Introduction

Have you ever wondered what 1 lot size represents in the financial world? Whether you’re a seasoned investor or just starting your financial journey, understanding lot sizes is crucial for successful trading and investing. In this comprehensive guide, we’ll delve into the concept of 1 lot size in dollars, exploring its significance, calculation, and impact on your portfolio.

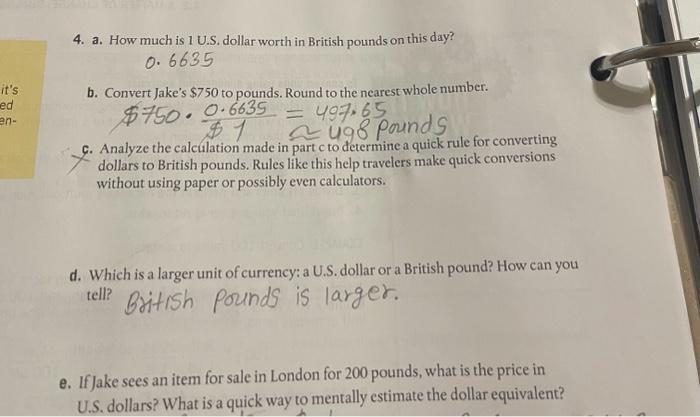

Image: forums.babypips.com

What is 1 Lot Size?

In forex and CFD trading, a lot size represents a standardized unit of measurement for a particular financial instrument. Typically, 1 lot size is equivalent to 100,000 units of the base currency. For example, in the EUR/USD currency pair, 1 lot represents 100,000 euros.

Calculating 1 Lot Size in Dollars

The value of 1 lot size in dollars varies depending on the current exchange rate between the base and quote currencies. To calculate the exact value, you need to multiply the 1 lot size (100,000) by the current exchange rate.

For instance, if the EUR/USD exchange rate is 1.15, 1 lot size (100,000 euros) would be equivalent to 100,000 × 1.15 = $115,000.

Significance of Lot Sizes

Understanding lot sizes is important for several reasons:

- Trading Volume: Lot sizes determine the volume of an order. Traders can adjust their lot size based on their risk tolerance and available capital.

- Transaction Costs: Brokerage fees are often calculated based on the number of lots traded. Knowing the lot size allows traders to estimate their transaction costs accurately.

- Leverage: Leverage in forex and CFD trading is calculated based on the lot size. Higher leverage can magnify potential profits but also increase risks.

- Margin Requirements: When leveraging funds, traders must maintain a certain amount of margin to cover potential losses. Lot sizes influence the amount of margin required.

Image: www.chegg.com

Choosing the Right Lot Size

Selecting the appropriate lot size is crucial for successful trading. Factors to consider include:

- Account Size: Your capital should support the lot size you trade.

- Risk Tolerance: Higher lot sizes increase potential profits but also risks. Adjust lot size according to your risk tolerance.

- Market Volatility: Fluctuations in exchange rates can affect profitability. Consider market volatility when choosing a lot size.

- Trading Strategy: Different trading strategies require different lot sizes. Scalpers may use smaller lot sizes, while position traders may opt for larger ones.

1 Lot Size In Dollars

Conclusion

Understanding 1 lot size in dollars empowers traders and investors with the necessary knowledge to make informed decisions in the financial markets. By considering lot sizes, traders can optimize their trading volume, calculate transaction costs, manage leverage effectively, and choose the most suitable lot size for their trading strategy. Remember, responsible trading involves not only profit-making but also prudent risk management.