Disclaimer: Trading binary options involves significant risk and may not be suitable for all investors. Consider your financial resources, investment objectives, and risk tolerance before engaging in binary options trading.

Image: tradersunion.com

Navigating the Binary Options Landscape in the USA

Binary options, a form of option trading, have emerged as a popular investment instrument, offering traders the potential for substantial returns over short time frames. However, understanding the nuances of binary options trading and identifying reputable brokers is paramount, especially in the USA, where regulations surrounding binary options have evolved over time. This article aims to provide a comprehensive overview of binary options brokers in the USA, encompassing historical developments, regulatory frameworks, and essential considerations for successful trading.

Defining Binary Options: A Simplified Explanation

Binary options are essentially financial instruments that derive their value from the underlying asset they represent, such as stocks, currencies, or commodities. Unlike traditional options, binary options present a simplified approach, with traders speculating on the asset’s price movement over a predetermined period. The payout structure is straightforward: traders either receive a fixed return if their prediction aligns with the market outcome or lose their entire investment otherwise.

Decoding the Regulatory Landscape: Legal and Licensing Considerations

The Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC) are the primary regulators governing binary options trading in the USA. While the SEC focuses on fraud prevention, the CFTC oversees futures and options markets, including binary options. Stringent regulations are designed to safeguard investors and ensure fair practices within the industry.

Binary options brokers operating in the USA must comply with these regulatory frameworks to obtain licensure and legitimacy. Traders should prioritize dealing exclusively with licensed brokers, verifying their status through broker-check tools offered by regulatory bodies.

