Imagine navigating a vast and intricate stock market, seeking an accurate gauge to measure the performance of this ever-fluctuating landscape. Enter the market value weighted index, a compass that guides investors through this tumultuous terrain. It captures the ebb and flow of the market’s movements, providing insights into the overall health and performance of stocks.

Image: www.chegg.com

Definition

A market value weighted index assigns weights to the underlying stocks based on their market value. The index’s value is then calculated by summing the weighted value of each stock. This means that stocks with higher market capitalizations (total market value) have a greater influence on the index’s value compared to those with lower market capitalizations.

Importance

Market value weighted indices are widely used by investors for several reasons:

- Broad Market Representation: They provide a comprehensive view of the overall market’s performance by capturing the movements of a large number of stocks.

- Benchmark for Performance: Investors can use the index as a benchmark against which they can measure the performance of their own investments.

- Sector and Industry Analysis: Indices can be created to follow specific sectors or industries, allowing investors to analyze the performance of particular segments of the market.

Components

The composition of a market value weighted index can vary depending on its purpose. Some common types include:

- Broad-Based Indices: These indices, such as the S&P 500 or FTSE 100, include a wide range of stocks from different sectors and industries.

- Sector-Specific Indices: These indices focus on a particular sector, such as technology or healthcare.

- Industry-Specific Indices: These indices track the performance of stocks within a specific industry, such as semiconductors or pharmaceuticals.

Image: www.youtube.com

Calculation

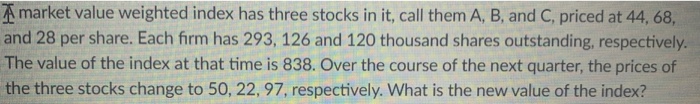

To calculate the value of a market value weighted index, follow these steps:

- Calculate the market capitalization of each stock in the index.

- Multiply the market capitalization of each stock by the relevant weight.

- Sum the weighted market capitalizations of all stocks in the index.

The result is the value of the market value weighted index.

Examples

Here are a few well-known market value weighted indices:

- S&P 500: Captures the performance of the 500 largest publicly traded companies in the United States.

- FTSE 100: Tracks the performance of the 100 largest publicly traded companies in the United Kingdom.

- MSCI World Index: Measures the performance of stocks from developed markets worldwide.

Advantages and Disadvantages

Advantages:

- Comprehensive market representation

- Easy to understand and interpret

- Widely used as a benchmark for investment performance

Disadvantages:

- Can be heavily influenced by a few large-cap stocks

- May not reflect the performance of small-cap or mid-cap stocks

- Can be slow to react to changes in smaller companies

Recent Trends

Market value weighted indices have seen increased demand as passive investing strategies grow in popularity. Exchange-traded funds (ETFs) and index mutual funds track the performance of indices, allowing investors to participate in the growth of the overall market or specific sectors without the need for individual stock selection.

Market Value Weighted Index

Conclusion

Market value weighted indices play a vital role in the financial markets by providing a comprehensive view of market performance. They are widely used by investors and analysts to measure their own investments, analyze different industries and sectors, and track the overall health of the stock market. While they have certain limitations, the insights they provide can be invaluable for investors navigating the ever-changing landscape of the stock market.