In the fast-paced world of foreign exchange (forex) trading, risk management is paramount. A crucial tool for effective risk management is a forex stop loss calculator, which enables traders to predetermine their maximum potential loss on a trade. By implementing a stop-loss order, traders can mitigate the financial impact of adverse price movements and safeguard their capital.

Image: carlfajardo.com

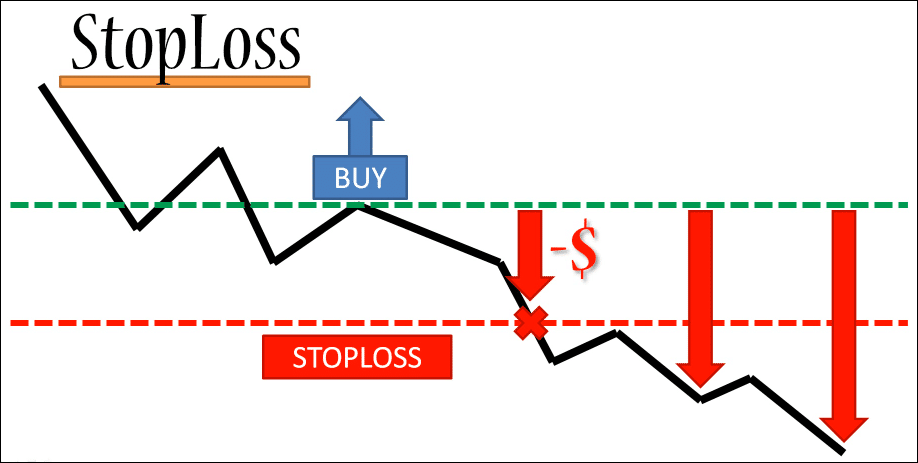

Imagine a scenario where you enter a long position on the EUR/USD currency pair, anticipating an upswing. However, the market unexpectedly turns against you, causing the value of EUR/USD to plummet. Without a stop-loss order in place, you face the risk of losing a substantial portion of your investment. A forex stop loss calculator would have empowered you to set a specific price point at which your position would automatically close, limiting your losses and preventing a catastrophic outcome.

Understanding Stop Loss Orders: A Defensive Measure

Concept and Mechanics:

A stop loss order is an instruction given to your broker to automatically close your trade when the market price reaches a predefined level. This level is typically set below the entry price for long positions and above the entry price for short positions. When the market price triggers the stop loss, the trade is closed, and you incur a loss equal to the difference between the entry price and the stop-loss price.

Stop loss orders act as a safety net, protecting you from excessive losses in volatile market conditions. By controlling your risk exposure, they allow you to trade with greater confidence, knowing that your potential downside is limited.

Importance in Risk Management:

In forex trading, risk management is crucial for long-term success. Volatility is inherent in the forex market, and unpredictable price fluctuations can quickly erode your profits or even lead to significant losses. Stop loss orders provide a systematic approach to managing risk by establishing pre-defined loss limits.

By using a forex stop loss calculator, you can precisely calculate the maximum amount you are willing to lose on a trade and set your stop loss accordingly. This disciplined approach helps you stay within your risk tolerance and prevents emotional decision-making that can lead to costly mistakes.

Image: tradethatswing.com

Navigating Forex Stop Loss Calculators: Efficacy and Features

Forex stop loss calculators are essential tools for discerning traders. They provide a simple and intuitive way to determine the optimal stop-loss level for your trades. These calculators typically incorporate sophisticated algorithms that take into account factors such as the trade’s entry price, the current market price, and the desired risk-reward ratio.

To use a forex stop loss calculator, you simply input the relevant information and specify the type of stop loss you wish to employ (e.g., fixed stop loss, trailing stop loss). The calculator will then generate the recommended stop-loss level based on your inputs.

Fixed Stop Losses: Precision and Simplicity

Fixed stop losses are the most straightforward type of stop loss order. You specify a fixed price at which you want the trade to close. This method provides a precise risk management strategy, ensuring that your losses will not exceed the predetermined amount.

Trailing Stop Losses: Dynamic Protection

Trailing stop losses add a layer of flexibility to your risk management approach. These stop-loss orders move in tandem with the market price, adjusting the stop-loss level as the trade moves in your favor. Trailing stop losses help you lock in profits while allowing for potential further gains.

Expert Advice for Effective Stop Loss Placement

While forex stop loss calculators provide valuable guidance, it is essential to supplement their recommendations with expert advice and your own trading experience.

Technical Analysis for Informed Decisions:

Technical analysis is a valuable tool for identifying potential support and resistance levels in the market. By studying historical price data, you can pinpoint areas where the market is likely to reverse direction. Placing your stop-loss order just beyond these levels can help you avoid false breakouts and minimize unnecessary losses.

Consider Volatility: Striking a Balance

The volatility of the currency pair you are trading is a crucial factor to consider when setting your stop loss. Highly volatile currency pairs require wider stop-loss levels to accommodate larger price swings.

FAQs for Enhanced Understanding

Q: How do I use a forex stop loss calculator?

A: Forex stop loss calculators require you to input the entry price, current market price, desired risk-reward ratio, and type of stop loss (fixed or trailing). The calculator then generates the recommended stop-loss level.

Q: What is the difference between a fixed stop loss and a trailing stop loss?

A: A fixed stop loss is set at a fixed price, while a trailing stop loss moves in tandem with the market price, adjusting as the trade moves in your favor.

Q: Where can I find a reputable forex stop loss calculator?

A: Many reputable brokers offer forex stop loss calculators on their trading platforms. Alternatively, you can find independent online calculators by searching for “forex stop loss calculator.”

Forex Stop Loss Calculator

Conclusion

Forex stop loss calculators are indispensable tools for effective risk management in the challenging world of forex trading. They empower traders to predetermine their maximum potential loss on a trade, mitigating financial risks and safeguarding their capital. By incorporating stop loss orders into your trading strategy and using a forex stop loss calculator to optimize their placement, traders can approach the market with greater confidence, knowing that their downside is controlled.

Are you curious to learn more about forex stop loss calculators and how they can enhance your trading? Engage with us in the comments section below and share your experiences or questions.