In the realm of finance, understanding and navigating market volatility is paramount. The CBOE Volatility Index, affectionately known as the VIX, has emerged as a valuable tool for traders seeking to capitalize on market fluctuations. However, trading the VIX requires a deep understanding of its intricacies and a strategic approach. This comprehensive guide will delve into the world of VIX trading, empowering you with the knowledge and strategies to navigate this dynamic market.

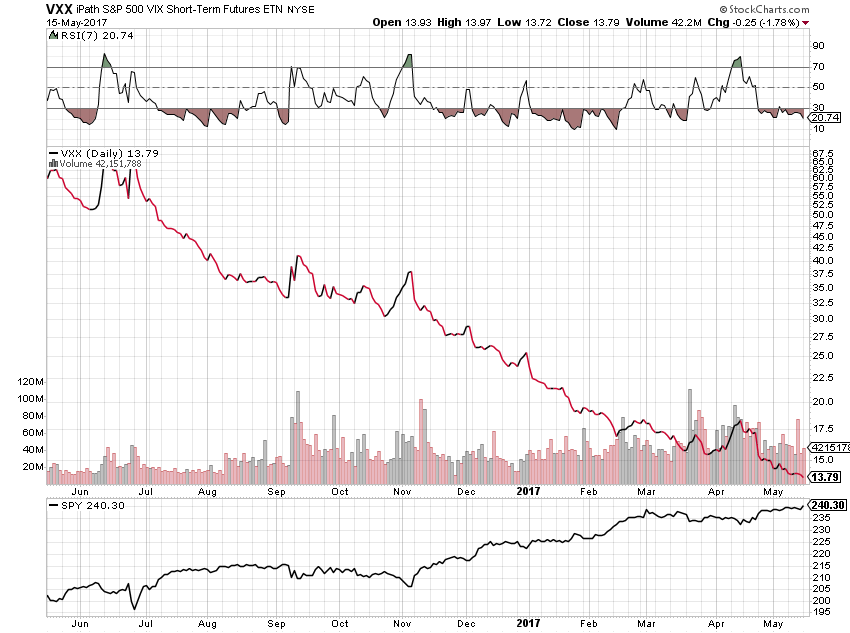

Image: www.seeitmarket.com

Unveiling the Volatility Index

The VIX is a measure of market volatility, specifically the implied volatility of the S&P 500 index options over the next 30 days. It is calculated by the Chicago Board Options Exchange (CBOE) and serves as a proxy for investor expectations of future market turbulence. A high VIX indicates heightened uncertainty and potential for significant price swings, while a low VIX suggests a more stable and predictable market.

Strategies for VIX Trading

Trading the VIX involves speculating on the future direction of market volatility. Traders can employ various strategies to capitalize on market fluctuations, including:

- Short-term Trading: Day traders and scalpers seek to profit from short-term price movements in the VIX. They typically hold positions for minutes or hours, relying on technical analysis and momentum indicators to identify trading opportunities.

- Long-term Investing: Investors with a longer-term horizon may consider investing in VIX-linked exchange-traded funds (ETFs) or closed-end funds. These funds provide exposure to the VIX without the need for active trading.

- Hedging: Sophisticated traders can use the VIX as a hedging tool to protect their portfolios against market downturns. By buying VIX futures or options, they can gain exposure to volatility and reduce their overall risk.

Expert Insights and Actionable Tips

Renowned experts in the field of VIX trading offer valuable insights and practical advice to enhance your trading strategy:

- Stay Informed: Closely monitor financial news and economic data that can influence market volatility. geopolitical events, central bank announcements, and corporate earnings can significantly impact the VIX.

- Understand Market Sentiment: Analyze market sentiment indicators, such as the VIX Fear & Greed Index, to gauge investor confidence and potential market turning points.

- Manage Your Risk: Implement strict risk management strategies, including stop-loss orders and position sizing. VIX trading involves inherent risk, and traders must be prepared for potential losses.

Image: www.youtube.com

How To Trade Volatility Index

Conclusion

Trading the VIX can be a lucrative endeavor, but it requires a thorough understanding of market dynamics, a strategic approach, and a prudent risk management framework. By embracing the insights and strategies outlined in this guide, you can navigate the complexities of VIX trading and harness its potential to enhance your financial portfolio. Remember, the stock market is always changing, so stay informed, adapt your strategies accordingly, and trade wisely.