Image: www.legitgambling.com

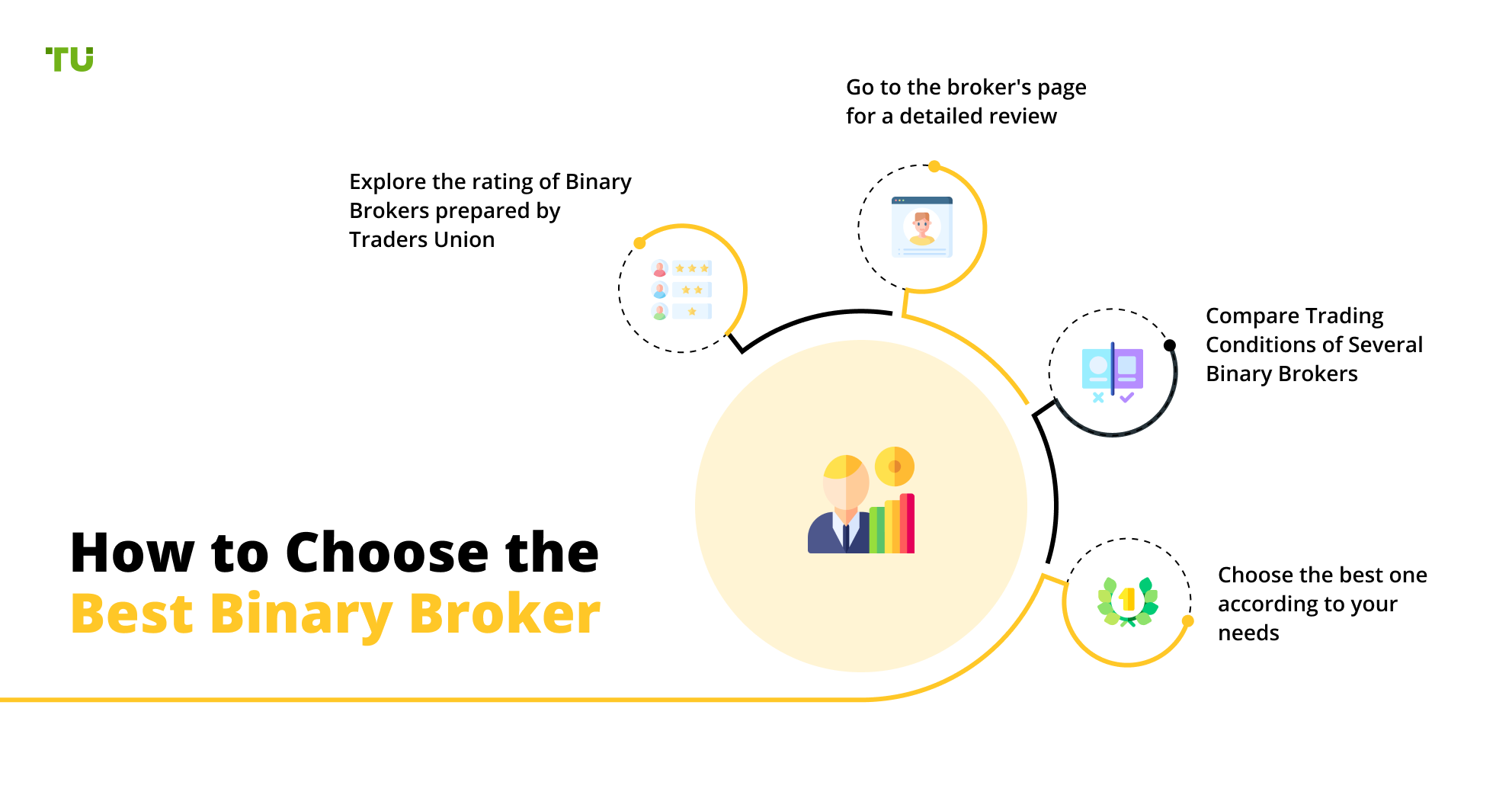

Selecting a Trustworthy Binary Options Broker: Essential Factors

Finding a reputable binary options broker is vital for successful trading experiences. Consider the following key factors in your selection process:

- Regulation and Licensing: Verify the broker’s compliance with regulatory requirements, ensuring licensure by recognized authorities such as the SEC, CFTC, or equivalent international organizations.

- Security and Transparency: Assess the broker’s security measures to protect client funds and data. Transparency in operation and financial reporting is essential for building trust.

- Trading Platform and Features: Evaluate the broker’s trading platform, ensuring it aligns with your trading style and preferences. Features such as user-friendliness, real-time data, and customizable options enhance the trading experience.

- Asset Selection and Payouts: Consider the range of underlying assets offered by the broker, accommodating your investment interests. Payouts, expressed as percentages or multipliers, vary across brokers, so compare them before selecting.

- Customer Support and Education: Seek brokers with responsive and knowledgeable customer support teams, available to assist with inquiries, platform usage, and trading strategies.

Trading Strategies and Risk Management: Minimizing Losses

Developing effective trading strategies is fundamental for success in binary options trading. Fundamental and technical analysis, studying market trends, and utilizing market news can provide valuable insights for decision-making.

Simultaneously, risk management plays a crucial role in mitigating potential losses. Establishing clear risk tolerance thresholds, managing trade sizes, and employing stop-loss orders can help limit financial exposure during market fluctuations.

Frequently Asked Questions (FAQs) on Binary Options Trading

Q: Are binary options legal in the USA?

A: Yes, binary options trading is legal in the USA, provided you engage with licensed brokers compliant with regulatory frameworks set by authorities such as the SEC and CFTC.

Q: Which regulatory body oversees binary options trading in the USA?

A: Binary options trading is primarily regulated by the Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC).

Q: How can I identify a reputable binary options broker?

A: Assess the broker’s regulation, security measures, trading platform features, asset selection, payouts, customer support, and educational resources when evaluating their credibility.

Q: Is binary options trading profitable?

A: While binary options offer potential returns, it’s essential to approach trading cautiously due to its inherent risk. Developing trading strategies, managing risk, and accessing educational resources can enhance profitability chances.

Q: Can I make a living trading binary options?

A: While theoretically possible, making a living solely through binary options trading requires a high level of skill, knowledge, and capital. Treating binary options as a secondary income source or a complement to other investment strategies may be more realistic.

Binary Options Brokers Usa

Conclusion: Embracing the Opportunities with Informed Decision-Making

Binary options trading presents opportunities for investors seeking alternative financial instruments with potential returns. However, navigating the landscape requires a comprehensive understanding of regulations, broker evaluation, trading strategies, and risk management. By embracing these key considerations, traders can maximize their chances of success while minimizing financial risks.

Are you ready to unravel the complexities of binary options trading in the USA? Explore our comprehensive resources, seek guidance from experienced traders, and approach binary options trading with a well-informed strategy for navigating the financial markets.