The foreign exchange market (forex) is an ever-evolving landscape, and traders need to be aware of the nuances involved in currency conversion. One fundamental concept is the pip, which plays a crucial role in determining the value of a currency trade. In this comprehensive guide, we’ll dive into the world of pips, explaining what they are, how they relate to currency values, and their impact on forex trading.

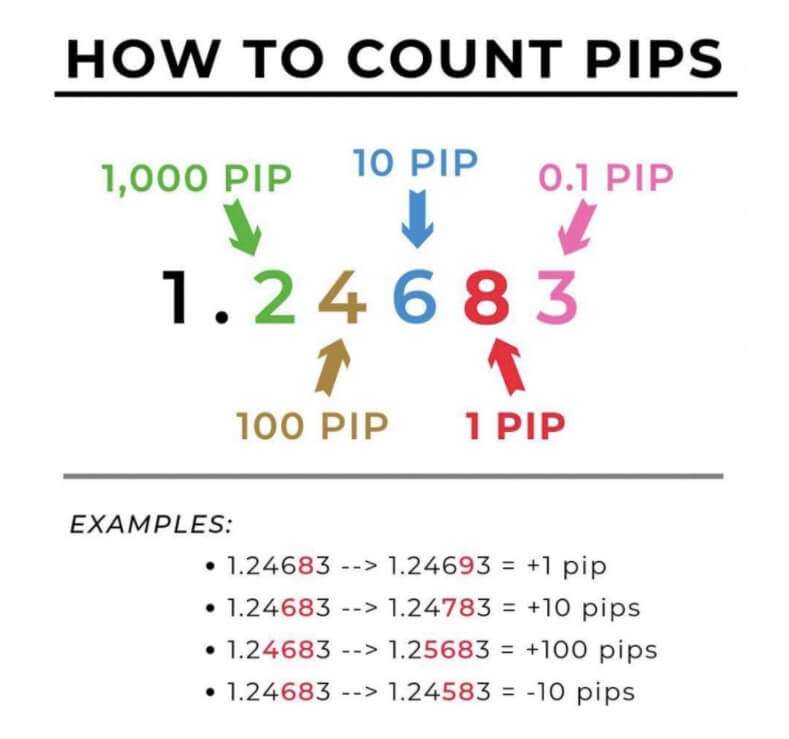

Image: www.forex.academy

What is a Pip?

A pip, also known as a point in percentage, is a unit of measurement used to track changes in currency exchange rates. It represents the smallest possible increment in the value of a currency pair. For most currency pairs, one pip is equivalent to 0.0001. For currency pairs that have the Japanese Yen (JPY) as the second currency, one pip is often equal to 0.01.

How to Calculate the Value of a Pip

To determine the value of a pip in dollars, we need to consider the following formula:

Pip Value = (1 Pip / Exchange Rate) * Contract Size

- 1 Pip: Always 0.0001 or 0.01 (depending on the currency pair)

- Exchange Rate: The current exchange rate between the two currencies

- Contract Size: The standard lot size in forex, which is typically 100,000 units of the base currency

Let’s illustrate with an Example

Suppose we have an exchange rate of EUR/USD at 1.2000 and a contract size of 100,000 Euros. If the EUR/USD exchange rate moves by 1 pip, the change in the value of the trade would be:

Pip Value = (1 Pip / 1.2000) * 100,000 = $8.33

Therefore, a 1 pip movement in the EUR/USD exchange rate would result in a change of $8.33 in the value of the trade.

Image: thetradingbible.com

Understanding the Relationship Between Pips and Profits

Pips play a critical role in determining the profit or loss in forex trading. Each time a currency pair moves by one pip in your favor, you gain or lose a certain amount of money, depending on the contract size and the direction of your trade.

For example, if you buy a standard lot of EUR/USD (100,000 Euros) and the exchange rate moves up by 10 pips, your profit would be:

Profit = 10 Pips * $8.33 (Pip Value) = $83.30

Leverage and the Impact on Pips

Leverage is a powerful tool in forex trading that allows traders to amplify their potential profits. However, it’s important to use leverage wisely as it also increases potential losses. The higher the leverage, the smaller the pip value will be, meaning that a smaller price movement can result in a more significant gain or loss.

How to Convert 1 Pip to Dollars: Practical Tips

- Check the Currency Pair: Determine the currency pair you’re trading and its pip value.

- Calculate the Contract Size: Determine the size of your trade in terms of the base currency (100,000 Euros for a standard lot).

- Apply the Pip Value Formula: Use the formula provided above to calculate the pip value for the specific trade.

- Monitor Exchange Rate Movements: Stay informed about current exchange rate movements to make informed trading decisions.

1 Pip Is Equal To How Many Dollars

Conclusion

Understanding pips is essential for successful forex trading. By grasp