The stock market is a fascinating and complex beast. Stock prices can fluctuate wildly, and it can be difficult to understand what’s driving those changes. In this article, we will explore the various factors that can affect stock prices, helping you gain a better understanding of this dynamic market.

Image: www.shiftingshares.com

Before delving into the details, it’s important to understand that stock prices reflect the value that investors place on a company. This value is influenced by a multitude of factors, including both internal and external elements.

Economic Factors

The overall health of the economy can have a significant impact on stock prices. When the economy is strong, businesses tend to perform well and their stock prices typically rise. Conversely, when the economy is weak, businesses may struggle and their stock prices can decline.

Specific economic indicators that can influence stock prices include:

- Gross domestic product (GDP)

- Inflation

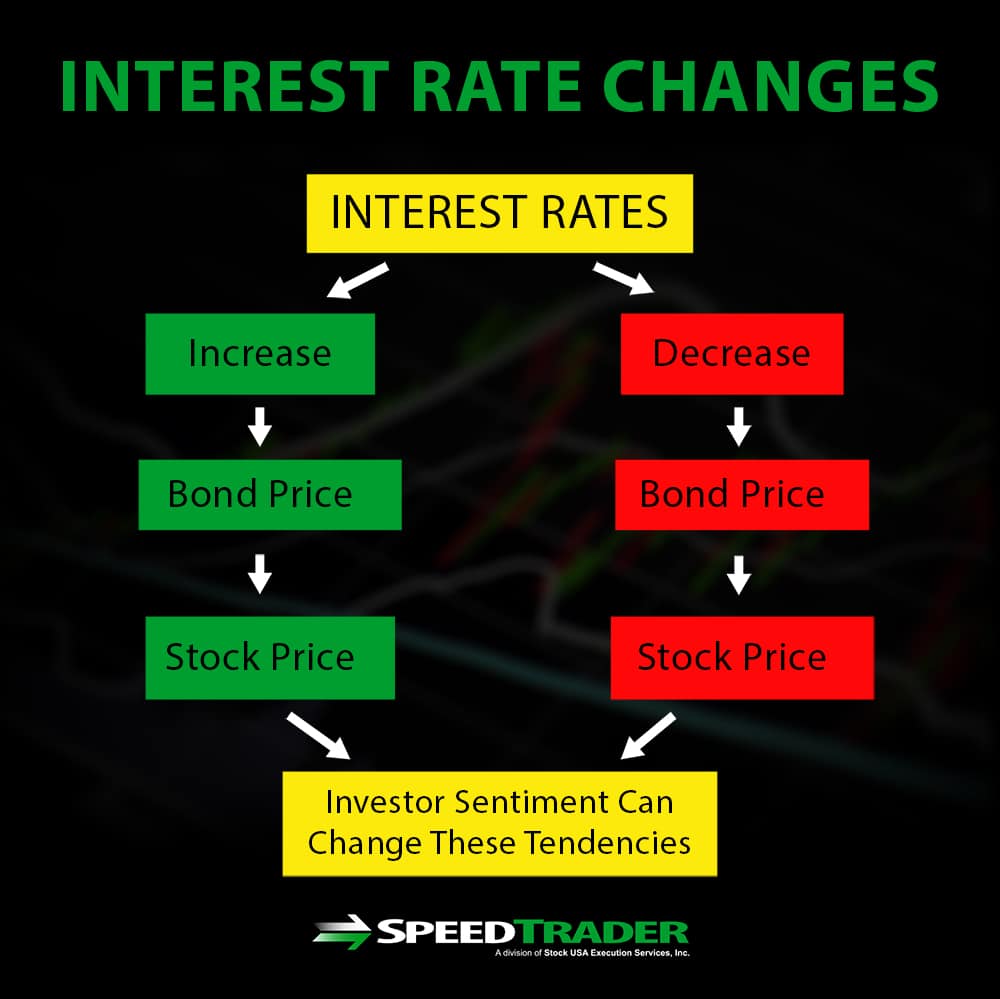

- Interest rates

- Unemployment rate

- Consumer confidence

Company-Specific Factors

In addition to economic factors, company-specific factors can also have a major impact on stock prices. These factors include:

- Earnings: A company’s earnings per share (EPS) is a key measure of its profitability. When a company reports strong earnings, its stock price tends to rise. Conversely, when a company reports weak earnings, its stock price can decline.

- Revenue: A company’s revenue is the total amount of money it earns from its operations. When a company reports strong revenue growth, its stock price tends to rise. Conversely, when a company reports weak revenue growth, its stock price can decline.

- Cash flow: A company’s cash flow statement shows how much cash it generates from its operations. When a company has strong cash flow, it has more money to invest in its business, pay off debt, or return to shareholders. This can lead to higher stock prices.

- Balance sheet: A company’s balance sheet shows its assets, liabilities, and equity. A strong balance sheet is a sign that the company is financially healthy. This can lead to higher stock prices.

- Management team: The quality of a company’s management team can also affect its stock price. A strong management team can make good decisions that lead to increased profitability and growth. This can lead to higher stock prices.

- Industry trends: The overall health of a company’s industry can also affect its stock price. A company that operates in a growing industry is more likely to have strong earnings and revenue growth. This can lead to higher stock prices.

- Government regulations: Government regulations can also affect a company’s stock price. Regulations that are favorable to a company can lead to higher stock prices. Conversely, regulations that are unfavorable to a company can lead to lower stock prices.

Analyst Recommendations

Analyst recommendations can also influence stock prices. When an analyst upgrades a stock, it means that they believe the stock is worth more than its current price. This can lead to increased demand for the stock and higher stock prices. Conversely, when an analyst downgrades a stock, it means that they believe the stock is worth less than its current price. This can lead to decreased demand for the stock and lower stock prices.

Image: speedtrader.com

News and Sentiment

News and sentiment can also affect stock prices. When a company announces positive news, such as a new product launch or a partnership with a major customer, its stock price can rise. Conversely, when a company announces negative news, such as a product recall or a loss of market share, its stock price can decline.

In addition to company-specific news, general market sentiment can also affect stock prices. When investors are optimistic about the future, they are more likely to buy stocks. This can lead to higher stock prices. Conversely, when investors are pessimistic about the future, they are more likely to sell stocks. This can lead to lower stock prices.

What Affects Stock Prices

FAQs

What are some tips for investing in stocks?

Here are a few tips for investing in stocks:

- Do your research. Before you buy any stock, it’s important to understand the company and its industry.

- Diversify your portfolio. Don’t put all of your eggs in one basket. Spread your money across a variety of stocks, industries, and asset classes.

- Invest for the long term. Don’t try to time the market. Buy stocks that you believe in and hold them for the long term.

- Don’t panic sell. When the market takes a downturn, it’s important to stay calm. Don’t panic sell your stocks. Just ride out the storm and wait for the market to recover.

- Get help from a financial advisor. If you’re not sure how to invest, consider getting help from a financial advisor. They can help you create a personalized investment plan that meets your specific needs.

What are some of the risks associated with investing in stocks?

Here are some of the risks associated with investing in stocks:

- You could lose money. The stock market is a volatile place. There is no guarantee that you will make money when you invest in stocks.

- The value of your stocks could fluctuate. The prices of stocks can go up and down. This means that you could lose money on your investment.

- You could lose all of your money. In the worst-case scenario, you could lose all of your money if a company goes bankrupt or the stock market crashes.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing involves risk, and you should always consult with a financial advisor before making any investment decisions.