loss they can expect from a given price movement.

Why Pip Value Matters

Accurately understanding pip value is paramount for successful forex trading. By calculating the pip value, traders can gauge the potential impact of price fluctuations on their positions. This knowledge enables them to calibrate their risk management strategies, set realistic trade targets, and determine the appropriate lot size for their trades. Without a precise understanding of pip value, traders may encounter difficulty in accurately assessing the risk and reward associated with their trading decisions.

Components of a Pip Value Calculator

Understanding the elements that comprise a pip value calculator is essential for its effective utilization. The core components include:

Image: www.fondazionealdorossi.org

Currency Pair:

This field specifies the currency pair that the trader intends to trade. Pip values vary depending on the specific currency pair due to differences in their exchange rates.

Trade Size:

Traders must indicate the size of their trade in units or lots. Standard lot sizes in forex trading are micro (0.01 lots), mini (0.10 lots), standard (1.00 lots), and mega (10.00 lots).

Exchange Rate:

The current exchange rate between the currency pair is entered into the calculator. This rate represents the price of one currency unit in terms of the other currency.

Advantages of Using a Pip Value Calculator

Harnessing the power of a pip value calculator offers several tangible advantages for traders:

Accurate Trade Assessment:

The calculator provides precise information on the monetary value of each pip movement, allowing traders to accurately assess the potential profit or loss of their positions.

Informed Risk Management:

By understanding the potential monetary impact of price fluctuations, traders can make informed decisions regarding the allocation of their risk capital and implement appropriate risk mitigation strategies.

Lot Size Optimization:

Traders can determine the appropriate lot size for their trades by factoring in the pip value and their risk tolerance. This ensures that they are neither overexposing themselves to risk nor limiting their profit potential.

Forex Pip Value Calculator

Conclusion

Mastering the concept of pip value and utilizing a pip value calculator are indispensable skills for proficient forex trading. By equipping themselves with this knowledge, traders gain the power to translate market movements into meaningful monetary terms, make informed decisions, optimize their risk management strategies, and ultimately enhance their profitability. Whether navigating the fast-paced world of scalping or pursuing long-term investment strategies, a deep understanding of pip value and the skillful use of a pip value calculator are essential ingredients for success.